Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2022-01, Charge-offs

A charge-off is the declaration by a creditor (your institution) that an amount of debt is unlikely to be collected. This occurs when a customer becomes severely delinquent on a debt (usually 180 days delinquent or six months of missed payments). While a charge-off is considered to be "written off as uncollectable" by your institution, the debt is still legally valid, and remains as such after the fact. Charge-offs are reported in the monthend credit reporting. Each state regulates how institutions are allowed to handle charged off debt. For example, some states may allow for certain types of loans to continue collecting interest and fees while the loan is charged off. Other states may not allow any interest accrual if a loan has been charged-off. Because charged-off loans differ so much from institution to institution, we have programmed many options available for charge-offs.

Charge-offs can be handled in the following ways:

1.You can manually charge off loans individually using the Charge-off/Write-off Transactions tab under Loans > Transactions > Charge-off screen in CIM GOLD. When you use that tab, users should be logged into CIM GOLDTeller, as the last steps involve actually running the transaction in CIM GOLDTeller.

2.You can manually charge off the loan directly from CIM GOLDTeller by bringing up the Charge-off transaction (tran code 2022-01) and running the transaction from there.

3.Charge-offs can occur automatically in the afterhours when accounts are more delinquent than the number entered in institution option CODY. Your institution must have that option set in order to automatically charge-off severely delinquent loans, as well as Afterhours Update Function 86. Contact your GOLDPoint Systems account manager to set these up for you.

Note: If an ACH payment return is received with a return code other than R01 or R09 and Institution Option ACFR is set, the system will automatically charge off the loan as well as stop all future one-time and recurring payments on the account.

The Charge-off transaction (transaction 2022-01) does not close the loan. The principal balance does not change. However, the General Ledger in the Autopost is adjusted as explained below.

•This transaction performs account reclassification of the loan amounts in the General Ledger. Amount L-104 (principal charge-off/recovery), L-204 (principal charge-off contra), L-105 (interest recoveries), and L-205 (interest charge-off contra) allow you to further refine the posting to the General Ledger. In addition, posting field L-27 (miscellaneous fees code) within L-23 (miscellaneous loan fees) is also used to reclassify the miscellaneous loan fees to the charge-off G/L.

•This transaction appears on the Charged Off Loans Posting Journal and the Charged Off Loans Trial Balance Reports (FPSRP220).

Precomputed loans must be converted to a daily simple interest (payment method 6) prior to processing this transaction. This is done on the Convert Precomputed to Simple tab.

This topic discusses the following information:

What Happens to Insurance Policies at Charge-off?

What Happens to Unearned Fees at Charge-off?

Can Payments or Changes Be Made on Charged-off Loans?

What Happens to Insurance Policies at Charge-off?

For loans with active insurance policies, the system performs the following file maintenance on the loan (except for COOPs 1 and 8):

•Cancels all open insurance policies with Cancellation Code "11 – Charge-off."

•If there are any open insurance policies remaining on the account, the system runs a tran code 890 (Cancel Forced Insurance Policy) for the amount of any remaining premiums and finance charges.

•If any of the premium amounts have not been earned by the charge-off date, the system refunds the Unearned Premium amount by reducing the Principal Balance on the loan by that amount. It also performs a offsetting tran code 1800 debit to the General Ledger Autopost account. This transaction also triggers a 100 transaction to clear remaining unearned insurance commissions and adjust the General Ledger accordingly.

•Any Remaining Amount of finance charges are refunded back to the customer by reducing the Principal Balance on the loan by that amount. It also performs an offsetting tran code 1800 debit to the General Ledger Autopost account. (For more about the Autopost, see the General Ledger topic.) Note: If this is a precomputed loan, the PC-to-IB transaction will adjust the insurance finance charge, not the Charge-off transaction (see Convert Precomputed to Simple tab).

•Any Remaining Amount of commissions are cleared from the General Ledger account using tran code 100 (insurance commission debit) with TORC 124 (Debit/Credit Remaining Insurance Comm-Office). The system also runs tran codes 461 and 462 (Commission Adjustment transaction) and tran codes 1811 and 1812 as the G/L offset. For insurance commission debits, the system assigns TORC 125 (Amortize Remaining Insurance Commission–Office). For insurance commission rebates, the system assigns TORC 127 (Rebate Remaining Insurance Commission–Office). The G/L accounts for insurance commissions are set up on the GOLD Services > General Ledger > Setup G/L and Commissions screen.

•Any Unearned Tax or Unearned Surcharge amounts are debited/rebated accordingly into their respective G/L accounts. The G/L accounts are set up on the GOLD Services > General Ledger > Setup G/L and Commissions screen.

Note about Automatic Charge-offs on Precomputed Loans with Open Insurance Policies

For precomputed loans, an option is available, IBCO, that when turned on (and either COOP option 0 or 6 set up) causes the system to automatically convert precomputed loans to interest-bearing loans before charging them off. If this option is not set, the system will still automatically charge-off precomputed loans, but the loan will not be converted to an interest-bearing loan first.

However, if the IBCO option is on, you must cancel all open force-placed insurance policies before the system can convert precomputed loans and then charge them off. Therefore, you may have precomputed accounts appearing in the Afterhours Exception Report (FPSRP013). The system cannot convert precomputed accounts to interest-bearing accounts if open force-placed insurance policies remain on the loans.

You could create a work around wherein someone at your institution runs a GOLDWriter or GOLDMiner report that lists all precomputed accounts with open force-placed insurance polices that are set to be charged-off in the afterhours. The employee could then manually cancel those open force-placed insurance policies. Or you can just use the Afterhours Exception Report to view which accounts were unable to charge-off. |

Insurance Reports

The following reports may be helpful in viewing canceled insurance policies:

FPSRP095 - Credit Life & Disability Insurance Premium Report (LOC payment method 5 only)

FPSRP190 - Summary of Insurance Report

FPSRP149 - Insurance Activity Report

FPSRP204 - Insurance New and Canceled VSI Insurance

FPSRP205 - Insurance Credit Life, Accident & Health, and Unemployment

FPSRP207 - Insurance New and Canceled Property Insurance

FPSRP218 - Insurance Finance Charge Amortization Posting Journal and Trial Balance Reports

FPSRP227 - Insurance Refund Report

FPSRP243 - Insurance Credit Life, Accident & Health, Unemployment, Property, and Auto

Specialty Insurance Reports:

FPSRP284 - Assurant Group (Payment Method 5)

FPSRP286 - Life of the South Insurance Download

FPSRP291 - Wells Fargo Upload File

FPSRP292 - Minnesota Life Download and Report

FPSRP293 - Cherokee National Download and Report

FPSRP294 - ANICO Download and Report

FPSRP305 - Insurance - Southeast Underwriters VSI Insurance

FPSRP308 - Plateau Insurance Report and Transmission

FPSRP309 - Insurance - Southeast Underwriters VSI Insurance 2

What Happens to Unearned Fees at Charge-off?

Fees originally set up on an account can be amortized over the life of the account. These are known as amortizing fees or deferred fees. Additionally, your loans may have deferred costs, discounts, or dealer premiums that amortize over the life of the loan. Maintenance fees are handled differently than amortizing and deferred fees, as discussed later in this help topic.

For example, when a loan is originated, a one-time processing fee of $200 is set up to be paid over the course of the loan. At monthend, the system takes a portion of the $200 and puts it into a General Ledger account (set up through the GOLD Services > General Ledger > Amortization Descriptions screen). What happens to any remaining fees that haven't been amortized when the loan is charged off?

Well, it depends on the institution options set up. The following options stop amortization accrual if the loan becomes non-performing (LNNONP = Yes):

SAAF – Stop Amortizing Fee Amortization if Loan is Non-performing

SAF1 – Stop Amortizing Fee 1 Amortization if Loan is Non-performing

SAF2 – Stop Amortizing Fee 2 Amortization if Loan is Non-performing

SAF3 – Stop Amortizing Fee 3 Amortization if Loan is Non-performing

A loan becomes non-performing when it is more delinquent than the number set up in institution option NPDY (number of days delinquent to set non-performing), or if it is more delinquent than 93 days if that option is not set. An option (Afterhours Update Function 59) is available that automatically changes performing loans to non-performing loans if the loan is 93 or more days delinquent (excluding loans with general categories 50 through 69 (securities)). This change takes place only at monthend. Each month, for all loans that exceed being delinquent by 93 days, the system puts a check in the Non-Performing field. If the loan becomes less than 93 days delinquent, the system unchecks the field at monthend. The system does not look at payment method 5, 9, or 10 loans with a zero principal balance. If you would like this option set up for your institution, send in a work order with your request. Action code 59 (Do not update non-performing field) stops the Non-performing field from changing.

At charge-off, for any remaining amortizing/deferred fees, costs, discounts, or dealer premiums, the system checks the Take All If Sold 100% box (if it isn't already checked) on the Loans > Account Information > Deferred Fees screen, but only if the COOP option is not 0 or 6. Additionally, at monthend during the amortization process, the system will take all remaining fees/costs/discounts/premiums and debit/credit the applicable General Ledger account (as set up on the GOLD Services > General Ledger > Amortization Descriptions screen).

The following will be completely amortized at the next monthend (after the charge-off—except for COOP 0 and 6):

•remaining Deferred Fees, Costs, Discount/Gain, Premium/Loss, MSR's

•remaining Finance Charge amount for Force Place Insurance (Loans > Insurance > Policy Detail screen > Finance Charge Information tab)

•remaining amortizing fees (F1GREM) (G/L section only on the Loans > Amortizing Fees And Costs screen)

•remaining Dealer Prepaid Interest (LNDLRP - LNDLRE).

For COOP 0 and 6, however, the system will not take any remaining fees, nor will it check the Take All If Sold 100% box. But it will continue amortizing fees/costs/discounts/premiums as long as institution options SAAF, SAF1, SAF2, or SAF3 are not set (or your institution does not designate non-performing loans). If they are set, the system stops amortizing fees/costs/discounts/premiums, but it does not take remaining fees/costs into income or expenses.

Maintenance Fees

Please be aware that deferred fees/costs and amortizing fees/costs work differently than maintenance fees. Maintenance fees are specific to your institution and require special set up. They are brought over from loan origination and usually involve paying a monthly fee for maintaining the loan. Maintenance fees are only for interest-bearing loan (payment method 6); however, some institution set up maintenance fees for precomputed loan (payment method 3), but they're really just amortizing fees. See the Maintenance Fees topic for more information.

Maintenance fees may be refunded or collected (depending on when the charge-off takes place) when the loan is converted from precomputed to interest-bearing or at the time of charge-off (if not a precomputed account). However, COOP 7 does not refund unearned maintenance fees.

Can Payments or Changes Be Made on Charged-off Loans?

Payments and changes can be made on charged-off loans if certain institution options are set.

If this option is set, the following payments are allowed on charge-offs:

Allows a loan payment (including auto/recurring payments*) - (Tran code 600/608) Allows a "teller spread" payment - (Tran code 690/698) Allows payment of late charges - (Tran code 550/558) Allows waiving of late charges - (Tran code 570/578) Allows VSI Add - (Tran code 870/878) Allows VSI Cancel - (Tran code 890/898) Allows assessing of miscellaneous fees - (Tran code 660/668) Allows a payment of miscellaneous fees - (Tran code 850/858) Allows waiving of miscellaneous fees - (Tran code 670/678) Allows an automatic (recurring) payment*.

* COOP options 6, 7, and 9 do not allow automatic (recurring) payments even with this institution option set. |

Allows a principal decrease on charged-off loans - (Tran code 510/518) Allows a principal increase on charged-off loans - (Tran code 500/508) Allows a charged-off loan to be paid off - (Tran code 580) |

See Charge-off/Write-off Transactions tab under Loans > Transactions > Charge-off screen in CIM GOLD for more information on the steps to actually charge off a loan. Charging off a loan is often times accompanied by a Repossession transaction or a Bankruptcy transaction. See the Repossession screen and the Bankruptcy or Bankruptcy Detail screens (depending on which system your institution uses) for more information.

|

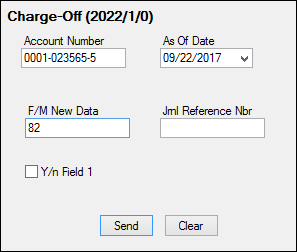

See the following example of the Charge-off transaction box in CIM GOLDTeller:

•The F/M New Data field is the new general category code you want the loan to be changed to. Your CIM GOLDTeller administrator can change the name of this field to be "General Category," as in the screen example above. Your administrator also needs to change this field to a drop-list. See Transaction Design and Creating a Droplist in the CIM GOLDTeller User's Guide for more information.

•The Y/N Field 1 checkbox (see transaction example above) is ignored by this transaction. You can hide that field on the transaction screen, as explained in the Transaction Design, then Field Properties topic in the CIM GOLDTeller User's Guide. The COOP options described below affect whether or not customers continue getting statements.

If charging off a precomputed loan, you need to first convert the precomputed loan to an interest-bearing loan using the Convert Precomputed to Simple tab. Certain institution options cause the system to automatically convert a precomputed loan to a simple-interest loan before the loan is automatically charged off. See COOP options 0 and 6 below for more information. Also see the Note box above concerning automatic charge-offs.

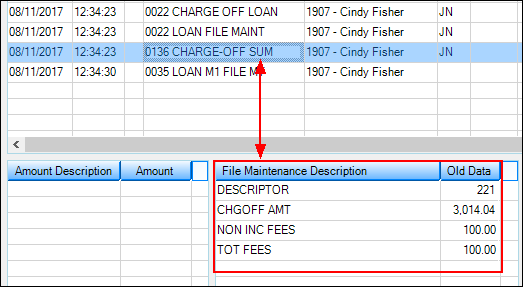

Transaction code 136 (Charge-off Summary) runs right after the Charge-off transaction (if the charge-off is run manually and not automatically in the afterhours). You can view it in the Loans > History screen > Details History tab, as shown below.

The 136 transaction provides a summary of the charge off amounts, including the total charge-off amount, total of income fees (amortizing and deferred fees), total of non-income fees (miscellaneous fees), any late fee amounts waived (if COOP option 6 or 9), adjustments to accrued interest (if COOP option 6), and total of insurance premium, tax, and surcharge refunds, if applicable.

Institution Option ACOS is available that, when set, allows this transaction, as well as the Reverse Charge-off transaction (tran code 2022-02), to be run on investor sold loans (LNISLD is greater than zero).

For Institution 158 Only:

The following additional information is for institution 158 when it comes to charge-offs:

1.When a loan is charged off, the system clears out the Interest Rate field, so the loan rate is now zero percent. Users cannot change the interest rate once it has been charged off. If users attempt to change the rate from zero to something else, they will receive an error message.

2.Accounts must first be charged off before they can be written off. If Hold Code 2 (charge-off) is not on the account and you attempt to run a Write-off transaction, the system will return the following message: |

The Charge-off transaction (tran code 2022-01) differs according to what COOP option your institution has set. The following table describes the different COOP option numbers, as well as how this transaction functions if no COOP option is selected for your institution. Send in a work order if you would like a COOP option set up for your institution. Note: These options affect accounts when the Charge-off transaction is run regardless of whether it is run manually through the Charge-off/Write-off Transactions tab under Loans > Transactions > Charge-off screen in CIM GOLD or automatically in the afterhours if institution option CODY is set.

If no COOP option is set, the following will take place on the account (in addition to everything above):

•Sets charge-off descriptor 221 in History.

•Places a general category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the current or As-of Date from the transaction and places it in the Charge-off Date and Charge-off Posted Date fields.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information for more details).

•If institution option IBCO is on, the system will convert precomputed loans (payment method 3) to interest-bearing loans (payment method 6) before charging off the loan. This is only for those institutions that automatically charge-off loans (institution option CODY must be set to the number of days delinquent before automatic charge off occurs).

•Statements are still sent to customers (unlike other COOP options). If you want statements to not be sent, manually check the Do Not Send Statements box on the CIF tab of the Marketing and Collections screen.

•If no COOP is set up, normal fee/cost amortization will take place after the charge-off (unless institution option SAAF is set up, as described in the Unearned Fees topic above).

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

|

If the COOP option is set to "1," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction. Usually this defaults to 82 (charge-off non-real estate property).

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account).

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

Note: This option does not refund insurance policy premiums like other COOP options do. See Insurance topic above.

|

If the COOP option is set to "2," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account).

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•Adds Event #24, Letter Number 200, and the transaction date of the Charge-off for the event Letter Date. If Hold Code 4 or 5 are on the account, an event letter will not be created.

•Clears any Accrued Interest (LNACIN). If you need to reverse the transaction, use the Reverse Charge-off transaction (tran code 2022-02) to reinstate the previous interest rate and accrued interest.

•On interest-bearing loans (payment method 6), the Interest Rate (LNRATE) is changed to "0.00." You will need to run the Reverse Charge-off transaction (tran code 2022-02) to reinstate the previous interest rate.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. See Insurance topic above.

|

If the COOP option is set to "3," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account).

•Updates the Date of Last Payment Activity (LNLPAD) to the date of the charge-off transaction so the delinquency/recency can be recalculated.

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. See Insurance topic above.

•If this is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•If this not a line-of-credit loan (payment method 5), the system will do the following: oSets the Special Charge-off Processing option (LNSCOP). oChanges the Payment Application to "1247" (principal, interest, fees, late charges)

•Sets the Late Charge Code to "3" (no late charge assessment).

•Adds Event #24, Letter Number 200, and the transaction date of the Charge-off for the event Letter Date. If Hold Code 4 or 5 are on the account, an event letter will not be created.

•Changes the Interest Rate (LNRATE) to "0.00." You will need to run the Reverse Charge-off transaction (tran code 2022-02) to reinstate the previous interest rate.

|

If the COOP option is set to "4," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account), if it is not already.

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•If this is not a line-of-credit loan (payment method 5), the system will do the following: oSets the Special Charge-off Processing option (LNSCOP). oChanges the Payment Application to "1247" (principal, interest, late charges, fees)

•Sets the Late Charge Code to "3" (no late charge assessment).

•Adds Event #24, Letter Number 200, and the transaction date of the Charge-off for the event Letter Date. If Hold Code 4 or 5 are on the account, an event letter will not be created.

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. See Insurance topic above.

|

If the COOP option is set to "5," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account), if it is not already.

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. See Insurance topic above.

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•If this is not a line-of-credit loan (payment method 5), the system will do the following: oSets the Special Charge-off Processing option (LNSCOP). oChanges the Payment Application to "1274" (principal, interest, miscellaneous fees, late charges)

•Adds Event #24, Letter Number 200, and the transaction date of the Charge-off for the event Letter Date. If Hold Code 4 or 5 are on the account, an event letter will not be created.

•Sets the Late Charge Code to "3" (no late charge assessment).

|

If the COOP option is set to "6," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•This COOP does not change the Statement Cycle to "1" (Do Not Send Statements for This Account). If you want to discontinue sending the account owner a statement, you will need to manually check the Do Not Send Statements for This Account box on the CIF tab of the Marketing and Collections screen.

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•Normal fee/cost amortization will take place after the charge-off (unless institution option SAAF is set up, as described in the Unearned Fees topic above).

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•If this is a signature loan (payment method 16), the loan interest rate (LN16RT) is cleared. Additionally, if this signature loan is backed by a CSO guarantee, the Loan Guarantee Amount (LN16GA) is cleared.

•On interest-bearing loans (payment method 6), the Interest Rate (LNRATE) is changed to "0.00." You will need to run the Reverse Charge-off transaction (tran code 2022-02) to reinstate the previous interest rate.

•Insurance policies remain open on the account when COOP 6 is set and the account is charged off. If you want to cancel the insurance policies after being charged off, you'll need to manually do that from the Loans > Insurance > Adjustments screen.

•All Late Charges Due will be waived (runs a tran code 570).

•Sets the Late Charge Code to "3" (no late charge assessment).

•Any Accrued Interest (LNACIN) is adjusted accordingly into the G/L account set up in the Autopost (runs a tran code 530). It also updates the Date Last Accrued field with the effective date of the Charge-off transaction.

•If institution option IBCO is on, the system will convert precomputed loans (payment method 3) to interest-bearing loans (payment method 6) before charging off the loan. This is only for those institutions that automatically charge-off loans institution option CODY must be set to the number of days delinquent before automatic charge off occurs).

•COOP 6 will stop cycled and recurring auto-payments on accounts with a General Category of 80 or higher, or if the following Hold Codes exist on the account:

|

If the COOP option is set to "7," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account).

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•Changes the Payment Application to 1247 (principal, interest, late charges, fees)

•Changes the Interest Rate (LNRATE) to "6.000."

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. See Insurance topic above.

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees). ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•COOP 7 will stop cycled and recurring auto-payments on accounts with a General Category of 80 or higher, or if the following Hold Codes exist on the account:

|

If the COOP option is set to "8," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account).

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•Changes the Payment Application to 12 (principal, interest).

•Sets the Late Charge Code to "3" (no late charge assessment).

•The Accrued Interest field is changed to zero. Any prior accrued interest is cleared.

•On interest-bearing loans (payment method 6), the Interest Rate (LNRATE) is changed to "0.00." You will need to run the Reverse Charge-off transaction (tran code 2022-02) to reinstate the previous interest rate.

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees). ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

Note: This option does not refund insurance policy premiums like other COOP options do. See Insurance topic above.

|

If the COOP option is set to "9," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account).

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. See Insurance topic above.

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•If the loan is not a line-of-credit card (payment method 5), the system sets the Special Charge-off Processing option (LNSCOP).

•Populate a requested event letter; use Event #24, Letter Number 200, and the transaction date of the Charge-off for the event Letter Date. If a hold code 4 or 5 (Bankruptcy) exists on the loan, the fields will be blank and no event letter will be sent.

•All Late Charges Due will be waived (runs a tran code 570).

•The option will also change the auto payment Cycle Code to “0” and set the Stop Loan Autopay (RASLAP) to a checked box if the Auto Cycle Code was 254 (recurring cards) or 255 (recurring ACH). oThe auto payment Cycle Code will not be put back on the account with the Reverse Charge-off transaction (tran code 2022-02). The recurring option (LNACYC = 254 or 255 and RASLAP = checked box) will not be put back on the account with the Reverse Charge-off (tran code 2022-02). The cycle code and recurring option will have to be reset manually.

•COOP option 9 will stop cycled and recurring auto-payments on accounts with a General Category of 80 or higher, or if the following Hold Codes exist on the account:

|

If the COOP option is set to "10," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements for This Account).

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. See Insurance topic above.

•Changes the Late Charge Code field (LNLTCD) to "3 - No Late Charge Assessment." It does not, however, clear any late charges already incurred on the loan. Late Charges Due (LNLATE) will remain on the account.

•The existing interest rate will stay on the loan. This option does not zero out the Interest Rate field.

•The accrued interest rate will stay on the loan. This option does not zero out the Accrued Interest field.

•The Payment Application changes depending on whether or not the loan is from Wisconsin. oIf the loan is originated in Wisconsin, the Payment Application is: 2 (interest), 4 (late charges), 1 (principal), 7 (miscellaneous fees) oIf the loan is anything other than Wisconsin, the Payment Application is: 4 (late charges), 2 (interest), 1 (principal), 7 (miscellaneous fees)

•Populate a requested event letter; use Event #24, Letter Number 200, and the transaction date of the Charge-off for the event Letter Date. If a hold code 4 or 5 (Bankruptcy) exists on the loan, the fields will be blank and no event letter will be sent. |

The biggest difference between this charge-off option and other COOP options is that the Accrued Interest (LNACIN) and the Interest Rate (LNRATE) remain on the account, and the system does not create an Event Letter 24 record.

Here are the details of what happens to a loan that has been charged off and your institution uses COOP option 11:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen. •Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements).

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•The existing interest rate will stay on the loan. This option does not zero out the Interest Rate field.

•The accrued interest rate will stay on the loan. This option does not zero out the Accrued Interest field.

•Does not create an Event Letter 24 record.

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then:

oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. |

This charge-off option is similar to option 2, but it checks to see if a Judgment (Hold Code 90) has been awarded on the account.

•If a Judgment has been awarded, the system will not clear out the Interest Rate (LNRATE), and it will not waive any Accrued Interest (LNACIN).

•If a Judgment is not on the account, the Interest Rate and Accrued Interest will be cleared.

To set judgments on an account, you should first run one of the Judgment transactions: Judgment (tran code 2510-02) or Judgment with Other Fees (tran code 2510-13).

If the COOP option is set to "2," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•The statement cycle will be changed to "1" (Do Not Send Statements).

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•At monthend during the amortization process, the system will take all the remaining fees the month the loan is charged off. See the Unearned Fees topic above for more information.

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•Adds Event #24, Letter Number 200, and the transaction date of the Charge-off for the event Letter Date. If Hold Code 4 or 5 are on the account, an event letter will not be created.

•Clears any Accrued Interest (LNACIN) if the loan has not been awarded a Judgment (Hold Code 90). If you need to reverse the transaction, use the Reverse Charge-off transaction (tran code 2022-02) to reinstate the previous interest rate and accrued interest. If the account has been awarded a judgment, the Accrued Interest will not be cleared.

•On interest-bearing loans (payment method 6), the Interest Rate (LNRATE) is changed to "0.00" if the account has not been awarded a judgment (Hold Code 90). You will need to run the Reverse Charge-off transaction (tran code 2022-02) to reinstate the previous interest rate. If the account has been awarded a judgment, the Interest Rate will not be cleared.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts. See Insurance topic above. |

This COOP option is for line-of-credit loans with a card (payment method 5 with LNCARD = “Y”).

If the COOP option is set to "14," the Charge-Off transaction will perform the following while charging off the account:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to 0, Do Not Advertise, if it is not already (LNSADV & M1ADVT).

•The statement cycle will be changed to "1" (Do Not Send Statements), if it is not already.

•Updates the Date of Last Payment Activity (LNLPAD) to the posting date of the charge-off transaction. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), the system will basically accrue any potential finance charges on the individual promotions, as well as accrue any outstanding interest as of the promotional interest rate. The following fields will be affected at charge-off: oAccrues interest (using the Promotion Interest Date (NLRATE)) for any open promotions to the charge-off date. That amount will show in the Accrued Interest field (NLACIN). Then the system will clear the Promotion Interest Rate to zero (0). oKeeps any Accrued Interest (NLACIN) to the charge-off effective date. Interest is not accrued after the charge-off date. oDate Last Accrued (NLDTAC) for each open promotion is updated to the charge-off date. oZeroes the Loan Penalty Rate (LNLPRT = 0). oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oSets the lost promotion (NLLOPO) and pending default indicator (NLRLPD) to “Y” for any open promotions (NLCLSD = “N”). oRolls Current Uncollected Interest (NLCUCI) and Prior Uncollected Interest (NLPUCI) into the Current Finance Charges (NLRLCC) at the time of the charge-off. oNo longer assesses the $29.00 annual fee (changes the Service Fee Method code (LNRLSM) to “0”).

•Sets the Late Charge Code to "3" (no late charge assessment).

•At monthend during the amortization process, the system will take all the remaining unearned fees the month the loan is charged off.

•Change the Cancellation Code to "11 – Charge-off" on all open insurance policies and refunds any unearned premium amounts.

Note: Charge-off transactions will read the Foreclosure record (FPFC) to determine if Repo Assets have been sold. |

If the COOP option is set to "15," the Charge-Off transaction will perform the following:

•Sets charge-off descriptor 221 in History.

•Places a General Category (80, 82, 83, 84, 86-89) that you selected in the General Category field of the transaction.

•Adds a hold code 2 (charge-off) in one of the Hold Code fields.

•Adds an Action Code 153 (charge-off date) (LNACDT-LNA10D) and the Action Date as the date the charge-off transaction was posted.

•Places the Effective Date from the Charge-off transaction and places it in the Charge-off Date field. The current date (or the actual date the transaction was run) is placed in the Charge-off Posted Date field. Both fields can be found on the Actions/Holds/Event Letters screen.

•Updates the charged-off amount to the Charged Off Amt field (LNCOBL).

•Clears Advertising Code to Do Not Advertise, if it is not already.

•This COOP does not change the Statement Cycle to "1" (Do Not Send Statements for This Account). If you want to discontinue sending the account owner a statement, you will need to manually check the Do Not Send Statements for This Account box on the CIF tab of the Marketing and Collections screen.

•Updates the Date of Last Payment Activity (LNLPAD) to the effective date of the charge-off transaction so the delinquency/recency can be recalculated. This date is also used to establish the last date of account information for credit reporting (see Date of Account Information in the Credit Reporting manual for more details).

•Normal fee/cost amortization will take place at monthend after the charge-off (unless institution option SAAF is set up, as described in the Unearned Fees topic above).

•If the loan is a line-of-credit card (payment method is 5 and LNCARD is "Y"), then: oThe charge-off transaction checks the Stop Advances box (LNRLST = "Y"). oIf the loan is a line-of-credit card and the Roll Charges into Balance box (LNCLTC) is checked, then: ▪Clears the Roll Charges into Balance box on the Cards and Promotions screen. ▪Changes the Payment Application to 2147 (interest, principal, late charges, fees) ▪Adjusts Prior Finance Charge Due to add "10.00" to it.

•If this is a signature loan (payment method 16), the loan interest rate (LN16RT) is cleared. Additionally, if this signature loan is backed by a CSO guarantee, the Loan Guarantee Amount (LN16GA) is cleared.

•On interest-bearing loans (payment method 6), the Interest Rate (LNRATE) is changed to "0.00." You will need to run the Reverse Charge-off transaction (tran code 2022-02) to reinstate the previous interest rate.

•All Late Charges Due will be waived (runs a tran code 570).

oSets the Late Charge Code to "3" (no late charge assessment).

oAny Accrued Interest (LNACIN) is adjusted accordingly into the G/L account set up in the Autopost (runs a tran code 530). It also updates the Date Last Accrued field with the effective date of the Charge-off transaction.

•The following will be completely amortized at the next monthend (month the charge-off is run): oRemaining deferred fees, costs, discount/gain, premium/loss, MSR's on the Loans > Account Information > Deferred Fees screen. oRemaining Finance Charge amount for force-placed insurance on the Loans > Insurance > Policy Detail screen > Finance Charge Information tab.. o Remaining amortizing fees (F1GREM) (G/L section only on the Loans > Account Information > Amortizing Fees And Costs screen) oRemaining Dealer Prepaid Interest (LNDLRP - LNDLRE) on the Loans > Account Information > Dealer Information screen.

•If institution option IBCO is on, the system will convert precomputed loans (payment method 3) to interest-bearing loans (payment method 6) before charging off the loan. This is only for those institutions that automatically charge-off loans institution option CODY must be set to the number of days delinquent before automatic charge off occurs).

•COOP 15 will stop cycled and recurring auto-payments on accounts with a General Category of 80 or higher, or if the following Hold Codes exist on the account:

|

||||||||||||||||||||||||

See also:

Full Write-off Transaction (tran code 2510-05)

Reverse Charge-off (tran code 2022-02)

Partial Write-Off (tran code 2510-00)