Anytime a payment transaction is run through EZPay, it is technically run with a tran code 2600-25. The Payment with Promos transaction as accessed from CIM GOLDTeller, however, is only for supervisors who need to balance G/L's based on account numbers. Regular tellers should not be given access to this transaction. If you are a teller and want to make a payment on a line-of-credit card loan, use the LOC Card Payments transaction (tran code 2600-45) instead.

If you are a supervisor who needs to move balances by journal, then you can use this journal only transaction. This loan payment transaction allows you to attach a descriptor to the payment. Descriptors show up in Loan History and define where the payment came from. You can also charge a fee for running this transaction, similar to the EZPay transactions. However, if you want to designate a fee, you must enter it in the provided field on this transaction.

An institution option (FPOQ) is available to ensure that any payment run with this tran code will pay off and close the account if the proper conditions are met.

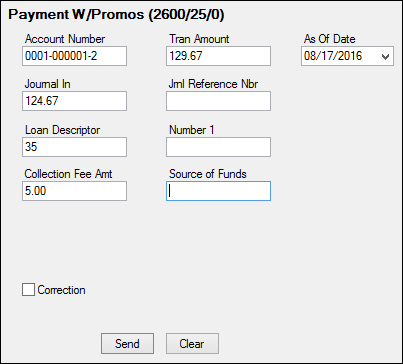

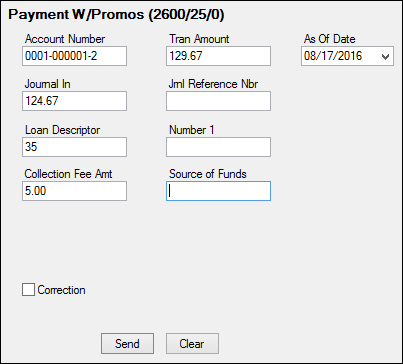

See the following example of this transaction:

Field Descriptions

Field

|

Description

|

Account Number

|

Enter the account number for which you want to apply this journal payment. If the account is displayed in the account list, you can double-click it and it will be entered in this field automatically. You can also search for accounts using the <F9> key, as explained in the CIF Search topic.

|

Tran Amount

|

This is the total amount of the transaction. The amount you enter in this field must total the Journal In and Collection Fee Amt fields, if you enter a Collection Fee Amt.

|

As Of Date

|

This is the date the payment was made. You can backdate a payment up to the date of the Last Transaction (LNTRAN) on the Loans > Account Information > Account Detail screen > Account tab.

|

Journal In

|

This is the amount of the journal payment. It will be applied to the account as indicated in the Payment Application (for example, first to principal and interest, then to late charges, if applicable).

|

Jrnl Reference Nbr

|

Usually, users enter the account number in this field. This is a reference field for General Ledger information.

|

Loan Descriptor

|

This is the descriptor you want to display in History after this transaction is run. For example, if you entered "35" in the Loan Descriptor field, the History would display "600 LOCKBOX PAYMENT."

You should change this field to a drop-down list and only include those descriptors most used by your institution. For more information on how to change a field to a drop-down list on transactions, see the Create a drop-down list topic in the CIM GOLDTeller User's Guide. Possible descriptors include:

Field

Number

|

Descriptor

Code

|

Description

|

Tran 600 Description

|

1

|

|

Unknown Descriptor

|

Regular Payment

|

2

|

1

|

Mailed Payment

|

Mailed Payment

|

3

|

2

|

Walk-in Payment

|

Walk-in Payment

|

4

|

3

|

Interest Only Payment

|

Int Only Payment

|

5

|

4

|

Drop Box Payment

|

|

6

|

5

|

Payment - Manual Offset

|

Pmt-Manual Offs

|

7

|

9

|

No Advance Payment

|

No Advance Pymt

|

8

|

10

|

Agency Payment

|

Agency Payment

|

9

|

11

|

Used by Waive Late Charge to skip cntrs

|

Loan Payment

|

10

|

12

|

Allotment Payment

|

Allotment Pmt

|

11

|

13

|

SteadyPay Payment

|

SteadyPay Pmt

|

12

|

14

|

3rd Party Payment

|

3rd Party Pmt

|

13

|

15

|

Recurring Payment

|

Recurring Pmt

|

14

|

19

|

Internet Payment

|

WWW Payment

|

15

|

20

|

Guaranteed Payment

|

Guaranteed Pmt

|

16

|

25

|

Internet Payment by Credit Card

|

WWW Pmt by CC

|

17

|

30

|

Garnishment Payment

|

Garnishment Pmt

|

18

|

35

|

Lock Box Mail-in Payment

|

Lockbox Mail Pmt

|

19

|

40

|

Electronic Lockbox Payment

|

eLockbox Paymen

|

20

|

41

|

Western Union Lockbox Payment

|

WesternUn

|

21

|

42

|

MoneyGram Lockbox Payment

|

MoneyGram

|

22

|

43

|

PayNearMe Lockbox Payment

|

PayNearMe

|

23

|

45

|

Call-in Payment by Credit Card

|

Callin Pmt By CC

|

24

|

55

|

Telephone Payment by Credit Card

|

Phone Pmt By CC

|

25

|

65

|

Internet Payment by Online Check

|

WWW Pmt By Check

|

26

|

75

|

Telephone Payment by Online Check

|

Phone Pmt By Check

|

27

|

85

|

Call-in Payment by Online Check

|

Callin Pmt By Ck

|

28

|

95

|

One-Time Scheduled Payment by Check

|

1-Time Pmt by Ck

|

29

|

96

|

WWW One-Time Scheduled Payment by ACH

|

WWW 1-Tm Pmt ACH

|

30

|

100

|

Accident or Health Insurance

|

A&H Ins Payment

|

31

|

110

|

Unemployment Insurance

|

Unemployment Pmt

|

32

|

120

|

Property Insurance

|

Prop Ins Payment

|

33

|

130

|

Credit Life Insurance

|

Credit Life Pmt

|

34

|

140

|

GAP Insurance

|

GAP-Auto Pmt

|

35

|

141

|

GAP Insurance

|

GAP-Mcycle Pmt

|

36

|

142

|

GAP Insurance

|

GAP-RV Pmt

|

37

|

150

|

User Defined Insurance

|

Misc Ins Payment

|

38

|

165

|

AD&D Insurance

|

AD&D Payment

|

39

|

171

|

LPD (Auto) Insurance

|

LPD Ins Payment

|

40

|

172

|

Property Dual

|

Prop Dual Pmt

|

41

|

173

|

Property Dual Protected

|

Prop Dual Pr Pmt

|

42

|

175

|

Collateral Plus

|

Coll Plus Pmt

|

43

|

190

|

VSI Insurance

|

VSI Ins Payment

|

44

|

191

|

Non File Insurance

|

Non File Ins Pmt

|

45

|

197

|

Homegard Insurance

|

Homegard Ins Pmt

|

46

|

198

|

Flood Insurance

|

Flood Ins Pmt

|

47

|

199

|

Fire Insurance

|

Fire Ins Pmt

|

48

|

217

|

Retraction of Promotion

|

Promo Retraction

|

49

|

221

|

Charge Off Loan

|

Charge-off Loan

|

50

|

222

|

Reverse Charge Off

|

Reverse Chrg-off

|

51

|

223

|

Repossession

|

Repossession

|

52

|

224

|

Reverse Repossession

|

Rev-Repossession

|

53

|

225

|

Prin / Int Adjustment

|

Prin/Int Pmt

|

54

|

226

|

Roll Finance Charges

|

Roll Finance Chg

|

55

|

227

|

Pay Promo to Zero

|

Pay Promo 2 Zero

|

56

|

228

|

Roll Finance Charge

|

Roll Finance Chg

|

57

|

229

|

Roll Misc Fees into Balance

|

Roll MF into Bal

|

58

|

250

|

Postpetition Trustee Payment

|

Trustee Payment

|

59

|

251

|

Adequate Protection Payment

|

Adequate Protect

|

60

|

252

|

Postpetition Escrow Payment

|

Postpet Escrow

|

61

|

253

|

Prepetition Claim Payment

|

Prepet Claim PMT

|

62

|

254

|

Postpetition Claim Payment

|

Postpet Claim PM

|

63

|

255

|

Insurance Payment on Bankruptcy

|

Ins Pmt Bankrupt

|

64

|

256

|

Payment on Bankruptcy

|

Pmt on Bankrupt

|

65

|

257

|

Increase escrow balance on BK loans

|

Inc RSV Balance

|

66

|

258

|

Reduce Principal Balance by Arrearage

|

Reduce Prn on BK

|

67

|

259

|

Waive Late Charges on Bk

|

Waive Lt Chrg BK

|

68

|

260

|

Write-off On BK Account

|

W/O BK Account

|

69

|

400

|

Partial Write-off

|

Prtl W/Off Pmt

|

70

|

401

|

Full Write-off

|

Full W/Off Pmt

|

71

|

402

|

Repo Write-off

|

Prtl W/Off Pmt

|

72

|

406

|

Retract Convert to IB

|

Retract Convert

|

73

|

410

|

Sale of Security

|

Sale of Sec Pmt

|

74

|

419

|

Interest Adjustment

|

Int Adjustment

|

75

|

500

|

Collection

|

Collection Pmt

|

76

|

510

|

Judgment Adjustment

|

Judgment Payment

|

77

|

580

|

Payoff

|

Payoff

|

78

|

600

|

Death Claim

|

Death Claim Pmt

|

79

|

601

|

Payment From Partial

|

Pmt From Partial

|

80

|

602

|

Curtailment from Partial

|

Prin To Partial

|

81

|

603

|

Deferment

|

Deferment

|

82

|

604

|

Convert to IB

|

Convert to IB

|

83

|

605

|

Advance Payment

|

Advance Payment

|

84

|

606

|

Stored Value Card

|

Value Card

|

85

|

607

|

Default/Extension Charge

|

Default/Ext chrg

|

|

Number 1

|

This is the sequence number of the promotion to which you are applying this payment, if applicable. You can leave this field blank. You should change the name of this field or hide it if you aren't using promotions.

|

Collection Fee Amt

|

This is the fee amount that is collected for running the transaction. When the transaction is processed, it is credited directly to a G/L account. The G/L account number is used is pulled from the EZPay Fee field on the GOLD Services > General Ledger > G/L Account By Loan Type screen.

|

Source of Funds

|

This field should be hidden. It is not used.

|