Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2600-03, Interest-only Payment

The amount of this transaction must be for at least 30 days of interest (even if 30 days of interest isn't due), plus fees and late charges. The 30-Day Interest Inquiry identifies the interest amount (see 30-Day Interest Inquiry, transaction code 2170-00).

Option OP04 IPCL, if set to "N" (no), will stop the transaction if the loan is a contract (when the Purchased radio button on the Additional Loan Fields screen > Origination/Maturity tab is selected).

Note: If institution option IORC (Interest-Only Requirement Code) is set to "1," then the following requirements must be fulfilled before an interest-only payment will be allowed:

1.The principal balance must be below $10,000.00.

2.The original maturity (MLOMAT) must be in the future. If MLOMAT is blank, then the loan maturity date (LNMATD) will be used instead.

3.The loan opened date (LNOPND) must be three or more months ago.

4.Three full payments must have been made on the loan. A payment is considered a full payment if the history's partial amount plus amount to fees plus amount to principal plus amount to interest plus amount to late charges is less than the principal/interest payment as of the history date.

5.The last payment can't be an interest-only payment.

6.Allow the payment if this is the second interest-only payment in the calendar year. You can also allow a third interest-only payment made in a calendar year, if the third payment is being made in December.

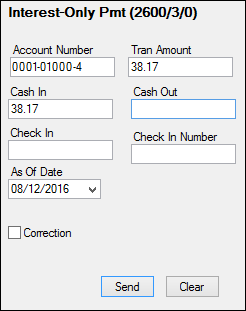

See the following example of the Interest-only Payment transaction. Note: This transaction can also be initiated in CIM GOLD using the Loans > Transactions > Make Loan Payment screen.

This transaction rolls the loan Due Date at least one payment frequency when the 30-day interest amount is paid. The transaction disregards the Payment Application (LNAPPL) and applies the money to fees, late charges, interest, and principal (in that order). Once the fees and late charges are paid, it then posts to all interest that is accrued, and if any amount is left over, it then applies that amount to principal. (If the amount of interest accrued is not at least as much as 30-days interest, you still must collect the 30-day interest amount and the difference is credited to the principal balance.) The Applied To Payment field on the Account Detail screen is always cleared to zero.

When you process this transaction:

•The Due Date is advanced by at least one frequency (see next bullet).

•This transaction adds the amount posted to principal, plus the amount in Applied To Payment, and divides that by the P/I Constant (Account Detail screen > Payment Detail tab). It the rolls the Due Date by the number of P/I constants that are satisfied, and any remaining amount will stay in Applied To Payment. (The net result is that it is rolling the due date by more than one frequency depending on the amount in the Partial Payments field.)

•The Maturity Date (Additional Loan Fields screen > Origination/Maturity tab) always advances by one frequency.

•The Date Last Accrued field (Account Detail screen > Account tab) will be updated to the date the transaction was processed.

•The Date Interest Paid To field (Account Detail screen > Interest Detail tab) will be updated.

This transaction does not affect variance fields.

The history description for this transaction is "Int Only Payment."

CP2 Rules on Payoffs

This transaction can be used with the CP2 Transaction Processing Rules screen (function 803/804) in GOLD Services (Application 8).

If, after taking the underpayment into consideration, the amount of credit insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-in Payment (tran code 2600-04) Walk-in Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example:

The loan balance is $100.00, and the principal and interest is $75.00, leaving $25 of the remaining loan balance to fees and late charges. The refunds total $40.00, if the loan is paid off today. A customer brings in an $80 payment.

As you attempt to post the loan payment using this transaction, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would not be able to use this transaction. You would instead open the Loans > Payoff screen, lock in the payoff, then post the payoff using the Post Payoff tab. The total amount of the payment, $80, would pay off the principal and interest and $5 of the fees and late charges, leaving $20 more to pay off the loan. Because the loan would be paid off early and therefore be eligible for refunds, the $40 in refunds would pay off the remaining $20 left on the loan, leaving $20 as a refund back to the customer. The loan would then be closed.

The system calculates this for you when running a payoff on the Loans > Payoff screen > Post Payoff tab. Any refunds (credits) will show on the Adjustments tab after the loan has been locked for payoff. |