Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

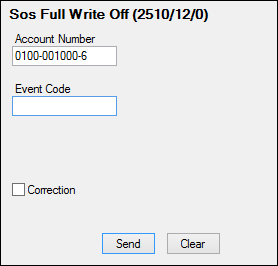

Tran Code 2510-12, SoS Full Write-off

Use this transaction when your institution has sold security collateral for the purpose of writing off the loan. This transaction is similar to the Full Write-off transaction (tran code 2510-05), but it does not process an IRS 1099-C Cancellation of Debt form and it assigns the account with Special Comment code "I - Election of Remedy" (see below).

Note: Before running this transaction, you should run one of the Sale of Security transaction (depending on which one your institution uses). The Sale of Security transaction reduces the amount of principal on the loan by the amount of the sold collateral. See any of the following links:

•Sale of Security (tran code 2510-03)

•Sale of Security with Taxes (tran code 2510-06)

•Sale of Security for Cards (tran code 2510-09)

Additionally, an option is available that will "chain" the SoS Full Write-off transaction to one of the Sale of Security transactions. Institution option AWAS (Ask for Write Off After SOS) causes the SoS Full Write-off transaction to appear after running a Sale of Security transaction where the full amount was not paid off.

This transaction cannot be run on precomputed accounts (payment method 3). To convert precomputed accounts to interest bearing, use the Loans > Transactions > Charge-off Transactions screen > Convert Precomputed to Simple tab

This transaction will do the following:

•Accrue interest to today and waive all interest owing.

•Waive all late charges owing.

•Waive all miscellaneous loan fees owing.

•Credit the principal balance to zero and close the loan.

•Populates the Written Off Amount field on the Actions/Holds/Event Letters screen with the amount of the loan.

•Assigns the account with Special Comment code "I - Election of Remedy" during the monthend Credit Reporting process (FPSRP184). Because only one Special Comment code is allowed per account, and the account may qualify for more than one Special Comment code, the system may or may not assign code "I" during Credit Reporting. When an account qualifies for more than one Special Comment code, the system determines which code to assign based on the Loans > System Setup Screen > Special Comment Priorities screen. See the Special Comment code definition in the Credit Reporting manual for more information.

If institution option OP10 CIFW is set to "Y," all open insurance policies will be refunded and canceled. Taxes and surcharges will also be refunded.

If institution option OP16 IRWO (Include repossessions in regular write off) is set and the general category code is 81 or 85, then this transaction will use the Write-Off—Regular Loan General Ledger number (GOLD Services > General Ledger > G/L Account By Loan Type screen); otherwise, it will use the Write-Off—Charge Off General Ledger number.

In order to correct the SoS Full Write-off transaction, the tran code 2510-12 history must be the last history on the account. If any other transactions or file maintenance have been processed after running the SoS Full Write-off transaction, the transaction must be corrected manually. If you are tracking your charge-offs on a daily OSR, this transaction can be used to show charged-off accounts moving from active charge-off status to non-active status.

The following is an example of the SoS Full Write-off transaction:

Event Code - We suggest hiding the Event Code (field 236). This field corresponds to the Identifiable Event Code on the Loans > IRS Form 1099-C screen). Since this transaction does not create a 1099-C, you should hide this field from the transaction.

•For instructions on how to hide a field on a transaction in CIM GOLDTeller, see: Transaction Design > Field Properties Screen in the CIM GOLDTeller User's Guide.

•For instructions on how to hide a field on a transaction in old GOLDTeller, see: Advanced GOLDTeller Features > Transaction Design > Field Attributes Screen in the GOLDTeller User's Guide. |

See also:

•Repossession Transaction (tran code 2203-00)

•Judgment transaction (tran code 2510-02)

•Sale of Security transaction (tran code 2510-03)

•Full Write-off transaction (tran code 2510-05)