Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2203-00, Repossession Transaction

This transaction identifies that property securing the loan has been repossessed or in the process of being repossessed. It does not process an amount for the repossessed property. Use the Sale of Security transaction (tran code 2510-03) to process the amount gained from selling the repossessed security, if applicable.

Running this transaction will cause the account to have Hold Code 93 (Repossession by Grantor), which will affect monthend Credit Reporting. Accounts with Hold Code 93 are assigned Account Status 96 (Merchandise was repossessed by credit grantor; there may be a balance due), which is reported in Base Field 17A in the Credit Report transmission (FPSRP184). See the Credit Bureau Status (Account Status) topic in the Credit Reporting manual for more information.

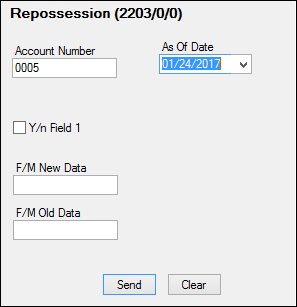

If this transaction has not been set up for your institution, it may resemble the following:

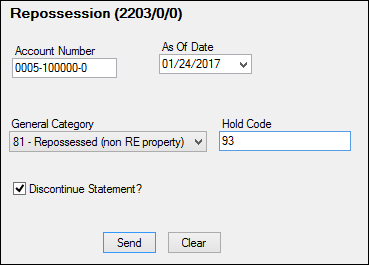

If you have proper security clearance, you should change it to look similar to this:

The Repossess transaction box displays the following fields:

Field |

Description |

||

|---|---|---|---|

Account Number |

Enter the account number for which you want to run the Repossession transaction for. See the Running Transaction topic in the CIM GOLDTeller manual for more information. |

||

As of Date |

Enter the date the repossession took place. This date updates the Date of Repossession field (FCRPOD) on the Loans > Bankruptcy and Foreclosure > Foreclosure, Repossession and Judgment screen in CIM GOLD. The date can be before today's date up to today's date. However, it can't be earlier than the Last Transaction Date on the loan. |

||

F/M New Data (Field 115) |

Change the name of this field to "General Category." The General Category that indicates a repossession are:

81 - Repossessed — non-real estate property 85 - Repossessed assets. Stops late charge assessments. See the General Category field for more information on different General Categories available.

You may want to make this a drop-list. Note: If the loan is charged off, whatever is entered in this field will be ignored and the account will retain the charge-off General Category (82, 83, 84, 86, 87, 88, 89).

See the following sections in CIM GOLDTeller that explain how to change names of fields and how to create drop-lists:

•CIM GOLDTeller > Functions > Administrator Options > Transaction Design > Field Properties Screen

•CIM GOLDTeller > Functions > Administrator Options > Transaction Design > Creating a drop-list field

|

||

F/M Old Data (Field 114) |

You should either hide this field or change the name of the field to "Hold Code." If this field is left blank (or you hide the field), a Hold Code 93 (Repossession by Grantor) will be placed on the account after the transaction is run. If any other Hold Code is entered in this field, that Hold Code will be placed on the account after the transaction is run.

Hold Code 93 affects monthend Credit Reporting. Accounts with Hold Code 93 are assigned Account Status 96 (Merchandise was repossessed by credit grantor; there may be a balance due), which is reported in Base Field 17A in the Credit Report transmission (FPSRP184). See the Credit Bureau Status (Account Status) topic in the Credit Reporting manual for more information. |

||

Y/N Field 1 (Field ) |

You should change the name of this field to "Discontinue Statements?" If this box is checked when the transaction is run, the following occurs:

•If you do not check this box, then nothing changes in the Statement Code or Advertising fields on the Loans > Account Information > Additional Loan Fields screen > Valuation/Billing tab.

•If you do check this box, the Statement Code field becomes "1 - No Statement" and the Advertise field becomes "0 - Do Not Advertise." These fields determine whether Consumer Finance statements (FSRP180, FPSRP280, FPSRP296, and FPSRP298) are sent to borrowers and whether or not advertising messages/fliers are included.

•If institution option COOP is equal to 6, then the Do Not Send Statements for this Account is also checked on the Valuation/Billing tab. |

After this transaction is successfully run, the system updates the following fields:

•Changes the General Category code to 81 (repossessed non-real estate) or 85 (repossessed assets), depending on what is selected in the F/M New Data field (see field descriptions above) of the transaction.

•Puts Action Code 93 (repossession) and the transaction date in the corresponding date field (see F/M Old Data field description above).

•Removes the Prepayment Penalty Code, if there is one.

•If the account is a card loan (payment method = 5, line-of-credit, LNCARD = Y), the Stop All Advances field (LNRLST) is selected.

•Flags the Alert Status with "REPOSS."

•During monthend Credit Reporting, the account will be flagged with Account Status 96 (Merchandise was repossessed by credit grantor) if Hold Code 93 is on the account (see F/M Old Data field above).

•Updates the Date of Repossession (on the Foreclosure, Repossession and Judgment Information screen) with the As of Date on the transaction.

•If institution option COOP is equal to 6, then the Do Not Send Statements for this Account is also checked on the Valuation/Billing tab.

Account reclassification of the loan amounts in the General Ledger are performed during the afterhours the night of the transaction.

If the loan has already been charged off before this transaction is run, the General Category and charge-off date on the loan will not be changed to whatever is entered in the F/M New Data field (the F/M New Data field will be ignored and the account will retain the charge-off General Category (82, 83, 84, 86, 87, 88, 89)).

Once the Repossession transaction has been run, you may need to then run the Sale of Security transaction (tran code 2510-03) to reduce the Principal Balance amount on the loan by the amount your institution can earn from selling the collateral.

Refer to the Bankruptcy, Repossessions, and Judgments Report (FPSRP208).

See also: Reverse Repossession Transaction (tran code 2204-00).