Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2600-00, CP2 Transaction

This is not a monetary transaction, although it can be processed in connection with a loan payment. This transaction allows you to advance the Due Date (run an exception payment). You would use this transaction to help account owners stay current on their payments. Also see the Deferment Transactions if your institution uses deferments instead.

You can run this transaction from either GOLDTeller or the Loans > Transactions > CP2 screen in CIM GOLD. This transaction can be run with or without the institution using the CP2 Transaction Processing Rules screen (function 803/804) in GOLD Services (Application 8).

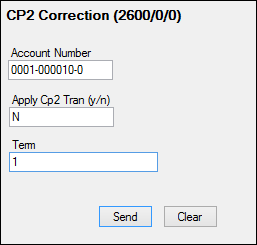

See the following example of the CP2 Transaction:

(Note: You should hide the Term field on the transaction. Currently, this field does not do anything. See the Field Properties topic in the CIM GOLDTeller User's Guide for information on how to hide a field on a transaction.)

The CP2 Transaction advances the Due Date (LNDUDT) to a current status.

Definition of Current: Once the Due Date is advanced to the month the transaction is processed, it then compares the Due Date to the CP2 Transaction date. If the new due date is within 10 days of the CP2 Transaction date, the due date is advanced by one frequency (if the loan has a frequency of "1," it would advance to the next month). The result is that the loan due date will always be advanced to at least 10 days greater than the date the CP2 was processed.

Example: The due date is 02-08-2016. On 04-05-2016 the CP2 Transaction is processed. The due date would be advanced to the next month (05-08-2016).

Note: If the CP2 is processed in connection with a loan payment, remember that the loan payment will advance the due date one frequency, plus the CP2 transaction will advance the due date another frequency as mentioned in the above paragraph.

If institution option OPO3 CP2R is set, the system will also advance the Term and Maturity Date by the same number of frequencies by which the loan due date is advanced.

This transaction also clears the amount in the Applied To Payment field on the Account tab of the Loans > Account Information > Account Detail screen.

The Loans > History description for this transaction is "CP2." See Walk-in Payment (tran code 2600-05) for more information about descriptors for certain transactions.

When any transaction that tests for CP2 eligibility is run (such as Insurance Payment), if the account is eligible, then the CP2 Transaction will automatically appear in GOLDTeller after the payment transaction is run.

If this transaction is run in conjunction with a payment, and the payment must be reversed, the CP2 Transaction must be reversed before reversing the payment. See the Reversing Transactions topic in the CIM GOLDTeller User's Guide for more information about reversing transactions.

CP2 Rules on Payoffs

This transaction can be used with the CP2 Transaction Processing Rules screen (function 803/804) in GOLD Services (Application 8).

If, after taking the underpayment into consideration, the amount of credit insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-in Payment (tran code 2600-04) Walk-in Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example:

The loan balance is $100.00, and the principal and interest is $75.00, leaving $25 of the remaining loan balance to fees and late charges. The refunds total $40.00, if the loan is paid off today. A customer brings in an $80 payment.

As you attempt to post the loan payment using this transaction, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would not be able to use this transaction. You would instead open the Loans > Payoff screen, lock in the payoff, then post the payoff using the Post Payoff tab. The total amount of the payment, $80, would pay off the principal and interest and $5 of the fees and late charges, leaving $20 more to pay off the loan. Because the loan would be paid off early and therefore be eligible for refunds, the $40 in refunds would pay off the remaining $20 left on the loan, leaving $20 as a refund back to the customer. The loan would then be closed.

The system calculates this for you when running a payoff on the Loans > Payoff screen > Post Payoff tab. Any refunds (credits) will show on the Adjustments tab after the loan has been locked for payoff. |