Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2600-01, Insurance Payment

This transaction is processed if the monthly loan payment is received from an insurance company (e.g., Accident & Health, Involuntary Unemployment). This transaction is similar to the regular payment (tran code 600), but this transaction posts with an insurance type, and you can waive any fees (such as late charges) at the same time as the payment.

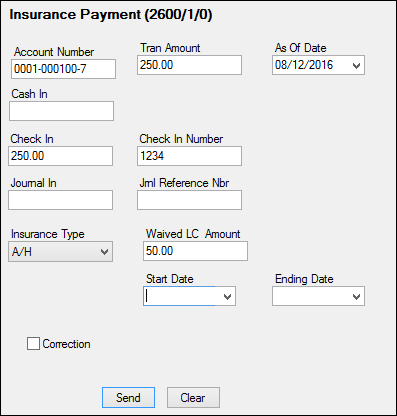

An example of the Insurance Payment transaction is shown below:

For the Loan Descriptor field (Field 136, in the example above it's called "Insurance Type"), someone at your institution with proper security should change the name of this field to "Insurance Type," and then add all possible insurance descriptors used by your institution to the drop-list. This is explained in detail in the CIM GOLDTeller User's Guide > CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Creating a drop-list field. (For old GOLDTeller, see this section: User's Guides > GOLDTeller > Adv. GOLDTeller Features > Transaction Design > Field Attributes Screen.) See descriptor definitions below.)

The following are the descriptors (insurance types) used in the Loan Descriptor field:

Descriptor |

Description |

|---|---|

0100 |

Accident and Health Insurance |

0110 |

Unemployment Insurance |

0120 |

Property Insurance |

0130 |

Credit Life Insurance |

0140 |

GAP Insurance - Auto |

0141 |

GAP Insurance - Motorcycle |

0142 |

GAP Insurance - RV |

0150 |

User Defined Insurance |

0165 |

AD&D Insurance |

0171 |

LPD (AUTO) Insurance |

0172 |

Property Dual |

0173 |

Property Dual Protected |

0175 |

Collateral Plus |

0190 |

VSI Insurance |

0191 |

Non-File Insurance |

0197 |

Homegard Insurance |

0198 |

Flood Insurance |

0199 |

Fire Insurance |

The payment is applied in the order designated in the Payment Application field.

When making an insurance payment, an open policy must be in effect for the insurance type for which you are making the payment, or the transaction will not run.

If an amount is entered in the Waived Fee Amount field (called "Waived LC Amount" in the example above), the transaction will reduce the amount in the Late Charges Due field (LNLATE) in CIM GOLD. Note: You may want to change the Waived Fee Amount description to "Waived Late Charges" in the GOLDTeller setup to make it more clear. Changing field names is done on the Functions > Administrator Options > Transaction Design in CIM GOLDTeller. Right-click the Waived Fee Amount field to bring up the Field Properties screen and change the name of the field.

If you don't enter a late charge amount:

1.It automatically waives the last unpaid late charge.

2.It does not decrease the number of times assessed.

3.It does increase the number of times waived.

Note: Some states don't allow late charges to be collected after injuries or layoffs. You will need to determine what late charges were assessed before and after the injury, and waive the applicable charges.

If the Insurance Payment transaction is run for at least two consecutive months, the system automatically assigns Special Comments code AB (Account being paid by insurance) to the account for Credit Reporting purposes. See the Special Comments field on the Credit Reporting screen for more information.

The history description for this transaction is the type of insurance you entered in the Loan Descriptor field on this transaction (for example, "A&H Ins Payment"). See Walk-in Payment (tran code 2600-05) for more information about descriptors for certain transactions.

CP2 Rules on Payoffs

This transaction can be used with the CP2 Transaction Processing Rules screen (function 803/804) in GOLD Services (Application 8).

If, after taking the underpayment into consideration, the amount of credit insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-in Payment (tran code 2600-04) Walk-in Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example:

The loan balance is $100.00, and the principal and interest is $75.00, leaving $25 of the remaining loan balance to fees and late charges. The refunds total $40.00, if the loan is paid off today. A customer brings in an $80 payment.

As you attempt to post the loan payment using this transaction, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would not be able to use this transaction. You would instead open the Loans > Payoff screen, lock in the payoff, then post the payoff using the Post Payoff tab. The total amount of the payment, $80, would pay off the principal and interest and $5 of the fees and late charges, leaving $20 more to pay off the loan. Because the loan would be paid off early and therefore be eligible for refunds, the $40 in refunds would pay off the remaining $20 left on the loan, leaving $20 as a refund back to the customer. The loan would then be closed.

The system calculates this for you when running a payoff on the Loans > Payoff screen > Post Payoff tab. Any refunds (credits) will show on the Adjustments tab after the loan has been locked for payoff. |