Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2510-03, Sale of Security

This transaction performs a credit to the principal balance for the amount of the transaction.

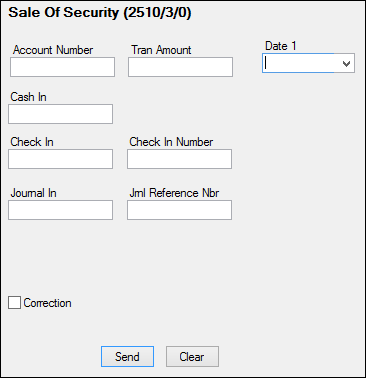

See the following example of the Sale of Security transaction:

Date 1 - This field updates the Date of Sale field (FCSALD) (found on the Loans > Foreclosure, Repossession, and Judgment Information screen, Notices and Sale tab). You can rename this field to be As of Date or Sale Date. To rename a field, see the Field Properties screen under Functions > Administrator Options > Transaction Design in CIM GOLDTeller.

The history description for this transaction is "Sale of Security."

This transaction does not check for CP2 eligibility.

The amount of this transaction also updates the Sale Amount field (FCSLOS) on the Loans > Foreclosure, Repossession and Judgment Information screen, Notices and Sale tab. If an amount already appears in that field, processing another Sale of Security transaction will add to that amount. The Sale Amount field totals the amount of all Sale of Security transactions run.

This also applies to corrections, when the Sale Amount field will be reduced by the amount entered on the Sale of Security correction transaction.

If this transaction closes the account due to pay off, the system assigns Special Comments code AX (Account paid by collateral) to the account for Credit Reporting purposes. See the Special Comments field on the Credit Reporting screen for more information. Also, see option O29 SSPP in the Options box below, because if that option is set, the system assigns Special Comments code "I - Election of Remedy" if the transaction is enough to pay off the loan.

Note: If any amount is due back to the customer (due to precomputed interest, amortizing fees, insurance credits, etc.), you will need to use the Payoff screen to payoff the loan.

Option for Writing Off Remaining Amount

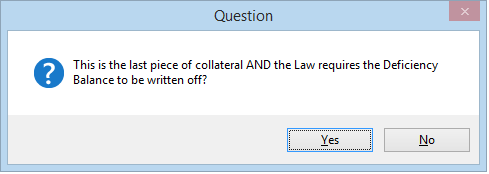

This transaction can be "chained" to the Sale of Security Full Write-off transaction (tran code 2510-12), if institution option AWAS (Ask for Write Off After SOS) is set up for your institution. If you run tran code 2510-06 (Sale of Security with Taxes) and the transaction amount (sale amount) isn't enough to pay off the loan and close it, the Sale of Security Full Write-off transaction will be displayed, after the following message appears:

From the Sale of Security Full Write-off transaction, the user can write-off the remaining amount of the loan. See that transaction for more details on how that works.

Options

•If institution option OP03 CISS is set, the transaction will collect interest and pay late charges, fees, and principal following the order set up in the Payment Application group box on the Payment Detail tab on the Loans > Account Information > Account Detail screen. It will also update the Date Last Accrued field (LNACDT) and Date Interest Paid To field (LNPDTO) to the date of the transaction (found on the Account tab of the Account Detail screen).

•If institution option OP02 APCO is set, this transaction can be run on charged-off accounts.

•If institution option OP01 BKPM is set, this transaction can be run on bankrupt accounts.

•If institution option AWAS (Ask for Write Off After SOS) is set, a question will appear asking if the user wants to write-off the remaining amount (if the transaction amount wasn't enough to pay off the loan). If the user click <Yes>, the Sale of Security Full Write-off transaction (tran code 2510-12) will appear. Using that transaction, the user can write-off the remaining balance on the loan.

•If institution option OP29 SSPP (Sale of Security with PC2IB and Payoff) is set, the Sale of Security transaction will automatically run a Payoff transaction (tran code 580) immediately after the Sale of Security transaction is run to close the loan if the amount of the transaction is enough to pay off the loan. If the transaction pays off the loan entirely and the borrower is due back more money than what is allowed in institution option OVCK, the transaction is not allowed and the following error message will appear in CIM GOLDTeller:

“OVERPAYMENT OF NNNNN.NN – USE PAYOFF”

The user would then need to pay off the loan using the Loans > Payoff screen instead.

After this transaction is successfully run, the system assigns the account with Special Comment code "I - Election of Remedy" during the monthend Credit Reporting process (FPSRP184). Because only one Special Comment code is allowed per account, and the account may qualify for more than one Special Comment code, the system may or may not assign code "I" during Credit Reporting. When an account qualifies for more than one Special Comment code, the system determines which code to assign based on the Loans > System Setup Screen > Special Comment Priorities screen. See the Special Comment code definition in the Credit Reporting manual for more information.

Additionally, if this option is set, the system will also require the transaction to only be allowed to run on interest-bearing accounts (payment method 6), not precomputed accounts (payment method 3). The system will return the error message “MUST CONVERT PC TO IB” if users attempt to run this transaction on a payment method 3 account. To convert precomputed accounts to interest bearing, use the Loans > Transactions > Charge-off Transactions screen > Convert Precomputed to Simple tab. |

Card accounts (LNCARD = Y, LNPMTH = 5) must use the Sale of Security for Cards transaction (tran code 2510-09).

See also:

•Judgment Transaction (tran code 2510-02)

•Sale of Security w/Tax (tran code 2510-06)