Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2600-06, Death Claim Payment

The Death Claim Payment transaction is processed when your institution receives a check from an insurance company upon death of one of the borrowers. The check may or may not be enough to pay off the loan. (See also: Insurance Payment (tran code 2600-01)).

In order to run this transaction, you must first enter the date the borrower died in the Date of Death field on the Loans > Marketing and Collections screen > CIF tab. Also, the account must have an open life insurance policy, as detailed on the Loans > Insurance > Policy Detail screen.

Before running this transaction, first run the Death Claim Quote transaction (tran code 2606-00). This will give you the proper payoff amount based on the borrower's death date. If the loan is for daily interest (such as a payment method 6 or payment method 5), the accrued interest stops as of the death date.

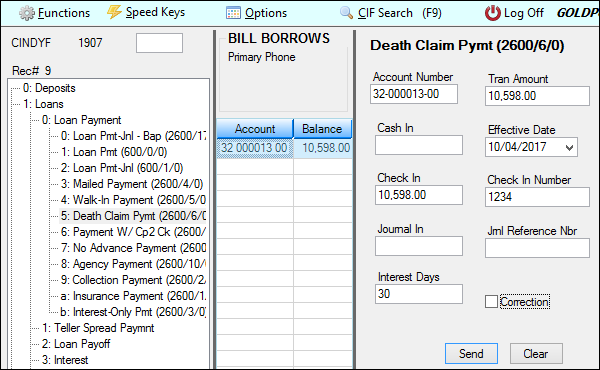

The following is an example of the Death Claim transaction, followed by information on what to enter in the fields:

Field |

Description |

|---|---|

Account Number |

Enter the account number of the borrower who has died and who the death claim payment is being made.

Quick tip: If you have not navigated to CIM GOLDTeller from viewing an account on the loan screen, you can quickly find the account owner by pressing <F9> and searching for the name, then double-clicking the account to have it entered in the Account Number field. See CIF Search topic in the CIM GOLDTeller User's Guide. |

Tran Amount |

Enter the amount of the transaction in this field. This will be the amount of the check. |

Effective Date |

Enter the date this borrower died in this field. This date should match the date entered on the Date of Death field on the Loans > Marketing and Collections screen > CIF tab. |

Cash In/Check In |

Usually, death claim payments are made via check; however, cash payments are allowed. Enter the amount of the check from the insurance company in the Check In field. The amount must match the Tran Amount. |

Check In Number |

Enter the number of the check from the insurance company. |

Journal In |

This field is not needed. |

Jrnl Reference Nbr |

This field is not needed. |

Interest Days |

For interest bearing accounts, this transaction will accrue and pay interest on the current principal balance up to the date of the death, plus the number of days entered in the Interest Days field on the transaction. For example, if the date of death was 09-01-2020 and "15" is entered in the Interest Days field, the system will accrue and collect interest (for payment method 6 only) up to 09-16-20.

For precomputed accounts (payment method 3) where the account closes due to this transaction, the interest days are added to the date of death to calculate the refund of precomputed interest based on the date of death plus the days in the Interest Days field. If the account does not close, the Interest Days field is ignored. (The amount of precomputed interest that is refunded back is found in the Rebated Interest field.)

If DCOP option is 0 or 1 for your institution (see DCOP Option box below), the program defaults to "30." The transaction will also update Rebated Interest (LN78RI) on precomputed interest loans. |

Correction |

Check this box if you previously ran a Death Claim Payment transaction, but want to reverse it. You can only correct this transaction the same day it was run. |

Results of the Death Claim Payment

The results of this transaction vary according to which DCOP option you have set (see DCOP Option box below). When processed, this transaction will accrue and pay interest on the current principal balance up to the date of the death, plus the number of days that were entered in the Interest Days field. If DCOP option 1 (see below) is used and nothing is entered in the Interest Days field, the program defaults to "30." If this is a precomputed loan and the loan qualifies for a rebate amount of any unearned precomputed interest, the system will debit the Principal Balance field by the amount of the unearned interest (see Rebated Interest (LN78RI)).

If the amount of this transaction is enough to pay off the loan, you may want to run the Payoff Inquiry transaction first to find out the amount of the payoff. Do not lock the loan on the Loans > Payoff screen. The Death Claim Payment transaction cannot run on loans that have been locked for payoff.

If this transaction closes the account due to payoff, the system assigns Special Comments code BP (Account paid by Insurance) to the account for Credit Reporting purposes. See the Special Comments field on the Credit Reporting screen for more information.

Additionally, the following takes place on the account:

•If the claim check is for enough money to pay the loan off (including the rebates), this transaction will also close the loan.

•On the Policy Detail screen for all policies, except the life insurance policy, the date of death is automatically entered in the Date Cancelled field, and a Cancellation Code of "4 - Insured Request" is entered. See DCOP Option box below for options that affect insurance policies. For the life insurance policy, a Cancellation Code of "8 - Death Claim" is added and the cancellation date is entered in the Date Cancelled field. This will cause the unearned premium for the life insurance to be fully earned at monthend. If you are using the Assurant Insurance Company transmission, the cancellation information for all policies will be sent with the next monthly transmission.

•Any Unearned Premium amounts are also refunded (credited to the Principal Balance) with this transaction.

•Unearned insurance finance charges, taxes, and surcharges (life included), if applicable, will be refunded and credited to the Principal Balance.

•For payment method 6 loans that refund interest back to the borrower, the interest will be credited to the Principal Balance.

WARNING: If the death claim check was not enough to pay off the loan and the DCOP institution option is not "3," all open insurance policies on the account are still cancelled. If you don't want them cancelled, you should not use this transaction, as the transaction refunds the unearned premiums and places the cancelled date on the policies on the Insurance Policy Detail screen. Instead, you can use the Insurance Payment transaction (tran code 2600-01) or run a Payoff transaction (tran code 580) for the claim check amount. |

|---|

•The DCOP options control whether this transaction processes fees or late charges. You may need to manually post or waive them prior to processing this transaction if your institution does not use any of the DCOP options. If the Death Claim Payment is not enough to pay off the loan, unearned interest and amortizing fees will not be refunded.

•If a loan has been locked for payoff (Loans > Payoff screen), you must drop it prior to processing this transaction.

•If the G/L account numbers for insurance commission rebates are not set up on the GOLD Services > General Ledger > Set Up G/L and Commissions, and unearned insurance commissions are still on the account, the transaction will not process.

•The Insurance Pmt Amt Received and Insurance Pmt Received Date fields are updated with the transaction amount and the transaction date. If the Insurance Claim Amount field already has an amount in it, the new transaction amount will be added to the amount in the box.

•The insurance claim date will be changed to the new date. The Insurance Claims Paid Report (FPSRP216) shows these transactions.

|

Institution option DCOP has the following four options that will affect this transaction:

Setting DCOP option 1 will do the following:

In addition to doing everything the transaction does currently, this option also:

•Collects any outstanding miscellaneous loan fees. •Collects all outstanding late charges up to the Date of Death, and waives any late charges assessed after the Date of Death. •This option will cancel all insurance policies regardless if the Death Claim Payment closes the account or not. The system cancels insurance policies using Cancellation Code 8 - Death Claim. •This option will only rebate interest and amortize fees if the Death Claim Payment closes the account (due to the check being enough to pay off the loan completely).

Setting DCOP option 2 will do the following:

This option does everything the transaction does currently, but it also:

•Waives all miscellaneous fees with a fee code of 9 (non-sufficient funds) or 16 (charge back). •This option also collects all outstanding late charges up to the Date of Death, and waives any late charges assessed after the Date of Death. •This option will cancel all insurance policies regardless if the Death Claim Payment closes the account or not. The system cancels insurance policies using Cancellation Code 8 - Death Claim. •This option will only rebate interest and amortize fees if the Death Claim Payment closes the account.

Setting DCOP option 3 will do the following:

This option does everything the transaction does currently, but it also:

•Waives all miscellaneous fees with a fee code of 9 (non-sufficient funds) or 16 (charge back) if the account is paid off during the transaction; it leaves all fees on the account if the account is not paid off. •Collects all outstanding late charges up to the Date of Death, and waives any late charges assessed after the Date of Death. •Cancels all insurance policies if the Death Claim Payment closes the loan. If the Death Claim Payment does not close the loan, only the life insurance will be cancelled with the payment. The system cancels insurance policies using Cancellation Code 8 - Death Claim. •This option will only rebate interest and amortize fees if the Death Claim Payment closes the account. •The Principal Balance is decreased effective the same date for which the interest was accrued (based on what was entered in the Interest Days field). The system then calculates interest up to today on the reduced Principal Balance.

Setting DCOP option 4 will do the following:

In addition to doing everything the transaction does currently, this option also: •Collects any outstanding miscellaneous loan fees. •Collects all outstanding late charges up to the Date of Death, and waives any late charges assessed after the Date of Death. •Cancels all insurance policies regardless if the Death Claim Payment closes the account or not. The system cancels insurance policies using Cancellation Code 8 - Death Claim. •This option will only rebate interest and amortize fees if the Death Claim Payment closes the account. •This option will accrue and pay interest on the current Principal Balance up to the Date of Death, plus the number of days that were entered in the Interest Days field. If nothing is entered in the Interest Days field, the program defaults to "0." |

Precomputed Loans Sold to Investors

For those institutions that have precomputed loans that are sold to another company, institution option OPT5 SCRT (Use Securitization) allows the system to post to additional General Ledger accounts when running a Payoff (tran code 580), Death Claim Payment (tran code 2600-06), or Convert Precomputed to Interest Bearing (tran code 510) transaction.

The transactions post to the same General Ledger accounts as they currently do; however, additional transactions are also run to offset debit or credit General Ledger accounts. The three General Ledger account fields are on the GOLD Services > General Ledger > G/L Account By Loan Type screen. The fields are Unearned Investor Contra, Interest Investor Contra, and Investor Clearing, as explained in the G/L Account By Loan Type help.

Note: Some state laws only allow you to collect interest up to 30 days after the date of death. Other states allow you to collect interest up to the date the claim check was received, or 30 days of interest, whichever is less. DCOP option 0 and 1 default to collecting 30-days interest.

Note: This transaction will not run if the loan does not have a life insurance policy (INTYPC = 50-59). The history description for this transaction is "510 - Death Claim Cr."

Correction Information

The Death Claim transaction can only be corrected the same day it is run. Once you reverse this transaction, all amortizing fees, insurance policies, and everything else that was accounted for during the transaction are put back on the account. If the account was closed because the amount was enough to pay off the loan, the loan is re-opened just as it was before the Death Claim Payment transaction was run.

Maintenance Fee Program

The maintenance fee for Alabama (MRMCOD = 01, 02, 03, 04, or 05) will either earn and collect fees or "unearn" and "uncollect" fees using the Date of Death. In addition, the maintenance fee indicator (MRMTNF) is unchecked to prevent future collections and/or fee earning. For fee codes 02, 03, 04, and 05, the earned date (MRMMDT) and collected date (MRPIFD) will be the Date of Death. See the Loans in CIM GOLD > Loan Screens > Account Information Screen Group > Additional Loan Fields Screen > Daily Statistics & Fees tab > Maintenance Fee field group.

Examples:

Example 1

Current Date—03/02/17

Date of Death—02/12/17

Due Date—02/10/17

Earned Date—02/10/17

Collected Date—01/25/17

When the Death Claim transaction is run, the system will collect on the fee earned in February since the Date of Death is after February's earned date.

Example 2

Current Date—03/02/17

Date of Death—02/11/17

Due Date—12/10/16

Earned Date—01/10/17

Collected Date—11/05/16

When the Death Claim transaction is run, the system will earn one month's fee since the Date of Death is after the Due Date Day. The system will also collect the fees for November, December, January, and February to match the fees earned through February. (Note: This situation would occur if the account became non-performing prior to the Date of Death.)

Example 3

Current Date—03/02/17

Date of Death—02/08/17

Due Date—02/10/17

Earned Date—02/10/17

Collected Date—12/25/16

When the Death Claim transaction is run, the system will use a negative 919 transaction to "unearn" one month since the Date of Death is prior to the earned date. The system will also collect the fee earned in January since the date of death is after January's earned date and we have only collected through December.

Example 4

Current Date—03/02/17

Date of Death—02/08/17

Due Date—02/10/17

Earned Date—02/10/17

Collected Date—02/28/17 (paid by deceased member's family or friends)

When the Death Claim transaction is run, the system will use a negative 919 transaction to "unearn" one month since the Date of Death is prior to the earned date. The system will also "uncollect" the fee for February since the date of death is prior to February's earned date and collected date.