Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes > Deferment Transactions >

Tran Code 2600-23, EZPay Def by CC

This Deferment transaction is currently only used by one institution (360). The name of this deferment can be changed to "Holiday Deferment." This transaction can be run from either the Loans > Transactions > EZPay screen or in CIM GOLDTeller. Your GOLDPoint Systems account manager must set up certain fields and functions in order for this transaction to run successfully for your transaction (e.g., how much to charge to run this transaction, the number of transactions allowed, etc.).

This transaction uses a flat fee (Deferment Code 7), which is set up by GOLDPoint Systems using institution option DFFF. The Deferment Code is applied to loan programs when setting up loan patterns for loan origination.

The account can have no more than three consecutive deferments. There must be at least one regular payment after three consecutive deferments are made before another deferment is allowed.

Seasonal accounts are not allowed holiday deferments. Instead, the system automatically defers payments during the months specified as not requiring a payment. Seasonal accounts are established on the Loans > Account Adjustment screen by checking the Multiple Payment Applications box (LNMULP) and entering the Application Code for each month requiring a payment. See the Multiple Payment Applications help on that screen for more information.

The fee for this transaction is credited to your General Ledger using the Deferment Fee account listed on the GOLD Services > General Ledger > GL Account By Loan Type screen.

Once this transaction is run, the following fields are updated accordingly:

•Due Date (LNDUDT) is advanced by the number of deferments processed.

•Term in Months (LNTERM) is advanced by the number of deferments.

•The Current Installment (LNCINO) number is increased by the number of deferments.

•The Installments Made (LNNINO) is increased by the number of deferments.

•The Last Payment Date (LNDTLP) is advanced by the number of frequencies of the deferments, unless institution option NDLP is "yes." If that option is "yes," then the Last Payment Date is not updated. In other words, the system will not consider the deferment as an actual payment. It's treated in a special category all its own.

•The Loans > Deferments screen is updated with the details of the deferments.

This transaction can be run with an ACH payment (eCheck) or credit card.

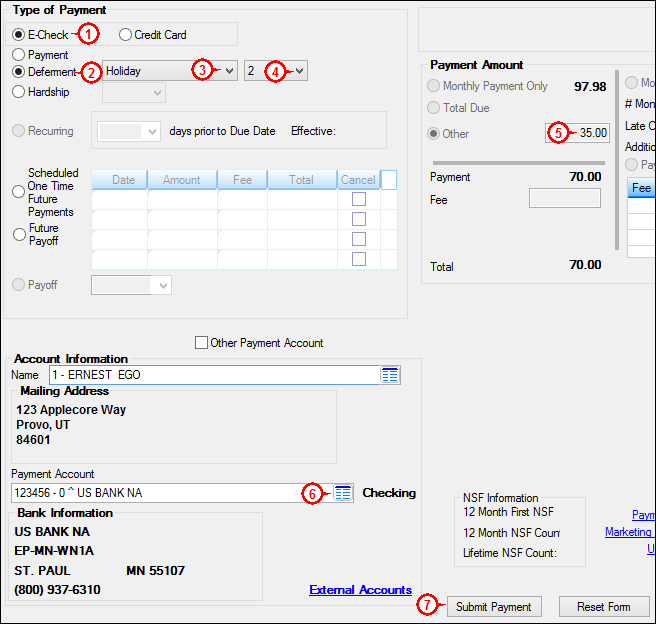

To run the transaction in EZPay:

1.Select whether the Deferment charge comes from a checking account or credit card account by selecting the applicable radio button at the top of the screen (see example below).

2.Select the Deferment radio button.

3.Select the Holiday deferment from the drop-down list to the right of the Deferment radio button.

4.Select how many consecutive deferments to be run on this account. The maximum number allowed is 3.

5.Notice that this transaction requires a flat fee and is displayed in the Other field.

6.Select the payment type:

•If the payment is from eCheck (ACH), select the external bank account from the Payment Account field.

•If the payment is from credit card, enter the applicable credit card information in the Card Information field group.

7.Click ![]() .

.

Loans > Transactions > EZPay Screen

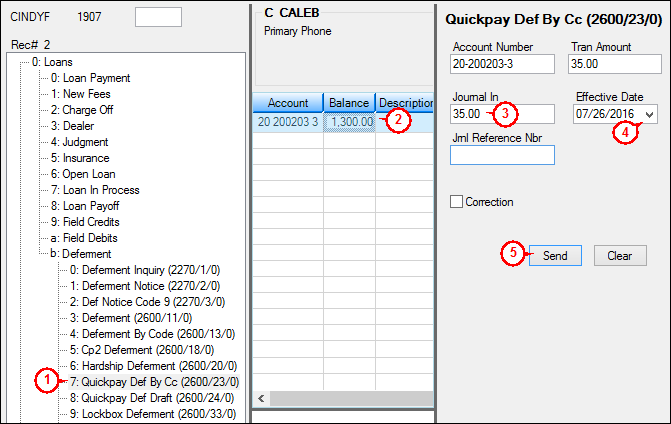

To run the transaction in CIM GOLDTeller:

1.Open CIM GOLDTeller and select tran code 2600-23.

2.Press <F9> and search and select the account for which you want to run the transaction. Once you select the account, the system will automatically populate the Account Number and Tran Amount fields. The Tran Amount reflects the flat fee amount your institution charges for holiday deferments.

3.Enter the amount of the transaction in the Journal In field.

4.Select the date when this deferment transaction takes affect in the Effective Date field. This is usually today's date.

5.Click ![]() .

.

Tran Code 2600-23 in CIM GOLDTeller

Contact your GOLDPoint Systems account manager if your institution has any interest in using this transaction.