Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2510-00, Partial Write-off

This transaction reduces the principal balance on a loan by the amount of the transaction. It is used when you are writing off only a portion of the actual principal balance rather than the full principal balance. For example, if you need to reduce the principal balance so it would be below the state limit for filing small claims, use this transaction. If the state limit for filing a small claim is $3,000, and your loan balance is $3,200, run the transaction for $200, leaving a principal balance of $3,000.

This transaction automatically debits the General Ledger account by the amount of the transaction, and credits that amount to the principal balance. The General Ledger number is pulled from the GOLD Services > General Ledger > GL Account By Loan Type screen. If option OP16 IRWO (Include repossessions in regular write off) is set to "Y" and the General Category code is 81 or 85, this transaction will use the Write-Off—Regular Loan General Ledger number; otherwise, it will use the Write-Off—Charge Off General Ledger number.

Institution option OP04 ANAC allows a partial charge-off if a loan is not in a non-accrual status.

Additionally, if you process this transaction, and institution option T99C is set up, an IRS 1099-C Cancellation of Debt form will automatically be created for the IRS owner connected to this account. However, the 1099-C form will only be created if the following circumstances exist for the loan:

•The write-off amount is $600 or more.

•The account is not in bankruptcy (Hold Code 4 or 5).

•You can view the form in CIM GOLD on the Loans > IRS Form 1099-C screen for the account. This form feeds to IRS GOLD and is automatically sent to the IRS when GOLDPoint Systems sends in all 1099-C forms for your institution (see the Loan Year-end documentation).

The history description for this transaction is "Prtl W/Off Cr."

This transaction updates the Partial Write-Off field. It also feeds to the Selected Transaction Report (FPSRP231).

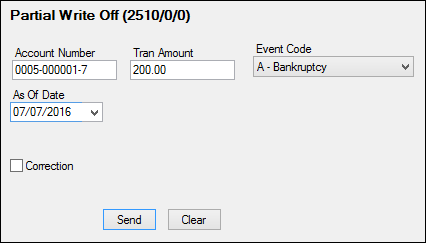

The following is an example of this transaction:

Note: The Event Code field corresponds to the Identifiable Event Code on the Loans > IRS Form 1099-C screen). These codes should be added to the Event Code field as a drop-down list.

| Tip: For instructions on how to create a drop-down list in CIM GOLDTeller, see View/Modify Droplists in the CIM GOLDTeller User's Guide. |

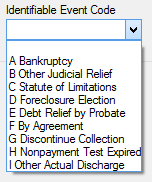

The following image is from the Identifiable Event Code drop-down list on the IRS Form 1099-C screen:

If you need to do a full write off, refer to the Full Write-off Transaction (tran code 2510-05).

This amount is not used in any regulatory reporting. If you report to the OTS or FDIC, use the Partial Charge Off fields (tran code 860).

See also:

•Charge-Off Transaction (tran code 2022-01)