Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2741-02, Convert LOC to IB

This transaction (TORC 742) automatically converts line-of-credit (LOC) accounts to interest-bearing at the end of the draw period or when the credit limit has been met. It is run by the system in the afterhours and cannot be run manually. The corresponding reversal transaction (tran code 2741-03) allows tellers to manually reverse the LOC-to-IB conversion through GOLDTeller.

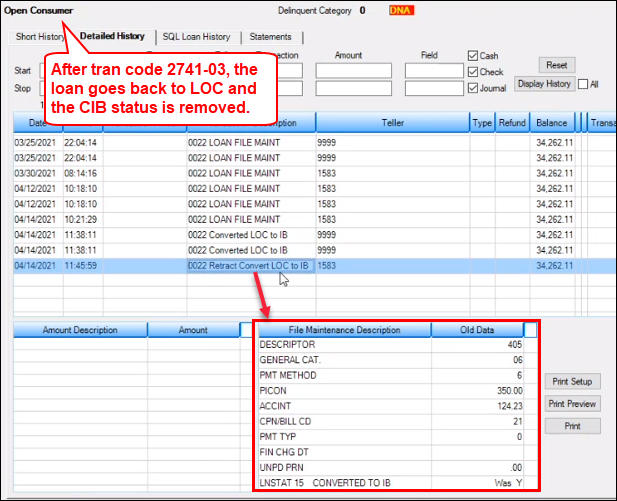

CAUTION: There are currently no restrictions on when the reversal transaction can be run after the account has been converted. The reversal transaction should be run as close to the date of the conversion as possible under the supervision of someone who understands LOC billing dates. See Figure 2 below.

Each night, Afterhours Update Function 100 (auto convert LOC to IB) checks to see if the LOC draw period has expired (in other words, if the date entered for Action Code 43 has been reached). The Update Function also checks to see if the current principal balance on the loan equals the credit limit. If the draw period expiration or credit limit has been met, the LOC (payment method 5) loan will be converted to an IB (payment method 6) loan.

Important:

•If the loan is paid in full before the expiration of the draw period, the LOC loan is not converted and the loan is closed.

•LOC (revolving) card loans are excluded from this conversion process.

•The account needs to be fully drawn or past the draw period expiration (Action Code 43 date). Released accounts will not be converted.

During the conversion process, the following changes will occur on each qualifying account:

•The amounts in the Current Finance Charge (LNRLCC) and Prior Finance Charge (LNRLPC) fields will be moved to the Accrued Interest (LNACIN) field. If the loan is current and the customer made all required payments before the expiration of the draw period (Action Code 43 date), then finance charges will not need to be moved into the Accrued Interest field (as they were paid/collected). If the loan is delinquent, interest that has been billed but not yet collected will also be added to LNACIN.

•If the Due Date is not in the future, the Due Date will be advanced to the next scheduled Due Date following the expiration of the draw period (Action Code 43 date) for the start of the amortized payment period.

•If the P/I Constant (LNPICN) is zero and the Original P/I Constant (LNOPIC) is not, the amount in LNOPIC will be designated as the new P/I Constant after the loan has been converted. If LNPICN and LNOPIC are both zero, the system will calculate a new P/I Constant based on the remaining loan balance, the Interest Calculation Method (LNIBAS), and Term of the loan (LNTERM). Note: When these loans are originated, it’s very important that LNTERM and LNIBAS are populated as part of origination.

•All line-of-credit fields will be changed to their default values.

•The Bill Code (LNBILL) will be changed to 21. Note that this conversion does NOT change the Statement Code (LNSTMT), which might need to be manually changed to a more appropriate code (such as 2 - Bill and Receipt).

•The Payment Method (LNPMTH) will be changed to 6 (Interest-Bearing).

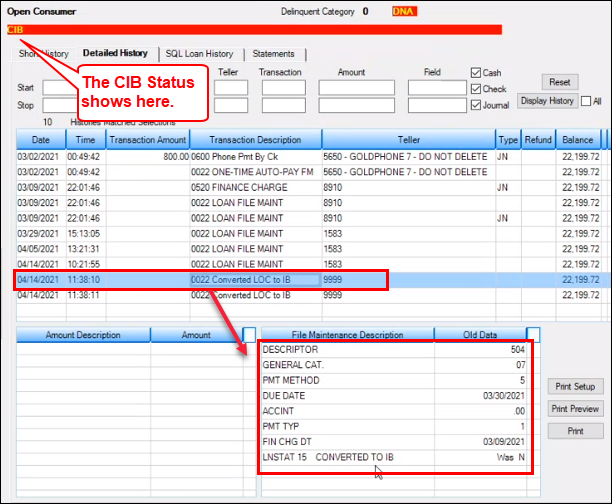

•The CIB account status will appear at the top of CIM screens to indicate the conversion. See Figure 1 below.

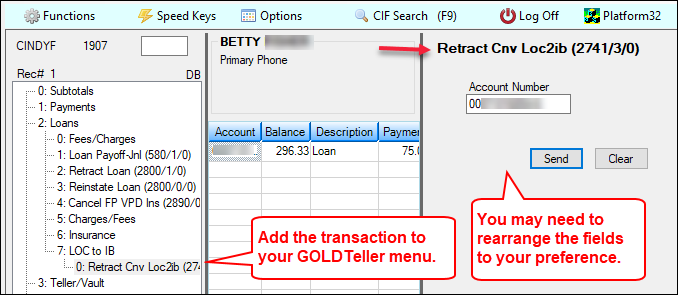

You will need to add tran code 2741-03 to your GOLDTeller menus if you plan on allowing reversals of the LOC-to-IB conversion. You may also want to adjust the placement of fields in the Transaction Design. See these topics in the CIM GOLDTeller menu for further information about adding and editing transactions:

Tip: If you want to add that transaction to your teller menu and can’t see it, go to Functions > Update All Transactions in GOLDTeller and the system will download all new transactions. You may need to log off GOLDTeller then log back on.

Contact your GOLDPoint Systems account manager for more information about implementing this transaction at your institution. A new version of CIM GOLD is not required for this programming.

The following examples show Loan History after an LOC-to-IB conversion, reversal transaction code 2741-03 in GOLDTeller, and Loan History after an LOC-to-IB conversion has been reversed.

Figure 1: Loan History After an LOC-to-IB Conversion

Loans > History Screen > Detailed History Tab

Figure 2: Transaction Code 2741-03

CIM GOLDTeller showing Retract Cnv Loc2Ib Transaction (tran code 2741-03)

Figure 3: Loan History After an LOC-to-IB Reversal

Loans > History Screen > Detailed History Tab