Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2910-03, Reversal of Vehicle Service Contracts

This transaction allows for Vehicle Service Contract (VSC) refunds to maintain regulatory compliance. This transaction can only be initiated within CIM GOLDTeller; you cannot run this transaction from the Loans > Insurance > Adjustments screen.

This transaction differs from the original Cancel Insurance transaction (tran code 2910-00) in that it allows you to decide what amount of the insurance policy’s commissions are to be refunded to the customer at cancellation. It also allows you to run the Cancel Insurance transaction by either policy type and number or insurance record sequence number.

Also, all refund options on the insurance policy, such as Refund Rule (INRULE), Minimum Refund Amount (INMINR), Do Not Refund (INDNRF), and Return All Within NN Days (INRTNA) are ignored. (See Insurance Information field group on the Loans > Insurance > Policy Detail help.)

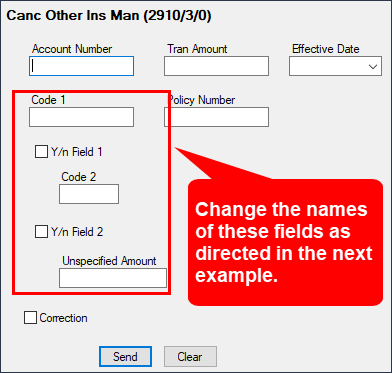

The transaction will appear as shown below when you first add the transaction. We recommend changing the name of the fields highlighted below for ease of use.

As with all transactions, you can edit the transaction for your institution’s specifications. We suggest making the following modifications in Administrator Options > Transaction Design:

•Change Code 1 (Field 185) to Policy Type

•Change Y/n Field 1 (Field 210) to Use Seq Counter

•Change Code 2 (Field 186) to Insurance Seq Counter

•Change Y/n Field 2 (Field 211) to Use Commission Override %

•Change Unspecified Amount (Field 74) to Override Commission %

Tip: See the Field Properties Screen topic in the CIM GOLDTeller User’s Guide for information on how to change the names of these fields.

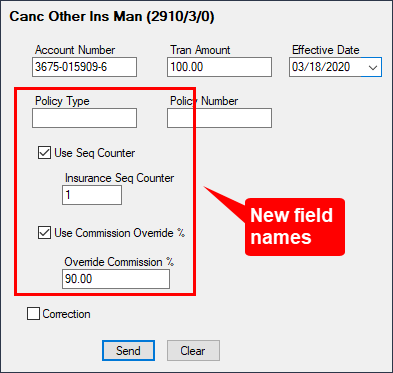

With your changes saved, the transaction will appear like the example below.

Running the Transaction

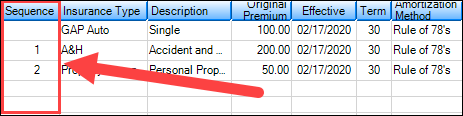

The insurance policy is retrieved by inputting the policy type and number or the insurance record sequence number, as shown above. To use the insurance record sequence number, check Use Sequence Counter (originally Y/n Field 1) and input the number listed in the Sequence column shown on the Policy Detail screen (Loans > Insurance > Policy Detail), as shown below. If no sequence number is listed, input "0" or leave blank the Insurance Seq Counter field.

Sequence Column

The refund amount will not be prorated and will need to be manually input by the teller in the Tran Amount field. You should train your tellers what amounts to put in the Tran Amount field, or only allow supervisors who understand this transaction to run it.

Tip: You can modify the Transaction Menu by profile, so only supervisors can view and select this transaction from the CIM GOLDTeller menu. See Menu Design in the CIM GOLDTeller User’s Guide on how to set up different menus based on profiles.

The Effective Date will default to today’s date if the teller does not input a different date.

Commission Refund Calculation

The Commission Refund is calculated differently depending on whether you use the Override Percentage fields on this new transaction, as described below.

If you do not use the commission override fields, the system will calculate the commission percent as the Tran Amount divided by the Original Premium amount times the Original Amount of the commission, as follows:

•If Commission Refund amount is less than the Remaining Amount of commission (INOREM), the system will run a 461 (G/L debit) transaction for the difference (INOREM – Commission Refund = commission amount refunded back to the customer). This will be the amount debited from the G/L account for this refund. It will show in History (see below).

•If that amount is more than the remaining commission (INOREM), the system will run a 462 (G/L credit) transaction for the difference (Commission Refund – INOREM = commission amount credited to the G/L). The amount will be credited to the G/L account for this refund. It too will show in History.

•Once the transaction is run, the Remaining Amount of commission (INOREM) will be cleared on the Policy Detail screen.

•The G/L accounts for these amounts are set up on the GOLD Services > General Ledger > Setup G/L and Commissions Screen, according to the Company Number, Branch Number, and Policy Type. Note: If you want to take advantage of this transaction, make sure the appropriate G/L accounts are set up on that screen. Contact your GOLDPoint Systems account manager or your finance department if you need help in knowing which G/L accounts to use.

Example:

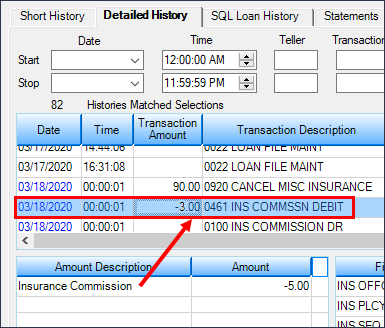

A VSC insurance policy is opened when a loan is originated. The Original Premium amount is $100.00, and the Original Commission Amount is $50. The Remaining Amount of commission is $47. After two months, the customer asks to cancel that insurance policy. Your supervisor says to return all but $10 of the Original Premium. So you enter "90.00" in the Tran Amount field.

$47 - $45 = $3.00. This is the amount debited from the G/L, as shown below:

Loans > History Screen > Detailed History Tab

|

If the Override Commission Percentage is entered (as well as the Use Override % box checked), the percentage of the commission refunded will be calculated as:

Original Commission Amount (INOORG) * Override Commission Percentage / 100 = Refund Commission

•If Refund Commission is greater than Remaining Amount of commission (INOREM):

•If Refund Commission is less than Remaining Amount of commission (INOREM):

Note: The percentage of the commission override cannot be greater than 100 percent.

A VSC insurance policy is opened when a loan is originated. The Original Premium amount (INOBAL) is $100.00, and the Original Commission Amount (INOORG) is $50. After two months, the customer asks to cancel that insurance policy. The Remaining Amount of commission (INNORG) is $42. Your supervisor says to return all $100 of the premium, but only 90 percent of the commission. So you enter “100” in the Tran Amount field and “90.00” in the Override Commission Percentage field. The system would calculate the return of commission as follows:

50 * 90.00 / 100 = $45.00

45 – 42.00 = $3 credited to the insurance commission G/L (tran code 462) |

Principal Balance Reduction

This transaction does not allow for any returned amounts to be sent via a check to the borrower. Instead, the Principal Balance is reduced by the amount of the transaction.

Other Field Maintenance

Other fields that are updated after this transaction is run are as follows:

•Cancellation Code (INCANC) is set to "4 – Insurer Request."

•Cancellation Date (INCAND) is set to the Effective Date entered on the transaction. If the Effective Date is left blank on the transaction, the Cancellation Date is populated with the transaction run date.

•Cancellation Posting Date (INCADT) is populated with the transaction posting date.

•If the transaction is reversed, the system reverses all the transactions at the time of cancellation and clears the insurance cancellation fields.

The following stipulations are required for the transaction to run:

•The account should be open (LNCLSD = N and LNUNOP = N)

•The account should not be released (LNRLSD = N)

•The account policy should not be canceled (LNCANC = 0)

•The account should not be frozen (LNHLD1 <> 60 and LNHLD2 <> 60 and LNHLD3 <> 60 and LNHLD4 <> 60)

•The should not be locked into payoff (Action Codes not set to “23 – Locked in for Payoff)

Corrections

If you need to make a reverse a cancellation, you can bring up the transaction, but when the transaction box appears, check the Correction box.

You will only need to input either the policy type and number or insurance record sequence number to reverse the transaction before clicking <Send> to reverse the transaction.

New Policy Type

We have also added a new Policy Type to the IMAC tables, so it will show in the Type field (INTYPC) on the Loans > Insurance > Policy Detail screen. The new type is "45 – Vehicle Service Contract."

GOLDPoint Systems adds the insurance policy type using IMAC Table FPINTYPD.

Setup

If your institution is interested in using this transaction, you will need to add the transaction to your GOLDTeller menu, as well as adjust the design of the transaction for tellers’ ease of use. See these topics in the CIM GOLDTeller User’s Guide for more information on how to setup transactions:

|

Tip: If you do not see transaction code 2910-03 in your list of transaction codes on the Menu Design screen, in your list of transaction codes on the Menu Design screen, complete the following steps to refresh the list and load any new transactions from Core Services: 1.While in CIM GOLDTeller, select "Update All Transactions" from under the Functions menu in CIM GOLDTeller. The system will download all changes to transactions and any new transactions. 2.Log off CIM GOLDTeller, then log back on. 3.You should see all new transactions available on the Menu Design screen. |

|---|