Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2600-04, Mail-in Payment

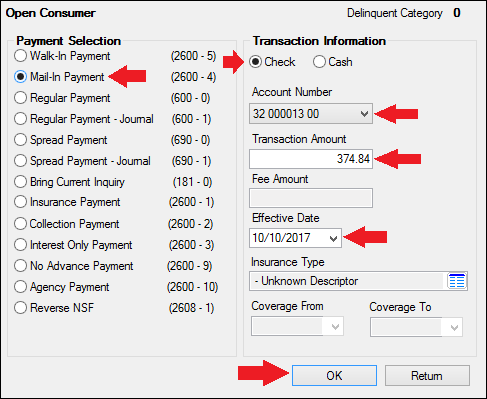

This transaction works like a regular payment (tran code 600) and follows the same rules. The best place to initiate this transaction is through the Loans > Transactions > Make Loan Payment screen. Once you enter information on that screen and click <OK>, CIM GOLDTeller will open with the Mail-in Payment transaction displayed, as shown in the following screen examples:

Loans > Transactions > Make Loan Payment Screen

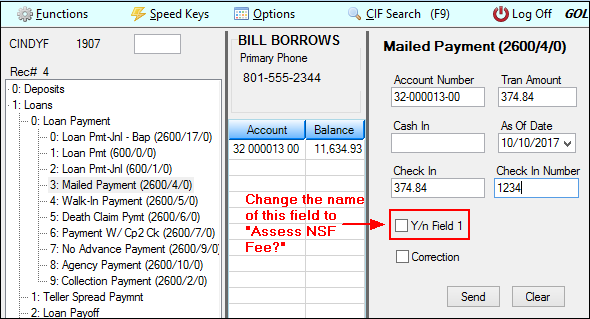

Mailed Payment Transaction in CIM GOLDTeller

Note: You should change the Y/n Field 1 field description to "Assess NSF Fee." See the Transaction Design section in the CIM GOLDTeller User's Guide for more information on how to rename fields.)

The history description for this transaction is "Mail_In Payment." See Walk-in Payment (tran code 2600-05) for more information about descriptors for certain transactions.

If the mail-in payment is from garnished wages, see Tran Code 2600-30, Garnishment Transaction.

Corrections

If you need to make a correction to a Mail-in Payment, you can bring up the transaction, but when the Mail-In Payment transaction box appears, check the Correction box. If you want to assess a non-sufficient funds fee at the same time as the corrected transaction, check the Y/n Field 1 box (renamed to "Assess NSF Fee"). For example, a customer mailed in a payment with a check. The check later bounces due to insufficient funds. You would need to correct the Mail-In Payment transaction and assess a non-sufficient-funds fee at the same time.

|

Tip: The name of this field should be changed to "Assess NSF Fee." Changing field names is done on the Functions > Administrator Options > Transaction Design in CIM GOLDTeller. Right-click the Y/n Field 1 field to bring up the Field Properties screen and change the name of the field. |

|---|

Once you click ![]() on the corrected Mail-in Payment transaction, the system reverses the transaction and assesses the non-sufficient funds fee. The amount of the fee assessed is pulled from the Loans > Account Information > Account Detail screen > Late/NSF tab > NSF Fields.

on the corrected Mail-in Payment transaction, the system reverses the transaction and assesses the non-sufficient funds fee. The amount of the fee assessed is pulled from the Loans > Account Information > Account Detail screen > Late/NSF tab > NSF Fields.

CP2 Rules on Payoffs

This transaction can be used with the CP2 Transaction Processing Rules screen (function 803/804) in GOLD Services (Application 8).

If, after taking the underpayment into consideration, the amount of credit insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-in Payment (tran code 2600-04) Walk-in Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example:

The loan balance is $100.00, and the principal and interest is $75.00, leaving $25 of the remaining loan balance to fees and late charges. The refunds total $40.00, if the loan is paid off today. A customer brings in an $80 payment.

As you attempt to post the loan payment using this transaction, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would not be able to use this transaction. You would instead open the Loans > Payoff screen, lock in the payoff, then post the payoff using the Post Payoff tab. The total amount of the payment, $80, would pay off the principal and interest and $5 of the fees and late charges, leaving $20 more to pay off the loan. Because the loan would be paid off early and therefore be eligible for refunds, the $40 in refunds would pay off the remaining $20 left on the loan, leaving $20 as a refund back to the customer. The loan would then be closed.

The system calculates this for you when running a payoff on the Loans > Payoff screen > Post Payoff tab. Any refunds (credits) will show on the Adjustments tab after the loan has been locked for payoff. |