Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2850-00, Pay Loan Fees

Usually loan fees are paid with a regular loan payment (see tran code 850). However, you can run a 2850 transaction in CIM GOLDTeller to manually pay loan fees. Note: Loan fees must have already been assessed on the loan in order to run this transaction. See the Miscellaneous Fees list view topic on the Loans > Marketing and Collections screen for more information.

Note: In order to use miscellaneous fees (also known as extended fees), institution option OP06-XFEE must be set.

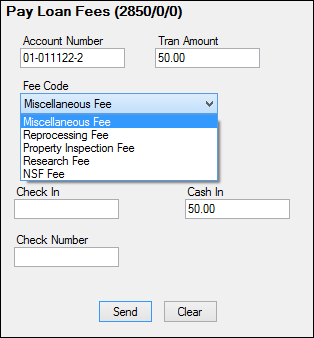

This transaction allows you to pay loan fees that have been assessed on an account. Some initial set up is required before this transaction can run. See the following example of this transaction:

Notice the Fee Code drop-down list in the transaction example above. Someone at your institution needs to design this field (it's field number 80) on the Transaction Design screen in CIM GOLDTeller to be a drop-list that is populated with all the fee codes used by your institution. Setting up fields on transactions to be drop-lists requires special security. It is a three-step process, starting with defining the items to be in the drop-list. See the System Field Dictionary topic in the CIM GOLDTeller User's Guide for step-by-step instructions on how to set up a drop-down list field on transactions.

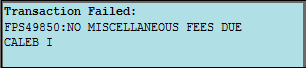

If you do not make this field a drop-list, the teller will be responsible for entering the loan fee code in the Fee Code field. The teller should enter the code as a number (not the description). For example, if trying to pay a miscellaneous fee, the teller would enter "001" in this field (that's the code for Miscellaneous Fees). Additionally, there must be a fee code record on the account (with that fee code) before the system will allow this transaction to process on the account (see the Assess Loan Fee transaction (tran code 660) for more information). If a fee code has not been assessed on the account, the transaction will not process and tellers will get an error similar to the following:

The following fee codes are available. Your institution may choose not to use all of these:

CODE |

DESCRIPTION* |

ASSESS/WAIVE TORC |

PAY |

RECEIVABLE/INCOME |

|---|---|---|---|---|

1 |

Miscellaneous Fee |

201 |

251 |

Receivable |

2 |

Reprocessing Fee |

202 |

252 |

Receivable |

3 |

Property Inspection Fee |

203 |

253 |

Receivable |

4 |

Research Fee |

204 |

254 |

Receivable |

5 |

Duplicate Copy Fee |

205 |

255 |

Receivable |

6 |

Duplicate Payment Book Fee |

206 |

256 |

Receivable |

7 |

Demand Cancel Fee |

207 |

257 |

Receivable |

8 |

Forced Insurance Fee |

208 |

258 |

Receivable |

9 |

NSF Fee |

209 |

259 |

Income |

10 |

Legal Fee |

210 |

260 |

Receivable |

11 |

Below Minimum Draft Fee |

211 |

261 |

Receivable |

12 |

Credit Limit Exceeded Fee |

212 |

262 |

Receivable |

13 |

Stop Payment Fee |

213 |

263 |

Receivable |

14 |

Abstracting Fee |

214 |

264 |

Receivable |

15 |

Delinquent Tax Fee |

215 |

265 |

Receivable |

16 |

Charge Back Fee |

216 |

266 |

Income |

17 |

Extension Fee |

217 |

267 |

Receivable |

18 |

Required Interest Fee |

218 |

268 |

Receivable |

19 |

Principal Decrease Fee |

219 |

269 |

Receivable |

20 |

Towing and Storage |

220 |

270 |

Receivable |

21 |

Postage Fee |

221 |

271 |

Receivable |

22 |

Detailing Fee |

222 |

272 |

Receivable |

23 |

Repairs and Damage Fee |

223 |

273 |

Receivable |

24 |

Keys Fee |

224 |

274 |

Receivable |

25 |

Lien Fee |

225 |

275 |

Receivable |

26 |

Marketing/Advertising Fee |

226 |

276 |

Receivable |

27 |

Fuel and Oil Fee |

227 |

277 |

Receivable |

28 |

Smog Fee |

228 |

278 |

Receivable |

29 |

DMV Fee |

229 |

279 |

Receivable |

30 |

DMV/Title Fee |

230 |

280 |

Receivable |

31 |

Attorney Fee |

231 |

281 |

Receivable |

32 |

Court Costs |

232 |

282 |

Receivable |

33 |

Back Interest |

233 |

283 |

Income |

34 |

NSF Check Amount |

234 |

284 |

Receivable |

35 |

Misapplied Payment |

235 |

285 |

Receivable |

36 |

Insurance |

236 |

286 |

Receivable |

37 |

Other Charges Converted |

237 |

287 |

Receivable |

38 |

Repo Fees |

238 |

288 |

Receivable |

39 |

Late Fees |

239 |

289 |

Income |

40 |

Prevailing Party Fees |

240 |

290 |

Income |

41 |

Maintenance Fee |

241 |

291 |

Receivable |

42 |

Investigation Fee |

242 |

292 |

Receivable |

43 |

Field Call Fee |

243 |

293 |

Receivable |

44 |

Skip Tracing Fee |

244 |

294 |

Receivable |

45 |

Transportation Fee |

245 |

295 |

Receivable |

46 |

Loan Fee |

246 |

296 |

Receivable |

47 |

Reage |

247 |

297 |

Receivable |

48 |

Write-off |

248 |

298 |

Receivable |

49 |

Attorney Fees |

249 |

299 |

Receivable |

50 |

Court Costs |

250 |

300 |

Receivable |

Your General Ledger Autopost must also be set up correctly in order to process loan fee payments. See the Miscellaneous Fees topic in the Loans > Marketing and Collections screen for more information.

Also see these other help topics for more information about miscellaneous fees:

Miscellaneous Fees list view on the Marketing and Collections screen