Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2510-09, Sale of Security for Cards

This transaction performs a credit to the principal balance for the amount of the transaction on a card account (LNPMTH = 5 and LNCARD = Y). It will also reduce the balance of the promotion associated with the sequence number you entered.

The Sale of Security transaction box displays:

Account Number

Tran Amount

Check In/Check out Number

Journal In

Jrnl Reference Nbr

G/L Account Number: You can hide this field.

Cash In

Date 1 - This field updates the Date of Sale field (FCSALD).

Number 1 - This is the sequence number of the promotion for which you are selling the collateral. If this field is left blank, the program will follow the procedure below on all promotions starting with the first one in the promotion priority list and continuing until all the monies have been exhausted.

The history description for this transaction is "Sale of Security."

When this transaction is run, the following will take place:

•Interest is accrued on the promotion.

•Interest is accrued on the loan.

•Interest is paid on the loan.

•The promotion interest is adjusted.

•Late charges are paid if owing.

•Miscellaneous fees are paid if owing.

•The principal balance is reduced.

•The promotion balance is reduced.

•A summary transaction is written.

If the balance of any promotion has zero due after the transaction is run, it will be marked as closed.

The amount of this transaction also updated the Sale Amount field (FCSLOS) on the Loans > Foreclosure, Repossession and Judgment Information screen, Notices and Sale tab. If an amount already appears in that field, processing another Sale of Security transaction will add to that amount. The Sale Amount field totals the amount of all Sale of Security transactions run.

This also applies to corrections, when the Sale Amount field will be reduced by the amount entered on the Sale of Security correction transaction.

Option for Writing Off Remaining Amount

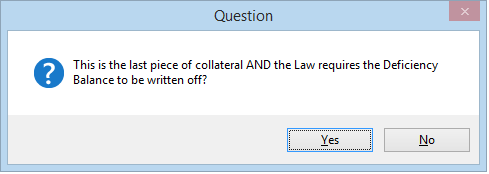

This transaction can be "chained" to the Sale of Security Full Write-off transaction (tran code 2510-12), if institution option AWAS (Ask for Write Off After SOS) is set up for your institution. If you run tran code 2510-06 (Sale of Security with Taxes) and the transaction amount (sale amount) isn't enough to pay off the loan and close it, the Sale of Security Full Write-off transaction will be displayed, after the following message appears:

From the Sale of Security Full Write-off transaction, the user can write-off the remaining amount of the loan. See that transaction for more details on how that works.

|

•If institution option OP03 CISS is set, the transaction will collect interest and pay late charges, fees, and principal following the order set up in the Payment Application group box on the Payment Detail tab on the Loans > Account Information > Account Detail screen. It will also update the Date Last Accrued field (LNACDT) and Date Interest Paid To field (LNPDTO) to the date of the transaction (found on the Account tab of the Account Detail screen).

•If institution option OP02 APCO is set, this transaction can be run on charged-off accounts.

•If institution option OP01 BKPM is set, this transaction can be run on bankrupt accounts.

•If institution option AWAS (Ask for Write Off After SOS) is set, a question will appear asking if the user wants to write-off the remaining amount (if the transaction amount wasn't enough to pay off the loan). If the user click <Yes>, the Sale of Security Full Write-off transaction (tran code 2510-12) will appear. Using that transaction, the user can write-off the remaining balance on the loan.

•If institution option OP29 SSPP (Sale of Security with PC2IB and Payoff) is set, the Sale of Security transaction will automatically run a Payoff transaction (tran code 580) immediately after the Sale of Security transaction is run to close the loan if the amount of the transaction is enough to pay off the loan. If the transaction pays off the loan entirely and the borrower is due back more money than what is allowed in institution option OVCK, the transaction is not allowed and the following error message will appear in CIM GOLDTeller:

“OVERPAYMENT OF NNNNN.NN – USE PAYOFF”

The user would then need to pay off the loan using the Loans > Payoff screen instead.

After this transaction is successfully run, the system assigns the account with Special Comment code "I - Election of Remedy" during the monthend Credit Reporting process (FPSRP184). Because only one Special Comment code is allowed per account, and the account may qualify for more than one Special Comment code, the system may or may not assign code "I" during Credit Reporting. When an account qualifies for more than one Special Comment code, the system determines which code to assign based on the Loans > System Setup Screen > Special Comment Priorities screen. See the Special Comment code definition in the Credit Reporting manual for more information.

Additionally, if this option is set, the system will also require the transaction to only be allowed to run on interest-bearing accounts (payment method 6), not precomputed accounts (payment method 3). The system will return the error message “MUST CONVERT PC TO IB” if users attempt to run this transaction on a payment method 3 account. To convert precomputed accounts to interest bearing, use the Loans > Transactions > Charge-off Transactions screen > Convert Precomputed to Simple tab. |