Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2510-13, Judgment with Other Fees

This transaction is run once your institution has been awarded a judgment. It changes the principal balance of the loan to the amount of the judgment unless option OP14 PJPL is set; then the judgment amount must be equal to the principal balance.

After the transaction is run, the system updates the fields on the Judgment tab of the Loans > Bankruptcy and Foreclosure > Foreclosure, Repossession and Judgment Information screen.

This transaction is similar to the other Judgment transaction (tran code 2510-02), except this transaction allows you to assess attorney fees using miscellaneous fee code 49 and court costs using miscellaneous fee code 50.

Note: Precomputed accounts (payment method 3) must be converted to interest-bearing accounts (payment method 6) before this transaction can be run. The system will return the following message if a user attempts to run a transaction on a precomputed account: "Account Must be Payment Method 6." See the Precomputed to Simple tab on the Charge-off screen for more information on how to convert a precomputed loan to an interest-bearing account.

Also, the Judgment Date (Effective Date) cannot be in the future. The system will return the following message if a future date is entered: "Judgment Date is in Future."

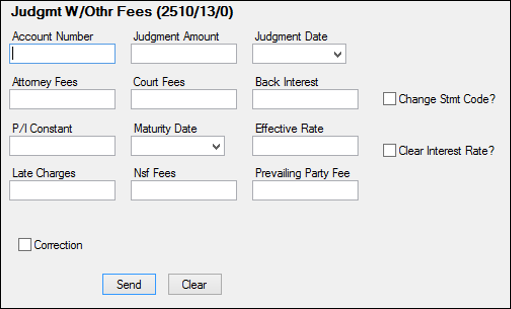

See the following example of this transaction:

You will need to do some setup to use this transaction. The following table explains the fields that need to be changed on this transaction:

Field |

Description |

|---|---|

Y/N Field 1 (Field 210) |

This checkbox field allows you to determine if the Statement Code (LNSCYC) should be changed to 1. This means no statement on Consumer Finance Statements only (FPSRP180). You can use the Transaction Design screen in CIM GOLDTeller to change the name of this field to something more meaningful to your institution's tellers or employees.) |

Y/N Field 2 (Field 211) |

This field allows you to clear the interest effective rate to zero (since this transaction is run on payment method 6 loans, the interest effective rate is LNRATE and is found on the Loans > Account Information > Account Detail screen > Interest Detail tab).

•If checked, the interest rate will clear to zero.

•If unchecked, the interest rate will remain as is or will change to whatever you enter in the Effective Rate field on the transaction (see example above).

You can use the Transaction Design screen in GOLDTeller (or CIM GOLDTeller) to change the name of this field to something more meaningful to your institution’s tellers or employees (such as “Clear Interest Rate?”). Or you can hide the field on the screen, as explained in these sections in either the CIM GOLDTeller or GOLDTeller manuals:

•CIM GOLDTeller User's Guide > CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Field Properties Screen

•GOLDTeller User's Guide > Advanced GOLDTeller Features > Transaction Design > Field Attributes Screen |

Using this transaction increases or decreases the principal balance by the difference between the current principal balance and the judgment amount. This is done as a journal transaction.

This transaction automatically debits or credits the General Ledger account number in the Write-off – Charge Off or Write-off – Regular Loan fields on the GOLD Services > General Ledger > G/L Account By Loan Type screen for the amount you write off. A different General Ledger number can be used for accounts that are charged off versus those that are not.

The transaction also performs the following functions:

•Places a Hold Code 90 (judgment) on the account.

•Places an Action Code 99 (judgment awarded) and Date on the account.

•Places a Partial Write-off amount on the account (if applicable).

•Clears any amount in the Partial Payments/Applied to Payment field, unless institution option DCJT is set to "Y."

•The Date Last Accrued and Date Interest Paid To fields are changed to the judgment date of this transaction.

•Waives the amount in Late Charges Due.

•Does not update/decrease the Times Late.

•Does decrease the Times Waived by 1.

•Changes the Late Charge Code to "No Late Charge."

•Waives any interest owing by running a tran code 120 (waive interest correction).

•Clears the Interim Paid Amount.

•Changes the Prepayment Penalty Code to 0.

•Changes the Lifetime Late Charges Collected field to 0 unless institution option DCJT is set to "Y."

•Clears the Interim Late Charges field if institution option OP04 UDQG is set to "Y."

•Waives any existing miscellaneous fees on the account.

•Assesses attorney fees as miscellaneous fee code 49, court costs as miscellaneous fee code 50, back interest as miscellaneous fee code 33, late charges as miscellaneous fee code 39, prevailing party fees as miscellaneous fee code 40, and NSF fees as miscellaneous fee code 9.

•If the Y/N Field 1 (Change Statement Code?) box is checked, the system assigns Statement Code (LNSCYC) 1 to the account. This means no statement on Consumer Finance Statements only (FPSRP180).

•Stops assessing monthly maintenance fees. The system will clear the Use Fee field (MRMTNF) for Maintenance Fees on the Loans > Account Information > Additional Loan Fields screen > Daily Statistics & Fees tab.

In addition, this transaction can change the future interest rate. This may be because the judge has included the ability to accrue future interest on the judgment amount at a different rate. Please not that if the Y/N Field 2 (Clear Interest Rate?) box is checked, interest effective rate (LNRATE) is zeroed out. If not checked, the interest rate will remain as is or will change to whatever you enter in the Effective Rate field on the transaction.

You can also change the interest rate (Effective Rate field) to zero if interest cannot be accrued beyond the judgment date.

Precomputed loans (payment method 3) must be converted to a daily simple-interest loan (payment method 6) before running this transaction. (See the Loans > Account Adjustment screen > for more information about converting precomputed loans.)

Institution option OP14 PJPL prohibits the Judgment transaction on precomputed loans. It also forces the judgment amount to be the same as the principal balance.

If institution option OP21 DCJT is set, Partial Payments (LNPRTL) and Lifetime Late Charges Collected (LNLLTC) will not be cleared during the Judgment transaction.