Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

The Judgment for Cards transaction (tran code 2510-14) is like the Judgment Transaction (tran code 2510-02) but is specifically for LOC card loans, also known as revolving loans (payment method 5 with LNCARD = Y). It also has some additional functionality, as will be discussed below.

This transaction should be run manually by someone at your institution once your institution has been awarded a judgment from a bankruptcy court concerning the account. Running this transaction changes the principal balance of the loan to the amount of the judgment, should the judgment amount be less than the principal balance. If institution option OP14 PJPL is set; then the judgment amount must be equal to the principal balance.

Using this transaction increases or decreases the principal balance by the difference between the current principal balance and the judgment amount. This is done as a journal transaction.

Additionally, this transaction allows you to assess fees involved with a bankruptcy, such as attorney’s fees, court costs, repossession fees, and others, which will be discussed below in more detail.

After the transaction is run, the system updates the fields on the Judgment tab of the Loans > Bankruptcy and Foreclosure > Foreclosure, Repossession and Judgment Information screen.

Also, the Judgment Date (Effective Date) cannot be in the future. The system will return the following message if a future date is entered: "Judgment Date is in Future."

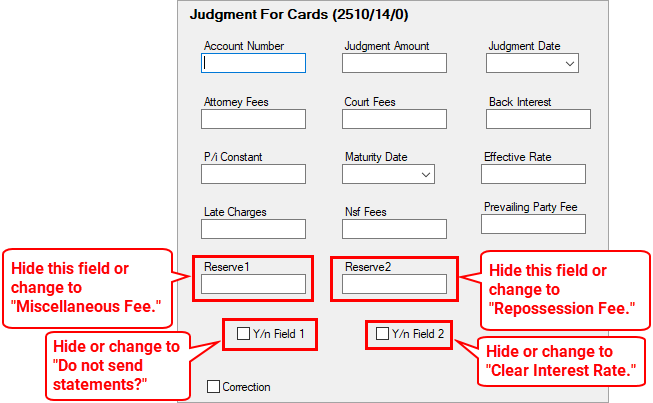

You will need to do some setup to use this transaction. The following table explains the fields that need to be changed on this transaction:

Field |

Description |

|---|---|

Y/N Field 1 (Field 210) |

This checkbox field allows you to determine if the Statement Code (LNSCYC) should be changed to 1. This means no statements will be sent to the borrowers on this loan (FPSRP 310 or FPSRP322; depending on which one your institution uses). You can use the Transaction Design screen in CIM GOLDTeller to change the name of this field to something more meaningful to your institution's tellers or employees, such as “Do not send statements?” |

Y/N Field 2 (Field 211) |

This field allows you to clear the interest effective rate to zero.

•If checked, the Interest Rate (LNRATE/NLRATE) on the loan/promotions will clear to zero. •If unchecked, the Interest Rate will remain as is or will change to whatever you enter in the Effective Rate field on the transaction (see example above). •You can use the Transaction Design screen in CIM GOLDTeller) to change the name of this field to something more meaningful to your institution’s tellers or employees (such as "Clear Interest Rate?"). Or you can hide the field on the screen, as explained in the following section in the CIM GOLDTeller User’s Guide: •CIM GOLDTeller User's Guide > CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Field Properties Screen. |

Reserve 1 (Field 45) |

This field allows you to enter an amount that will be assessed to miscellaneous fees (fee code 001). Just like the court costs (fee code 032) or attorney fees (fee code 031), the miscellaneous fee will be assessed during the Judgment Transaction if an amount is entered. After the transaction is run, the fees will be displayed in the Fees list view (LNFEES) on the Loans > Marketing and Collections screen.

Use the Transaction Design screen in CIM GOLDTeller to change the name of this field to something more meaningful to your institution's tellers or employees, such as "Miscellaneous Fee." Or you can hide the field on the transaction if your institution does not want to use these fields, as explained in this section in the CIM GOLDTeller User’s Guide:

•CIM GOLDTeller User's Guide > CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Field Properties Screen |

Reserve 2 (Field 46) |

This field allows you to enter an amount that will be assessed to repossession (Repo) fees (fee code 038). Just like the court costs (fee code 032) or attorney fees (fee code 031), the repossession fee will be assessed during the Judgment Transaction if an amount is entered.

Use the Transaction Design screen in CIM GOLDTeller to change the name of this field to something more meaningful to your institution's tellers or employees, such as "Repossession Fee." Or you can hide the field on the transaction if your institution does not use these fields. |

If there are multiple promotions on the account and the calculated difference is less than the outstanding balance of the oldest promotion, the amount from the oldest promotion record (earliest promotion opened date (NLOPND)) will be written off. If the calculated amount is greater than the outstanding balance of the oldest promotion, then it will write off that entire promotion and close it (set NLCLSD = Y). The remaining amount will be written off in the next oldest promotion, and so on until the full calculated amount of the account has been written off.

Example: Account with $1,500 in outstanding principle, split evenly between three separate promotion purchases ($500 for each promotion) has a judgment awarded for $800 dollars. That means $700 would need to be written off (1500 – 800 = 700). Therefore, after the Judgment Transaction was run:

•The oldest promotion would be entirely written off and closed.

•The next oldest promotion would have a partial write off transaction in the amount of the remaining $200.

•The account would be left with $800 remaining to be paid, according to the judgment.

Before Judgment Transaction

Open Date |

Principal Amt |

Status |

Promo Seq |

|---|---|---|---|

1/1/2018 |

500 |

Open |

1 |

9/9/2019 |

500 |

Open |

2 |

2/2/2020 |

500 |

Open |

3 |

After Judgment Transaction

Open Date |

Principal Amt |

Status |

Promo Seq |

|---|---|---|---|

1/1/2018 |

0 |

Closed |

1 |

9/9/2019 |

300 |

Open |

2 |

2/2/2020 |

500 |

Open |

3 |

The transaction also performs the following functions:

•Users can leave the P/I Constant field blank, and the P/I Constant will continue to be the amount before the Judgment Date. Often times the judge will decree a new P/I Constant. Enter that amount in the P/I Constant field on the transaction, and the system will update the P/I Constant (LNPICN) field on the loan with that amount.

•Places a Hold Code (judgment) on the account.

•Places an Action Code 99 (judgment) with the Action Date of the effective date of the judgment.

•Places a Partial Write-off amount on the account (if applicable).

•Clears any amount in the Partial Payments/Applied to Payment field, unless institution option DCJT is set to "Y."

•The Date Last Accrued and Date Interest Paid To fields are changed to the judgment date of this transaction.

•Waives the amount in Late Charges Due.

•Does not update/decrease the Times Late.

•Does increase the Times Waived by 1.

•Changes the Late Charge Code to "No Late Charge."

•Waives any interest owing for all promotions (on the Cards and Promotions screen > Promotion Interest tab) as follows:

oAccrued Interest (NLACIN)

oPrior Uncollected Interest (NLPUCI)

oCurrent Uncollected Interest (NLCUCI)

oCurrent Finance Charge (NLRLCC)

oPrior Finance Charge (NLRLPC)

•Also clears the following interest from the loan record (on the Cards and Promotions screen > Finance Charge tab):

oCurrent Finance Charge (LNRLCC)

oPrior Finance Charge (LNRLPC)

•Clears the Deferred Interest Date (NLDIED) on promotions.

•Updates the following date fields to the Judgment Date from the transaction:

oDate Last Accrued (LNDLAC)

oInterest Paid To Date (LNPDTO)

oDate Last Accrued for any promotions (NLDTAC)

•Changes the Lifetime Late Charges Collected field to 0 unless either (or both) institution options DCJT and KLLT are set to "Y."

•Waives any existing miscellaneous fees on the account (before the Judgment Transaction is run). Of course, if the Judgment Transaction is run with additional miscellaneous fees (described below), those fees are applied to the account.

•Assess all the following fees (tran code 660) if a value is populated for them in the transaction:

oattorney fees as miscellaneous fee code 31

ocourt costs as miscellaneous fee code 32

oback interest as miscellaneous fee code 33

olate charges as miscellaneous fee code 39

oprevailing party fees as miscellaneous fee code 40

oNSF fees as miscellaneous fee code 9

oMiscellaneous fee as miscellaneous fee code 1

oRepossession fee as miscellaneous fee code 38

•If the Y/N Field 1 (Do not send statement?) box is checked on the transaction, the system assigns Statement Code (LNSCYC) 1 to the account. This means no statement will be sent for the Revolving LOC loan. S).

•In addition, this transaction can change the future interest rate. This may be because the judge has included the ability to accrue future interest on the judgment amount at a different rate. Please note that if the Y/N Field 2 (Clear Interest Rate?) box is checked, interest effective rate (LNRATE) is zeroed out. If not checked, the interest rate will remain as is or will change to whatever you enter in the Effective Rate field on the transaction.

•Stops any annual service fee assessments (LNRLSA).

•If institution option OP21 DCJT is set, Partial Payments (LNPRTL) and Lifetime Late Charges Collected (LNLLTC) will not be cleared during the Judgment transaction.