Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2608-01, NSF-Pmt Reversal

The NSF Payment Reversal transaction should be used when you need to reverse a check, ACH, or credit card payment on an account due to non-sufficient funds. This transaction will also charge a fee to the account due to the non-sufficient return of the ACH, check, or credit card payment. If you want to reverse a payment and not charge a fee, use the NSF-Payment Reversal No Fee transaction (tran code 2608-02) or use the Loans > Transactions > Payment Adjustments screen.

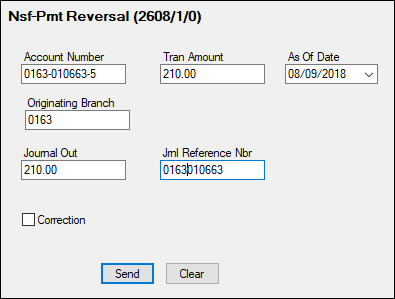

The following is an example of the NSF Payment Reversal transaction:

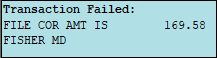

Once this transaction is processed, it reverses the last loan payment made on the account. The Tran Amount and Journal Out fields must match the amount of the last payment. If the transaction does not match the last payment amount (the amount you're reversing), you will receive the following error after clicking <Send>:

You can use that message to redo the transaction with the correct transaction amount.

|

Tip: Press <Shift> + <F12> on your keyboard while in CIM GOLDTeller, and the system will bring up the last transaction with the last account information already entered. |

|---|

Transaction Effects on the Account

This transaction reverses the last payment made on the account. If late charges and fees were part of the last payment amount, those are also reversed. It also does the following:

•Processes an account payment correction by journal (correction code 608 for payments and 858 for miscellaneous fees, if applicable).

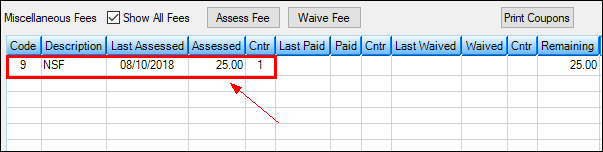

•Processes an Account Miscellaneous Fee transaction (tran code 660) using fee code 9 (non-sufficient fee).

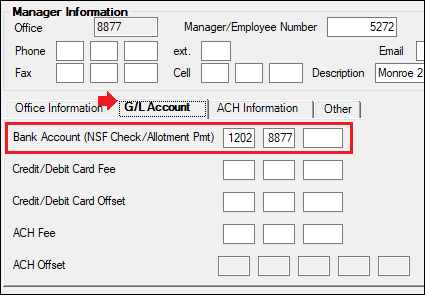

•Processes a G/L credit (tran code 1810) to the Bank Account (NSF Check/Allotment Pmt) field found on the GOLD Services > Office Information screen > G/L Account tab in CIM GOLD for the office the transaction is run.

This transaction updates the following fields:

•The system rolls the Due Date and Due Date Last Rolled back by one frequency.

•Decreases the Installments Made (LNINNO) by 1.

•Date Interest Paid To is reversed to the previous payment date.

•Last Payment Date is reversed to the previous payment date.

•Last Payment Amount is reversed to the amount of the previous payment.

Late Charges

If reversing a payment would cause the loan to be late enough to incur a late charge (Due Date + Grace Days), the system will apply a late charge in the afterhours following the reversal.

Fee Amount

The amount of the fee assessed to the account after this transaction processes depends on if you use a flat fee or percent for non-sufficient funds. The transaction will first use the amount in the NSF Fee Amount field or, if blank, it will use the NSF Fee Percent to calculate the percent of the fee. The NSF Fee Percent is a percentage of the P/I Constant on the loan. These fields are found on the Loans > Account Information > Account Detail screen > Late/NSF tab.

•If using the NSF Fee Percent, the system checks the NSF Fee Maximum and NSF Fee Minimum fields and does not assess NSF fees for more or less than those amounts. For example, if the NSF Fee Maximum is $10, and the system calculates 5 percent of a $300 P/I Constant, the fee amount would normally calculate to $15. But because the maximum is $10, the fee amount will be $10.

•If there is no NSF Fee Amount and no NSF Fee Percent, then the transaction uses the default amount stored in institution option LNFA.

•If the NSF Fee Not Allowed box is checked, no fee will be assessed.

On the Marketing and Collections screen, the fee will be displayed in the Fees list view table, as shown below. Fees should be part of the Payment Application if you want a part of the payment to go toward fees.

G/L Account for Office Number

The G/L account used for the reversal of this payment is set up in the Bank Account (NSF Check/Allotment Pmt) on the GOLD Services > Office Information screen > G/L Account tab. The G/L office used is determined by what (or if) an office is entered in the Originating Branch field on the transaction.

•If the Originating Branch number is left blank on the transaction, the system will use the G/L account tied to the office that the teller is currently signed onto. (For those institutions that allow the branches to handle their own NSF payments, the field can be hidden in GOLDTeller. See the Field Properties Screen topic in the CIM GOLDTeller User's Guide for more information on hiding fields on transactions.

•If the teller enters a valid office number in the Originating Branch field, the system will credit the G/L account tied to that office with the transaction amount.

Common Errors

The following common errors may be displayed when attempting to run this transaction.

Error |

Cause |

G/L Account Missing/Closed |

This error is displayed if no G/L account exists for the Originating Branch entered on the transaction. If your institution hides the Originating Branch field, the system looks at the office tied to the teller. If either of those offices is not set up with a valid G/L account in the Bank Account (NSF Check/Allotment Pmt) on the GOLD Services > Office Information screen > G/L Account tab, than this error will be displayed. See the following example of where that G/L account must exist on the Office Information screen:

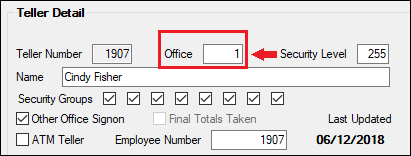

Note: The account tied to the teller is set up on either the Deposits > Definitions > Teller Information screen or the Security > Setup screen > Teller tab, as shown below:

|

File Cor Amt is: NNNNN |

If the transaction does not match the last payment amount (the amount you're reversing), you will receive this error after clicking <Send> or <Transmit>.

You can use that message to redo the transaction with the correct transaction amount. |

See also: