Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2600-02, Collection Payment

This transaction is processed when the loan payment is received by a third party (such as an attorney or collection agency). This transaction allows for the transaction amount, plus the amount that will go back to the attorney or collection agency. Using this transaction increases the principal balance by the amount of the fee, and combines the principal increase amount with the check received and posts the full loan payment. (It does both a journal to the G/L account (tran code 500) and a check payment transaction (tran code 600)).

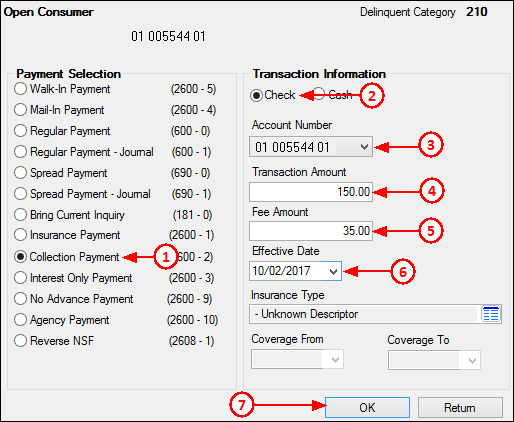

The best way to run the Collection Payment transaction is to start by entering the collection payment information on the Loans > Transaction > Make Loan Payment screen, and completing the following steps:

1.Select the Collection Payment radio button.

2.Select the Check radio button in the Transaction Information field group. Note: This transaction will not work with the Cash selection.

3.Select the Account Number from the drop-down list, if it isn't already selected.

4.Enter the amount of the transaction in the Transaction Amount field. The collection agency likely sent your institution the check with the amount on it.

5.If the collection agency requires a fee, enter that amount in the Fee Amount field. Remember: This amount will be added back on the Principal Balance of the loan and applied to the Partial Payment/Applied to Payment field.

6.Select the Effective Date the payment was made. Especially for collection payments, this payment may have been made before today's date. Backdating is allowed.

7.Click <OK>. The system will bring up the Collection Payment transaction in CIM GOLD, with the fields pre-filled with information entered on the Make Loan Payment screen. The following examples illustrate these steps, followed by the transaction as it appears in CIM GOLDTeller:

Loans > Transactions > Make Loan Payment Screen

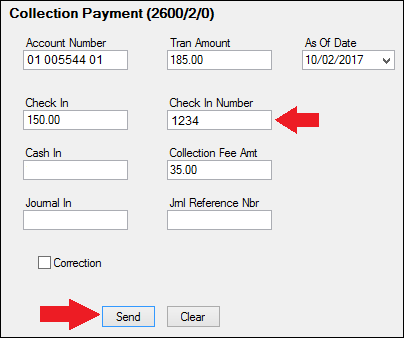

Collection Transaction (tran code 2600-02) in CIM GOLDTeller

8.Look over the Collection Payment transaction, add the check number of the collection payment (optional), and if everything looks okay, click <Send> to finish processing the transaction.

Note: This transaction is different from the Agency Payment transaction (tran code 2600-10) because this transaction increases the principal balance by the fee amount, instead of debiting the fee from the G/L.

Example

A collection agency sends you a check for an account with a payment of $150. The collection agency requires a 15% fee for all payments they collect. You would run the transaction for $172.00: $150 for the Check In and $22.00 for the Collection Fee Amt.

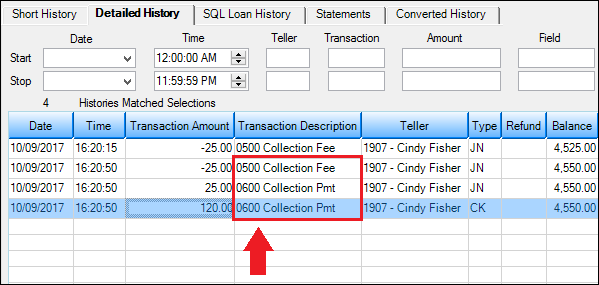

History

The transaction will increase the Principal Balance by the amount of the fee (tran code 500 journal). It will then increase the Partial Payment/Applied to Payment amount by the fee (tran code 600 journal). The transaction will also process another loan payment (tran code 600) for the amount that goes toward principal, that will process according to the Payment Application (e.g., interest first, then principal, then late charges; or however it is set up in the Payment Application).

The history description for this transaction consists of three descriptions: "Collection Fee, Collection Pmt, Collection Pmt," as shown below:

CP2 Rules on Payoffs

This transaction can be used with the CP2 Transaction Processing Rules screen (function 803/804) in GOLD Services (Application 8).

If, after taking the underpayment into consideration, the amount of credit insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-in Payment (tran code 2600-04) Walk-in Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example:

The loan balance is $100.00, and the principal and interest is $75.00, leaving $25 of the remaining loan balance to fees and late charges. The refunds total $40.00, if the loan is paid off today. A customer brings in an $80 payment.

As you attempt to post the loan payment using this transaction, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would not be able to use this transaction. You would instead open the Loans > Payoff screen, lock in the payoff, then post the payoff using the Post Payoff tab. The total amount of the payment, $80, would pay off the principal and interest and $5 of the fees and late charges, leaving $20 more to pay off the loan. Because the loan would be paid off early and therefore be eligible for refunds, the $40 in refunds would pay off the remaining $20 left on the loan, leaving $20 as a refund back to the customer. The loan would then be closed.

The system calculates this for you when running a payoff on the Loans > Payoff screen > Post Payoff tab. Any refunds (credits) will show on the Adjustments tab after the loan has been locked for payoff. |