Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2510-02, Judgment Transaction

This transaction is run once your institution has been awarded a judgment. It changes the principal balance of the loan to the amount of the judgment unless option OP14 PJPL is set; then the judgment amount must be equal to the principal balance. You may need to run a Partial Charge-off transaction (tran code 860) before you run the Judgment transaction to write-off the amount of the loan that wasn't covered by the judgment.

After the transaction is run, the system updates the fields on the Judgment tab of the Loans > Bankruptcy and Foreclosure > Foreclosure, Repossession and Judgment Information screen.

Note: Precomputed accounts (payment method 3) must be converted to interest-bearing accounts (payment method 6) before this transaction can be run. The system will return the following message if a user attempts to run a transaction on a precomputed account: "MUST CONVERT TO IB BEFORE RUNNING TRAN." See the Precomputed to Simple tab on the Charge-off screen for more information on how to convert a precomputed loan to an interest-bearing account.

Also, the Judgment Date (Effective Date) cannot be in the future. The system will return the following message if a future date is entered: "Judgment Date is in Future."

See also: Judgment with Other Fees (tran code 2510-13).

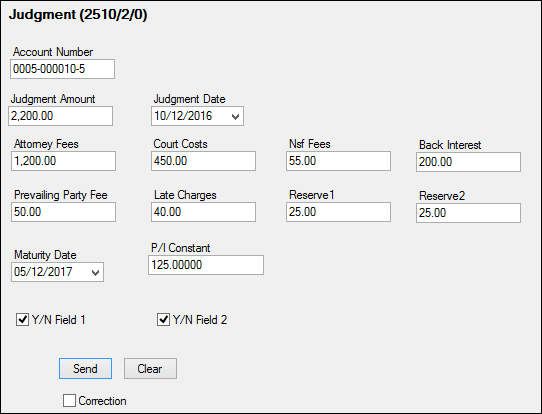

See the following example of this transaction:

You will need to do some setup to use this transaction. The following table explains the fields that need to be changed on this transaction:

Field |

Description |

|---|---|

Y/N Field 1 (Field 210) |

This checkbox field allows you to determine if the Statement Code (LNSCYC) should be changed to 1. This means no statement on Consumer Finance Statements only (FPSRP180). You can use the Transaction Design screen in CIM GOLDTeller to change the name of this field to something more meaningful to your institution's tellers or employees.) |

Y/N Field 2 (Field 211) |

This field allows you to clear the interest effective rate to zero (since this transaction is run on payment method 6 loans, the interest effective rate is LNRATE and is found on the Loans > Account Information > Account Detail screen > Interest Detail tab).

•If checked, the interest rate will clear to zero.

•If unchecked, the interest rate will remain as is or will change to whatever you enter in the Effective Rate field on the transaction (see example above).

You can use the Transaction Design screen in GOLDTeller (or CIM GOLDTeller) to change the name of this field to something more meaningful to your institution’s tellers or employees (such as “Clear Interest Rate?”). Or you can hide the field on the screen, as explained in these sections in either the CIM GOLDTeller or GOLDTeller manuals:

•CIM GOLDTeller User's Guide > CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Field Properties Screen

•GOLDTeller User's Guide > Advanced GOLDTeller Features > Transaction Design > Field Attributes Screen |

Reserve 1 (Field 45) |

This field allows you to enter an amount that will be assessed to miscellaneous fees (fee code 001). Just like the court costs (fee code 032) or attorney fees (fee code 031), the miscellaneous fee will be assessed during the Judgment Transaction if an amount is entered. After the transaction is run, the fees will be displayed in the Fees list view (LNFEES) on the Loans > Marketing and Collections screen.

Use the Transaction Design screen in CIM GOLDTeller (or GOLDTeller) to change the name of this field to something more meaningful to your institution's tellers or employees, such as “Miscellaneous Fee.” Or you can hide the field on the transaction if your institution does not want to use these fields, as explained in these sections in either the CIM GOLDTeller or GOLDTeller manuals:

•CIM GOLDTeller User's Guide > CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Field Properties Screen

•GOLDTeller User's Guide > Advanced GOLDTeller Features > Transaction Design > Field Attributes Screen |

Reserve 2 (Field 46) |

This field allows you to enter an amount that will be assessed to repossession (Repo) fees (fee code 038). Just like the court costs (fee code 032) or attorney fees (fee code 031), the repossession fee will be assessed during the Judgment Transaction if an amount is entered.

Use the Transaction Design screen in CIM GOLDTeller (or GOLDTeller) to change the name of this field to something more meaningful to your institution's tellers or employees, such as “Repossession Fee.” Or you can hide the field on the transaction if your institution does not use these fields, as explained in these sections in either the CIM GOLDTeller or GOLDTeller manuals:

•CIM GOLDTeller User's Guide > CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Field Properties Screen

•GOLDTeller User's Guide > Advanced GOLDTeller Features > Transaction Design > Field Attributes Screen |

Using this transaction increases or decreases the principal balance by the difference between the current principal balance and the judgment amount. This is done as a journal transaction.

This transaction automatically debits or credits the General Ledger account number in the Write-off – Charge Off or Write-off – Regular Loan fields on the GOLD Services > General Ledger > G/L Account By Loan Type screen for the amount you write off. A different General Ledger number can be used for accounts that are charged off versus those that are not.

The transaction also performs the following functions:

•Places a Hold Code 90 (judgment) on the account.

•Places an Action Code 99 (judgment awarded) and Date on the account.

•Places a Partial Write-off amount on the account (if applicable).

•Clears any amount in the Partial Payments/Applied to Payment field, unless institution option DCJT is set to "Y."

•The Date Last Accrued and Date Interest Paid To fields are changed to the judgment date of this transaction.

•Waives the amount in Late Charges Due.

•Does not update/decrease the Times Late.

•Does decrease the Times Waived by 1.

•Changes the Late Charge Code to "No Late Charge."

•Waives any interest owing by running a tran code 120 (waive interest correction).

•Clears the Interim Paid Amount.

•Changes the Prepayment Penalty Code to 0.

•Changes the Lifetime Late Charges Collected field to 0 unless institution option DCJT is set to "Y."

•Clears the Interim Late Charges field if institution option OP04 UDQG is set to "Y."

•Waives any existing miscellaneous fees on the account.

•Assesses miscellaneous fee amounts to the following fee codes (if information is entered in the applicable fields of the transaction, as shown in the transaction example above).

oMiscellaneous fees as miscellaneous fee code 01

oNSF fees as miscellaneous fee code 9

oAttorney fees as miscellaneous fee code 31

oCourt costs as miscellaneous fee code 32

oBack interest as miscellaneous fee code 33

oRepossession fees as miscellaneous fee code 38

oLate charges as miscellaneous fee code 39

oPrevailing party fees as miscellaneous fee code 40

•If the Y/N Field 1 (Change Statement Code?) box is checked, the system assigns Statement Code (LNSCYC) 1 to the account. This means no statement on Consumer Finance Statements only (FPSRP180).

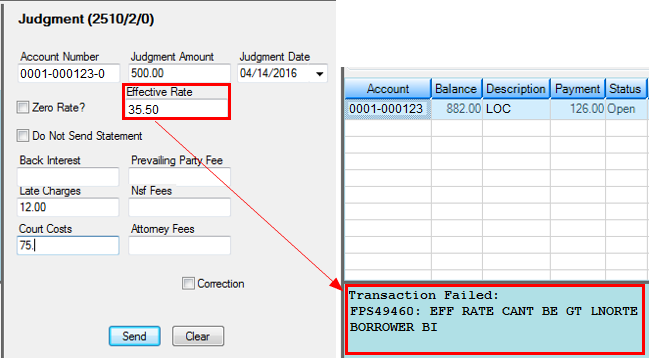

•In addition, this transaction can change the future interest rate. This may be because the judge has included the ability to accrue future interest on the judgment amount at a different rate. Please not that if the Y/N Field 2 (Clear Interest Rate?) box is checked, interest effective rate (LNRATE) is zeroed out. If not checked, the interest rate will remain as is or will change to whatever you enter in the Effective Rate field on the transaction.

•You can also change the interest rate (Effective Rate field) to zero if interest cannot be accrued beyond the judgment date. Note: If institution option OP29 EGTO (Effective Rate Cannot be Greater than LNORTE) is set up for your institution, the system will return an error message if the user attempts to process an Effective Rate greater than the original interest rate, as shown below:

Precomputed loans (payment method 3) must be converted to a daily simple-interest loan (payment method 6) before running this transaction. (See the Loans > Transactions > Charge-off Transactions screen > Convert Precomputed to Simple tab for more information about converting precomputed loans.)

Institution option OP14 PJPL prohibits the Judgment transaction on precomputed loans. It also forces the judgment amount to be the same as the principal balance.

If institution option OP21 DCJT is set, Partial Payments (LNPRTL) and Lifetime Late Charges Collected (LNLLTC) will not be cleared during the Judgment transaction.

See also:

Sale of Security Transaction (tran code 2510-03)

Full Write-off Transaction (tran code 2510-05)

Partial Repossessed Write-off Transaction (tran code 2510-08)