Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 600, Regular Payment

A regular payment transaction is likely the most used transaction. Regular loan payments can come from the Loans > Transactions > Make Loan Payment screen, GOLDPhone, your website, EZPay screen, or from manually processing a loan payment through CIM GOLDTeller.

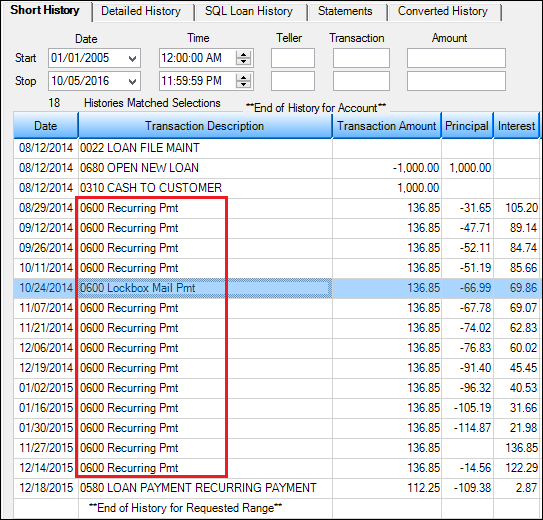

A descriptor is included in Loan History for each regular loan payment to help identify where the payment came from (e.g., walk-in payment, lockbox payment, recurring payment, etc.), as shown in the following example:

Additionally, many of the special loan payment transactions are recorded in Loan History as a tran code 600, even though in CIM GOLDTeller they begin with a 2, such as Insurance Payment (tran code 2600-01), Collection Payment (tran code 2600-02), Interest-only Payment (tran code 2600-03), and Payment with Promos (tran code 2600-25).

The following table explains all possible loan descriptors for loan payments.

Field Number |

Descriptor Code |

Description |

Tran 600 Description |

|---|---|---|---|

1 |

|

Unknown Descriptor |

Regular Payment |

2 |

1 |

Mailed Payment |

|

3 |

2 |

Walk-in Payment |

|

4 |

3 |

Int Only Payment |

|

5 |

4 |

Drop Box Payment |

|

6 |

5 |

Payment - Manual Offset |

Pmt-Manual Offs |

7 |

9 |

No Advance Pymt |

|

8 |

10 |

Agency Payment |

|

9 |

11 |

Used by Waive Late Charge to skip cntrs |

Loan Payment |

10 |

12 |

Allotment Payment |

Allotment Pmt |

11 |

13 |

SteadyPay Payment |

SteadyPay Pmt |

12 |

14 |

3rd Party Payment |

3rd Party Pmt |

13 |

15 |

Recurring Payment |

Recurring Pmt |

14 |

19 |

Internet Payment |

WWW Payment |

15 |

20 |

Guaranteed Payment |

Guaranteed Pmt |

16 |

25 |

WWW Pmt by CC |

|

17 |

30 |

Garnishment Pmt |

|

18 |

35 |

Lock Box Mail-in Payment |

Lockbox Mail Pmt |

19 |

40 |

Electronic Lockbox Payment |

eLockbox Paymen |

20 |

41 |

Western Union Lockbox Payment |

WesternUn |

21 |

42 |

MoneyGram Lockbox Payment |

MoneyGram |

22 |

43 |

PayNearMe Lockbox Payment |

PayNearMe |

23 |

45 |

Call-in Payment by Credit Card |

Callin Pmt By CC |

24 |

55 |

Telephone Payment by Credit Card |

Phone Pmt By CC |

25 |

65 |

Internet Payment by Online Check |

WWW Pmt By Check |

26 |

75 |

Telephone Payment by Online Check |

Phone Pmt By Check |

27 |

85 |

Call-in Payment by Online Check |

Callin Pmt By Ck |

28 |

95 |

One-Time Scheduled Payment by Check |

1-Time Pmt by Ck |

29 |

96 |

WWW One-Time Scheduled Payment by ACH |

WWW 1-Tm Pmt ACH |

30 |

100 |

Accident or Health Insurance |

A&H Ins Payment |

31 |

110 |

Unemployment Insurance |

Unemployment Pmt |

32 |

120 |

Property Insurance |

Prop Ins Payment |

33 |

130 |

Credit Life Insurance |

Credit Life Pmt |

34 |

140 |

GAP Insurance |

GAP-Auto Pmt |

35 |

141 |

GAP Insurance |

GAP-Mcycle Pmt |

36 |

142 |

GAP Insurance |

GAP-RV Pmt |

37 |

150 |

User Defined Insurance |

Misc Ins Payment |

38 |

165 |

AD&D Insurance |

AD&D Payment |

39 |

171 |

LPD (Auto) Insurance |

LPD Ins Payment |

40 |

172 |

Property Dual |

Prop Dual Pmt |

41 |

173 |

Property Dual Protected |

Prop Dual Pr Pmt |

42 |

175 |

Collateral Plus |

Coll Plus Pmt |

43 |

190 |

VSI Insurance |

VSI Ins Payment |

44 |

191 |

Non File Insurance |

Non File Ins Pmt |

45 |

197 |

Homegard Insurance |

Homegard Ins Pmt |

46 |

198 |

Flood Insurance |

Flood Ins Pmt |

47 |

199 |

Fire Insurance |

Fire Ins Pmt |

48 |

217 |

Retraction of Promotion |

Promo Retraction |

49 |

221 |

Charge-off Loan |

|

50 |

222 |

Reverse Chrg-off |

|

51 |

223 |

Repossession |

|

52 |

224 |

Rev-Repossession |

|

53 |

225 |

Prin / Int Adjustment |

Prin/Int Pmt |

54 |

226 |

Roll Finance Charges |

Roll Finance Chg |

55 |

227 |

Pay Promo to Zero |

Pay Promo 2 Zero |

56 |

228 |

Roll Finance Charge |

Roll Finance Chg |

57 |

229 |

Roll Misc Fees into Balance |

Roll MF into Bal |

58 |

250 |

Postpetition Trustee Payment |

Trustee Payment |

59 |

251 |

Adequate Protection Payment |

Adequate Protect |

60 |

252 |

Postpetition Escrow Payment |

Postpet Escrow |

61 |

253 |

Prepet Claim PMT |

|

62 |

254 |

Postpet Claim PM |

|

63 |

255 |

Insurance Payment on Bankruptcy |

Ins Pmt Bankrupt |

64 |

256 |

Payment on Bankruptcy |

Pmt on Bankrupt |

65 |

257 |

Increase escrow balance on BK loans |

Inc RSV Balance |

66 |

258 |

Reduce Principal Balance by Arrearage |

Reduce Prn on BK |

67 |

259 |

Waive Late Charges on Bk |

Waive Lt Chrg BK |

68 |

260 |

Write-off On BK Account |

W/O BK Account |

69 |

400 |

Prtl W/Off Pmt |

|

70 |

401 |

Full W/Off Pmt |

|

71 |

402 |

Prtl W/Off Pmt |

|

72 |

406 |

Retract Convert to IB |

Retract Convert |

73 |

410 |

Sale of Sec Pmt |

|

74 |

419 |

Interest Adjustment |

Int Adjustment |

75 |

500 |

Collection Pmt |

|

76 |

510 |

Judgment Payment |

|

77 |

580 |

Payoff |

|

78 |

600 |

Death Claim Pmt |

|

79 |

601 |

Payment From Partial |

Pmt From Partial |

80 |

602 |

Curtailment from Partial |

Prin To Partial |

81 |

603 |

Deferment |

Deferment |

82 |

604 |

Convert to IB |

Convert to IB |

83 |

605 |

Advance Payment |

Advance Payment |

84 |

606 |

Stored Value Card |

Value Card |

85 |

607 |

Default/Extension Charge |

Default/Ext chrg |

See Regular Payment Options for information about institution options that affect regular payments.

Loan Payment—Notes:

1.When posting a payment on a loan that is two or more payments past due, the system requires a teller override (TOV).

2.For contract collections, late charges included in the regular payment are shown in the seller history as a separate item. If a correction transaction is processed on the same day and for the same amount as the 600 transaction regular payment, both transactions are canceled. Otherwise, the correction will show on the Afterhours Processing Exceptions Listing (FPSRP013). You must manually retrieve the funds from the seller and reduce the Year-to-Date Disbursements field for that amount (on the Contract Collections screen).

3.When posting a payment on a payment method 5 loan that is higher or lower than the actual amount, the system will require a TOV and display one of the following messages: "TOV AMT TOO LOW -- PMT IS $XXX.XX" or "TOV AMT TOO HIGH -- PMT IS $XXX.XX."

4.For payment methods 0, 1, 2, and 7, when posting a payment on a loan that has received a partial payment, the system requires a teller override (TOV).

5.When making a correction of a Regular Payment (tran code 608), if one or more tran code 500s (field debits) and/or tran code 510s (field credits) were posted after the payment was posted, all the 500s and 510s must be reversed prior to the reversal tran (608). If one or more 500s and/or 510s were posted and you only want to reverse one particular transaction (and not the payment), you don't have to reverse all of the transactions posted after that transaction, just that transaction itself.

6.For payment method 3 (precomputed) and 6 (daily simple interest) loans, if the payment transaction would make the principal balance zero, the system will check the following fields; if they are all zero, it will automatically close the loan at the time the payment is processed.

Late Charges

Reserve 1

Reserve 2

Miscellaneous Funds

LIP Balance

Customer LIP Balance

Subsidy Balance

Fees

Partial Payment

Accrued Interest

Insurance Rebate (Any add-on insurance policies where the borrower is due back a rebate if the loan is paid off early. See the Unearned Premium field on the Loans > Insurance > Policy Detail screen for more information.)

7.The action date for Action Code 28 (curtailment/payoff lockout) must be earlier than or the same as the present day’s date in order to make a payment.

|

The following institution options are available when loan transactions are posted:

OPT 8 BSOV: Allows you to bypass the supervisor override when posting payments for interest-bearing loans (payment method 6) where the borrower pays more than the scheduled amount (if the loan has not been sold to an investor).

OPT Y CFEE: Requires a teller override (TOV) when posting a payment if miscellaneous fees are due on the loan. (This option is available for all payment methods.)

OPT Y BTOV: Stops the requirement for a TOV when posting a loan payment for an amount greater than the payment amount. This was created for processing mass payments; however, it also works with regular loan payments. (This option is only available with line-of-credit loans (payment method 5).)

OP01 BKPM: Bankruptcy (Hold Code 4 and 5) Allows a principal decrease (tran code 510/518) Allows a principal increase (tran code 500/508) Allows a payoff (tran code 580) Allows a loan payment (including automatic payments) (tran code 600/608) Allows a spread payment (tran code 690/698) Allows payment of late charges (tran code 550/558) Allows waiving of late charges (tran code 570/578) Allows VSI Add (tran code 870/878) Allows VSI Cancel (tran code 890/898) Allows assessing of miscellaneous fees (tran code 660/668) Allows a payment of miscellaneous fees (tran code 850/858) Allows waiving of miscellaneous fees (tran code 670/678) Allows a partial payment (tran code 510/508 to field 33)

OP01 PIWD: Allows interest to be paid only in full-day increments for interest-bearing loans (payment method 6). If this option is set, when a payment is posted (600 transaction code only), interest will only be paid in full-day increments. For example, if the per diem is $5.50, only multiples of $5.50 would be paid to interest ($5.50, $11.00, $16.50, etc.), up to the full amount of interest owed. Any remaining amount will be applied to principal. If the amount paid is less than the per diem, no interest will be paid.

The result of this option will be a more accurate Date Interest Paid To (LNPDTO).

Example:

Given: Principal balance: $3,816.10 Loan rate: 30.0000% Interest base: 365 Per diem: $3.14 Interest for 30 days: $97.34 P/I Constant: $264.00

A payment of $100.00 divided by the per diem of $3.14 will be 31. The per diem multiplied by 31 is $97.34. The remainder of the payment ($2.66) will be applied to the principal.

OP02 APCO: Charge-offs (Hold Code 2) Allows a loan payment (including auto payments) (tran code 600/608) Allows a spread payment (tran code 690/698) Allows payment of late charges (tran code 550/558) Allows waiving of late charges (tran code 570/578) Allows VSI Add (tran code 870/878) Allows VSI Cancel (tran code 890/898) Allows assessing of miscellaneous fees (tran code 660/668) Allows a payment of miscellaneous fees (tran code 850/858) Allows waiving of miscellaneous fees (tran code 670/678)

OP03 ACCO: Charge-offs: (Hold Code 2) Allows a principal decrease (tran code 510/518) Allows a principal increase (tran code 500/508) Allows a payoff (tran code 580)

OP03 PM07: Allows you to bypass the supervisor override when posting payments for payment methods 0 and 7 where the borrower pays more than the scheduled amount (if the loan has not been sold to an investor). |