Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2600-10, Agency Payment

This transaction performs a payment on a loan in which a collection agency received the full payment. This transaction provides a way to run the payment received from the collection agency if they subtract their fee prior to sending it to your company. You can run the transaction when a fee is not subtracted, entering the full payment amount. If the collection agency sends the payment less their fee, run the transaction as described. The full payment amount should be placed in the Tran Amount field; the fee amount charged by the collection agency should be entered in the Collection Fee field; and the remaining check amount should be entered in either the Check In or Cash In fields.

If the transaction is run without a fee, follow the same procedure as above, only place the full payment amount in the Check In or Cash In fields and leave the Collection Fee field blank.

Note: This transaction always posts funds in the following order: principal balance, interest, then either late charges or loan miscellaneous fees, depending on the order indicated in the Payment Application field.

Note: The remaining funds must be either cash or check. The transaction does not process mixed cash and check amounts.

Note: This transaction is different from the Collection Payment transaction (tran code 2600-02) because this transaction does not increase the principal balance by the fee amount.

Note: You can run this transaction without requiring a fee. Just enter "0.00" in the Collection Fee Amt field or leave it blank.

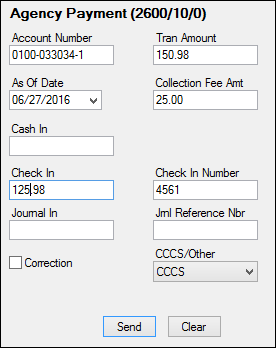

The Agency Payment transaction box displays the following fields:

The transaction posts the transaction amount to the loan. The collection fee (if applicable) is debited to the General Ledger account specified. The General Ledger account for collection agency fees is set up in the Collection Fee field on the GOLD Services > General Ledger > G/L Account By Loan Type screen in CIM GOLD.

Example: |

A collection agency collects a $100.00 payment and charges a $25.00 fee. Then $75.00 is sent to the institution.

The Agency Payment transaction should be run with $100.00 in the Tran Amount field, $25.00 in the Collection Fee field, and $75.00 in either the Check In or Check Out fields. Consequently, $100.00 will be posted to the loan, and $25.00 will be debited to the General Ledger account listed in the Collection Fee field on the GOLD Services > General Ledger > GL Account By Loan Type screen. |

Note: The CCCS/Other field is initially called "Event Code" (Field number 236) when you first download this transaction. You should change the name of this field to "CCCS/Other" and make it a drop-list, as displayed in the transaction example above. The list should include two choices: CCCS and Other. (Or you can hide it if your institution does not use this field.)

If the teller selects “CCCS,” the account is flagged with Special Comment Code “B” (account payments managed by Credit Counseling Service) during monthend credit reporting. If the teller selects “Other,” no Special Comment Code is reported unless another Special Comment Code applies to the account. The next month, the flag is removed, unless another agency payment is made on the account.

To change the name of a field in CIM GOLDTeller or to hide a field, see this section in the CIM GOLDTeller manual:

To create a drop-list on a transaction in CIM GOLDTeller, see this section in the CIM GOLDTeller manual: