Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 0660, Assess Loan Fees

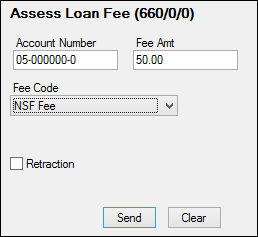

You can assess miscellaneous fees to an account after the loan is opened by using the Miscellaneous Fees program. Your institution must have institution option OP06-XFEE set in order to allow miscellaneous fee processing. The following is an example of the Assess Loan Fee transaction:

This is a journal transaction that adds the amount of the transaction to the total fees (LNFEES) on the loan. Only one fee can be assessed with each transaction. Notice the Fee Code field in the example above. That field should be changed to a drop-list to make processing easier for tellers. Someone at your institution needs to design this field (it's field number 80) on the Transaction Design screen in CIM GOLDTeller to be a drop-list that is populated with all the fee codes used by your institution. Setting up fields on transactions to be drop-lists requires special security. It is a three-step process, starting with defining the items to be in the drop-list. See the System Field Dictionary topic in the CIM GOLDTeller User's Guide for step-by-step instructions on how to set up a drop-down list field on transactions.

If you do not make this field a drop-list, the teller will be responsible for entering the loan fee code in the Fee Code field. The teller should enter the code as a number (not the description). For example, if trying to assess a non-sufficient funds fee, the teller would enter "009" in this field (that's the code for NSF Fees).

Once the transaction is run, the system will assess that fee to the account and it will be displayed on the Miscellaneous Fees list view on the Loans > Marketing and Collections screen > Delinquent Payments tab. This is known as the fee record. This is different from the amortizing fees, which are completely different and usually assessed during loan origination (see the Amortizing Fees and Costs screen for more information).

Correcting an assessed fee subtracts the amount from the total fees. The system subtracts the amount from the amount assessed in the fee record for the fee code, the date last assessed is set back to its previous value, and the counter is decremented by one. Only one fee can be corrected with each correction transaction.

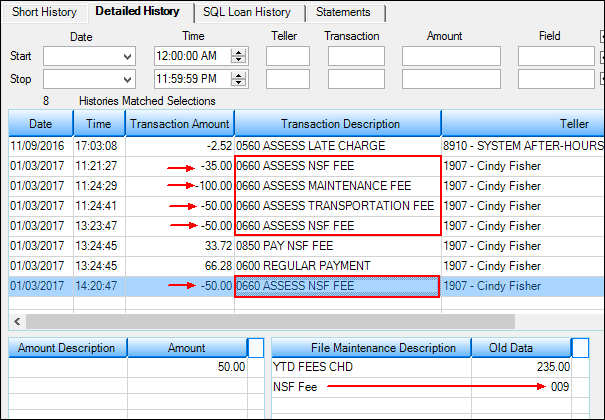

History records the fee as tran code 660, with a description of the fee that was assessed from the fee code, as shown below:

Also see these other help topics for more information about miscellaneous fees:

Miscellaneous Fees list view on the Marketing and Collections screen