Navigation: Teller System > Transactions > Loan Transactions >

This section lists all possible loan transactions in GOLDPoint Systems. Transactions are how the system changes amounts for loans. For example, loan payments require transactions, as do assessing fees and insurance premiums. Special security may be required in order to perform certain transactions, such as changing the amount of principal on a loan due to a fee charge.

The supervisor responsible for setting up CIM GOLDTeller for your institution needs to add any of the transactions your institution uses to the Transaction Menu in CIM GOLDTeller, as described in the Menu Design section in the CIM GOLDTeller User's Guide.

Corrections/Reversals

When processing a correction or reversal transaction, the tran code will have an "8" at the end. For example, if you processed a loan payment (tran code 600), a reversal or correction would be tran code 608, a field credit (tran code 510) would be 518, etc.

When reversals are processed, the system reads the history to determine the dollar amounts for each part of the transaction. For example, if a loan payment credited money to principal, interest, reserves, and late charges, the system reads the history to reverse everything exactly the way it was posted. It also requires items to be reversed in the exact order they were posted.

This is true for field credits and debits also (500 and 510 tran codes).

Did you know you can tailor each transaction to your institution's needs? You can rename transactions, copy transactions, hide fields, create drop-lists, and much more. This guide will give you a general overview of transactions, but please remember that your transactions may vary. The CIM GOLDTeller User's Guide contains detailed descriptions on how you can alter transactions to your institution's specifications. See these relevant sections in CIM GOLDTeller:

|

A report is available that shows all loan transactions that were processed on the date of the report. This report may also be set up as a "Teller Override" report, which shows transactions that were processed with a TOV (teller) or SOV (supervisor) override. For more information, see the Teller Posting Journal (FPSRP002) in the Loan Reports manual in DocsOnWeb.

Transactions are processed on accounts in three ways:

1.Through CIM GOLDTeller or the Transactions screens in CIM GOLD.

2.Automatically by the system in the afterhours.

3.Customer-directed account activity through your website or GOLDPhone.

If you would like information concerning Deposit tran codes or Other tran codes, see Deposit Transactions and Other Transactions.

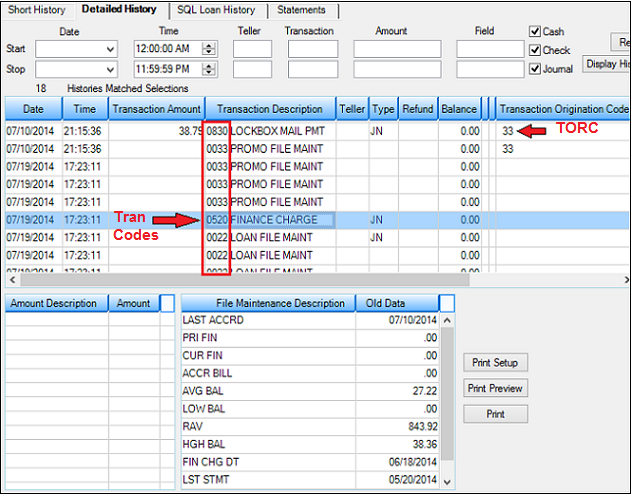

Once a transaction is run, the Loans > History screen displays details concerning that transaction. Each transaction is recorded with a tran code, as shown in the following example:

Loans > History Screen displaying the Tran Codes and TORCs

The tran code, TORC (if applicable), amount fields (if applicable), and the correction tran code are listed in the following table. Amount fields are used in the Autopost, as explained in Financials > GOLD Services in CIM GOLD > General Ledger > General Ledger Autopost Overview.

Click the tran code link in the following table, when available, to learn more about fields on the transaction or other detailed information concerning each transaction.

Tran Code |

Transaction Description |

||

|---|---|---|---|

009 |

Balancing Memo—Created by GOLDPoint Systems at the beginning of each year to reflect the principal balance and the YTD interest. This code is found in Loan History, but not on statements. |

||

Yes |

|||

Yes |

4, 104, 204 |

||

4, 104, 204 |

|||

Repossession (This transaction functions identically to tran code 2203.) |

|||

Reverse Repossession (This transaction functions identically to tran code 2204.) |

|||

Refund Credit to Reserve 1—Journal |

|||

Refund Credit to Reserve 2 |

|||

Refund Credit to Reserve 2—Journal |

|||

Loan General Inquiry |

|||

Stat File Inquiry |

|||

Loan Payment Information Inquiry |

|||

Loan Investor Inquiry |

|||

Loan LIP Inquiry |

|||

Loan Balances Inquiry |

|||

Loan Dates Inquiry |

|||

Loan Interest Inquiry |

|||

Loan Dates Inquiry |

|||

Loan Interest Inquiry |

|||

Loan Classification |

|||

Bring Current Inquiry |

|||

Adjust Mortgage Inquiry |

|||

Loan Auto-Payment Fields |

|||

Loan Late Fields Inquiry |

|||

Loan Reserve 2 Inquiry |

|||

Loan Reserve 1 Inquiry |

|||

Loan Payment Due Inquiry |

|||

Loan Payoff Inquiry |

|||

Loan Payment Breakdown Inquiry |

|||

Pay to Zero Inquiry |

|||

0200-00 |

Dealer Interest Debit |

||

0200-01 |

Dealer Interest Increase—Journal |

||

0210-00 |

Dealer Int Decrease |

||

0210-01 |

Dealer Interest Decrease—Journal |

||

0420 |

Amortize Costs |

||

0430-00 |

LIP Disbursement |

||

0430-01 |

LIP Disbursement—Journal |

||

Reserve 1 Disbursement |

|||

0440-01 |

Reserve 1 Disbursement—Journal |

||

0450-00 |

Amortize Fees |

||

Yes |

1-3, 23 |

||

Loan Extended General Inquiry |

|||

209 |

|||

742 |

|||