Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 580, Payoff

To run a Payoff transaction, you should first access the Loans > Payoff screen and lock the loan by clicking <Lock> at the bottom of that screen. Locking the loan will finalize all balances, as well as any unearned interest, unearned insurance premiums and finance charges, and interest earned. Institution options are available that cause the system to drop the payoff lock in the afterhours. See the Payoff Locking topic in the Loan help for more information.

The Adjustments tab of the Payoff screen will display all the adjustments to the Principal Balance, as well as adjustments to G/L accounts.

Use the Post Payoff tab on the Payoff screen to actually set up the Payoff transaction. See the Payoff by Journal or Payoff-Journal Offset if you want to post a payoff by journal in order to close a delinquent loan.

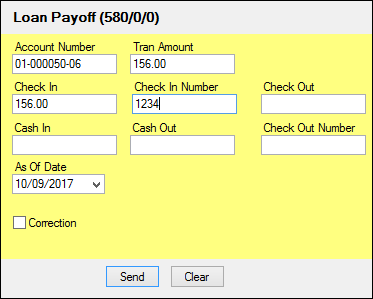

Once you enter the payoff information on the Post Payoff tab and click <Post Payoff>, CIM GOLDTeller opens with the Payoff transaction displayed and all the fields pre-filled from the information you entered on the Post Payoff tab, as shown below:

Click <Send> from the CIM GOLDTeller Payoff transaction screen, and the system will process the payoff.

Note

Use the Payoff-Journal Offset (tran code 2580-01) transaction to close the loan by journal. This is a good transaction to run in the following circumstances:

•The loan is severely delinquent, charged off, and your institution wants to close the loan to clear it off balances. •The loan has been in bankruptcy and the bankruptcy courts have ruled the loan to be discharged. •The borrower opens a new loan to payoff this loan.

See the Payoff-Journal Offset (tran code 2580-01) description for more information. |

Result of Payoff Transaction

•This transaction closes the loan.

•All amortization of fees, maintenance fees, precomputed interest, insurance premiums, insurance commissions, and insurance finance charges are balanced to G/L accounts. (See Note below.)

•Any unearned insurance premiums, precomputed unearned interest, unearned maintenance fees or amortizing fees, or unearned insurance finance charges will reduce the principal balance owing on the loan, and therefore, reduces the amount of payoff due. (See Note below.)

•Any open insurance policies are closed with Cancellation Code of "1 - Early Payoff."

•Miscellaneous loan fees are paid with a tran code 850, and the system adds that amount to the Payoff amount. The Marketing and Collections screen will show those fees as paid.

•Action Code 96 (History Statement Request) and 163 (FHLMC EDR - 61 Payoff Prepaid) will be placed on the account with the Action Date of the Payoff date.

•Any Accrued Interest will be added to the Payoff amount.

•Collects all outstanding Late Charges Due and adds it to the Payoff amount. (See Note below.)

•If you want to create an event letter based on the payoff information, enter event #14 on the Loans > Account Information > Actions/Holds/Event Letters screen, with the payoff date and letter number. You must have previously set up the merge fields for the Payoff letter using Microsoft® Word. Then you can run GOLD EventLetters and print the Payoff letter to send to your customers. See these topics in the GOLD EventLetters User's Guide for details on how to set up, download, and print event letters: