Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes > Deferment Transactions >

Tran Code 2600-13, Deferment by Code

The Deferment by Code transaction (tran code 2600-13) processes deferments on accounts as determined by the Deferment Code used by the account.

The Deferment Code field (shown on the CIM GOLD Loans > Deferments screen) determines how your institution calculates the deferment charge. The Deferment Code is established during loan origination. Not every institution charges for deferments, and certain codes determine how much to charge for deferments, as explained in the Deferment Code field topic on the Deferments screen.

The Deferment Code can also determine other important loan criteria before deferments are eligible. Such as:

•Whether late charges are waived when the deferment is processed.

•What payment methods are allowed deferments using that Deferment Code.

•Whether the charge amount for running the transaction is added to the Applied To Payment amount.

•How many payments must be made before a deferment can be processed.

•Some Deferment Codes restrict deferments on accounts if the loan is less than a certain amount.

•Other Deferment Codes will not allow deferments on accounts if the account is more than one or two payments past due.

•Deferment Codes establish the number of deferments allowed per year or life of the loan based on a rolling year, contractual year, or calendar year (see differences below).

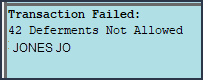

The system will show a reason if that account is not eligible for deferments by code, as shown below:

This transaction can also be run through the Loans > Transactions > EZPay screen or the Loans > Transactions > Make Loan Payment screen. However, your institution must be set up with certain options to allow this. See these topics for more information:

•Deferments from the Make Loan Payment screen

The Deferment Code establishes if the deferment options operate with a rolling year, contractual year, or calendar year.

•A rolling year means the most recent deferment date determines when the next deferment is available. For example, if deferments were made on 5/15/20 and 7/15/20 and institution option DFRM (maximum deferments allowed per year) is set to "2," the borrower would not be eligible for another deferment until 5/16/21. Deferment Codes 4, 5, 17-25, 27, 29-30, 34-35, 36-39, 41-44 all use a rolling year.

•For contractual year, deferments are eligible again the anniversary of the Date Opened. So if the Date Opened was 03/05/2018, DFRM was set to 1, and a deferment was made on 03/01/2020, the loan would be eligible for another deferment on 03/06/2020. If another deferment was made on 04/06/2020, another deferment would not be eligible until 03/06/2021. Deferment Codes 1-3, 6-16, 26, 31, 33, 35, and 40 all use a contractual year.

•For calendar year, deferments are eligible from January 1 to December 31 of that year. So if a deferment was processed on December 30, 2020, and DFRM was set to 1, the next deferment would be eligible on January 1, 2021. Deferment Codes 28 and 32 use a calendar year.

Other types of deferment transactions, such as No Rules (tran code 2600-17), will allow a deferment at any time and for as many deferments as your institution wants. Your institution can set up and use whichever deferment transactions are best for your institution. See the Deferment Transactions topic for a list of all possible deferment transaction codes. |

Before processing this account, you should first process the Deferment Inquiry transaction to determine how much the charge is for running deferments on this account. This amount is also displayed on the Loans > Deferments screen in the Deferment Inquiry box, as shown below, as well as on the Loans > Transactions > Make Loan Payment screen.

Enter the charge amount (as shown in the Deferment Amount field above) for the deferment in the Tran Amount field on the Deferment By Code transaction. This is done automatically if you first run the Deferment Inquiry transaction.

Note: If you first set up this transaction through the Make Loan Payment screens in CIM GOLD, the amount will automatically be entered for you. Not all institutions allow deferments made through the Make Loan Payment screen. See the Deferments topic in the Make Loan Payment help for more information. |

The Deferment By Code transaction box in CIM GOLDTeller is shown below:

If your institution wants to use this transaction, the following setup is required:

1.Add the transaction to the Transactions menu, as described in the Menu Design topic in CIM GOLDTeller.

2.Design the transaction according to how your front-end tellers should use the transaction, as described in the Transaction Design topic in CIM GOLDTeller.

3.Add all deferment reasons to the Loans > System Setup Screens > Deferment Reasons screen. See Note below about reserving Reason Code 2 for hardship deferments and Reason Code 6 for natural and declared disasters.

4.As of August 2020, a new field is available on this transaction. The new field is called "Collection Fee Amt" but you should either hide this field, or rename it to "Processing Fee Amount" if your institution requires a processing fee for running the Deferment by Code transaction. The processing fee is different from the charge amount of the deferment. See Processing Fees for Deferments for more information.

5.You'll notice a Code 1 field. The name of that field should be changed to "Deferment Reason," as described in the Field Properties topic in CIM GOLDTeller. If you do not want to establish a reason when this transaction is run, you can hide the field from tellers and skip requirement 5 below. See Field Properties topic in CIM GOLDTeller for information on hiding fields.

6.You need to make the Code 1 (now renamed "Deferment Reason") field a drop-list that includes the same entries as those you entered in step 3 above. It is very important that those reasons are added to the System Field Dictionary. Creating a drop-list is a three-part process, as described in the following topics:

a.Creating drop-list items in the System Field Dictionary. b.Create the drop-list in the View/Modify Droplists. c.Assigning a field to that drop-list.

|

A Deferment Notice (tran code 2270-02) can be automatically initiated after the Deferment transaction. Deferment notices are institution-defined. They can include all the details concerning a deferment that would be applicable to the borrower. They can also include an area for the borrower to sign, that you can keep for your records by attaching the notice to File Services Plus.

See the Deferment Notice help for more details. |

Some initial setup is required before deferments can be processed. These options are usually set up by your GOLDPoint Systems account manager when you convert onto our system or start allowing deferments.

1.The Deferment Charge Rebate/Extension Fee field on the GOLD Services > General Ledger > G/L Account By Loan Type screen must contain a valid General Ledger number. This is the General Ledger account used for crediting or debiting deferment and extension funds.

2.The number of deferments allowed per customer account per year must be indicated using Institution Option DFRM.

3.The number of deferments allowed over the life of a customer account must be indicated using Institution Option DFRL.

4.For deferments requiring a flat fee (Deferment Code 7), the deferment fee amount must be indicated using Institution Option DFFF. |

Once this transaction is run, the following takes place on the account:

•The Due Date is rolled to the next Due Date.

•The amount entered in the Tran Amount field (the deferment charge amount) is credited to the G/L account indicated in the Deferment Charge Rebate/Extension Fee field on the GOLD Services > General Ledger > G/L Account By Loan Type screen for that loan type.

•The Term in Months field advances by one (or the number of deferments processed).

•The Current Installment Number field advances by one (or the number of deferments processed).

•For interest-bearing loans (payment method 6), the Date Last Accrued (LNDLAC) is updated to the Effective Date entered on the Deferment by Code transaction.

•For precomputed loans (payment method 3), the Date Interest Paid To (LNPDTO) field is updated to the Effective Date entered on the Deferment by Code transaction.

•The Last Payment Date (LNDTLP) is changed to the Effective Date entered on the Deferment by Code transaction, unless institution option NDLP is "yes." If that option is "yes," then the Last Payment Date is not updated. In other words, the system will not consider the deferment as an actual payment. It's treated in a special category all its own. The Last Payment Date is found on the Loans > Marketing and Collections screen > Delinquent Payments tab.

•Late Charged Due (LNLATE) may be waived if the Deferment Code allows it. See the Deferment Code description for more information.

Additionally, the following fields are updated on the Loans >Deferments screen:

•The Effective Date (D0DTEF) is updated with the effective date of the transaction. •The Deferred Due Date (D0DUDT) is updated with the date the deferment Due Date starts. •The Next Due Date (D0DUNX) is updated with the date the deferment ends and the next payment is due. •The Maturity Date (D0MATD) advances to the next frequency, but only if institution option RMTD (roll maturity date on deferment) is set to "Y." •The Term in Months (D0TERM) is increased by 1. •If a charge amount (other than zero) is applied when this transaction is run, the Deferment Amount (D0DFAM) is updated with the amount of the charge. •If this is an interest-bearing account (payment method 6), the Interest Amount (D0IAMT) is also updated with the charge amount. •If late charges were waived as determined by the Deferment Code, the amount of late charges will be shown in the Late Charges Waived field (D0LCCW). •The Deferment Counter, which isn't shown on any screen in CIM GOLD, is updated by 1. The Deferment Counter is important in determining the number of deferments allowed on a loan or lifetime of loan, as determined by the Deferment Code and institution options. See Deferment Code help for more information.

See also Credit Reporting below for how deferments affect Credit Reporting. |

To run the Deferment transaction, the loan must meet the following criteria: •OP02 STRN must be set to "Y." •It cannot be a closed account. •It cannot be a service-released account. •It cannot be an unopened account. •The account cannot have reached the maximum number of deferments for the contract year (Institution Option DFRM). •The account cannot have reached the maximum number of deferments over the life of the loan (Institution Option DFRL).

See the Deferment Code help for other restrictions based on the Deferment Code on the account.

Note: If any of these exist and you find the deferment cannot be run, but your institution has determined that the borrower can have a deferment, consider using the No Rules Deferment transaction (tran code 2600-17), if your institution allows it. See the No Rules Deferment topic for more information. |

You can view the results of the Deferments transaction on the Loans > History screen or on the Loans > Deferments screen. The Deferment Inquiry field group is also on this screen. It will display the number eligible and can also calculate more than one deferment amount.

See the following examples of these screens showing deferments:

|

If a Regular Deferment is run on a transaction using Deferment Reason Code 6, the deferred account will be flagged as a natural/declared disaster. Two institution options are available that will automatically update the Special Comment Code and Account Status accordingly:

1.If institution option K402 is set, the Account Status will be reported with “11” (current account) and Special Comment Code “AW.”

2.If institution option K403 is set, the account will be reported with the same information as regular deferments (see above), but with Special Comment Code “AW" only. The Account Status will be "11" if the account was current before the deferment was run; or the Account Status as it was reported the previous month (if in delinquency).

Additionally, the account will be reported as follows:

•The Terms Duration (Base field 13) field will be blank. •The Terms Frequency (Base field 14) field will be “D” (deferred). •The Scheduled Monthly Payment Amount (Base field 15) will be zero. •The current Payment History Profile (Base field 18) will reflect a “B” if deferring the first payment; “D” if previously in repayment. •Amount Past Due (Base field 22) will be zero. •The K4 Segment for Specialized Payment Information will be included in the transmission. It will be populated as follows: oThe Segment Identifier (Field 1) will be “K4” (default). oThe Specialized Payment Indicator (Field 2) will be “02” (deferred payment). oThe Deferred Payment Start Date (Field 3) will be the date when the deferment period starts (uses mnemonic BUSTRP). The Deferred Due Date (D0DUDT) on the Loans > Deferments screen will be the date reported for the Deferred Payment Start Date for Credit Reporting. oThe Payment Due Date (Field 4) will be the date when the deferment period ends and the next payment is due (uses mnemonic BUSTDF). The Next Due Date (D0DUNX) on the Loans > Deferments screen will be the date reported for the Payment Due Date for Credit Reporting. oThe balloon Payment Amount (Field 5) will be blank.

Deferments run with Deferment Reason Code 6 can only be included with the following transactions:

•Deferment Payment Transaction (tran code 2600-11) •Deferment By Code Transaction (tran code 2600-13) •No Rules Deferment (tran code 2600-17) •Deferment with Reason (tran code 2600-35) •Fee Reg Deferment (tran code 2600-50)

Note: If you are using a regular deferment transaction (2600-11, 2600-13, 2600-17, 2600-35, or 2600-50) and you use Deferment Reason Code 2 (instead of using the actual Hardship Deferment transaction), be aware that it does not update the D0MOD field, and Special Comment Code “CP” will not be automatically applied to the account during monthend Credit Reporting. You would need to manually update the Special Comment Code field if you want the account to be reported with “CP” and you used Deferment Reason Code 2 with a regular deferment. See the Hardship Deferment for more information. |

The Deferment transaction is correctable. However, you cannot correct it by pressing <F8> while in CIM GOLDTeller. You can correct it by completing the following steps:

1.Select "Journal/Forwarding" from the GOLDTeller Functions menu (or press <Ctrl> + J on your keyboard). Run a report listing all the transactions run on the particular date for the teller who ran the deferment.

2.In the report, find the journal transaction for 2600-11, 2600-13, 2600-35 (or any other Deferment transaction) that you want to correct and right-click it and select "Correct Transaction" from the pop-up menu, as shown below:

3.The Deferment By Code transaction will appear with the fields automatically entered, and the Correction box checked.

4.Click 5.An Override Required box will be displayed. If you have the security clearance to do corrections, enter your password and click <OK> and the transaction will finish processing. If you do not have security clearance, your manager will need to enter their security clearance and click <OK> to finish processing the correction.

The system will reverse all the information from the account that was originally established when the Deferment by Code transaction was run. See Results of this Transaction above for more information on all the fields affected.

|

If the deferment code is 33 - California, the Deferment by Code transaction does the following:

•Accrues interest to the Effective Date of the transaction (for interest-bearing loans only). •The Due Date is rolled one payment frequency, unless extra funds are paid, in which case it will roll as many times as needed until the extra amount is exhausted or equals 0. For example, suppose the payment amount is 100.00, the deferment charge is 10.00, and the customer pays 250.00. The program collects the 10.00 for the deferment and rolls the Due Date, leaving 240.00 extra to be applied toward the account. The money will be applied according to the Payment Application code. In this case, no late charges or fees are due, so the entire 240.00 is divided by the payment amount of 100.00, which is enough to roll the Due Date two payment frequencies. The additional 40.00 is stored in the Applied To Payment field. •The Maturity Date is rolled one payment frequency if institution option OP08 RMTD is set. •The Date Interest Paid To is updated to the date of the transaction. •The term of the loan is increased by one payment frequency. |

If the account is a line-of-credit card loan (LNCARD = Y, LNPMTH = 5) and the Deferment Code = 7 (Flat Fee), then the following will apply:

•Only one deferment is allowed in 12 months, using a contractual year (Date Opened (LNOPND) to Date Opened). •Only two deferments are allowed in 60 months, using a contractual year. •The billing information for the Due Date being deferred will be cleared. •The Last Payment Date (LNDTLP) field will be updated to the date this transaction is run. Note: An option is available that causes the Last Payment Date to not be updated when a payment is made on a loan that is in deferment. If you would like this option set up for your institution, send in a work order with your request or talk to your GOLDPoint Systems account manager that you want institution option OP23-NDLP set to "Y." |