Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2600-05, Walk-in Payment

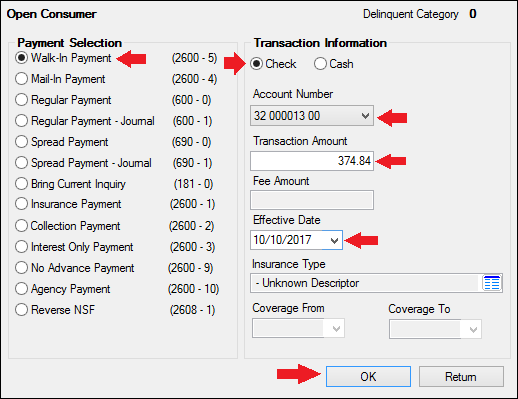

This transaction works like a regular payment (tran code 600) and follows the same rules. The best place to initiate this transaction is through the Loans > Transactions > Make Loan Payment screen. Once you enter information on that screen and click <OK>, CIM GOLDTeller will open with the Walk-in Payment transaction displayed, as shown in the following screen examples:

Loans > Transactions > Make Loan Payment Screen

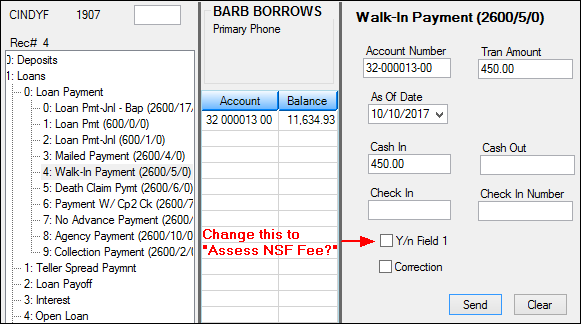

Walk-in Payment Transaction in CIM GOLDTeller

Note: You should change the Y/n Field 1 field description to "Assess NSF Fee." See the Transaction Design section in the CIM GOLDTeller User's Guide for more information on how to rename fields.)

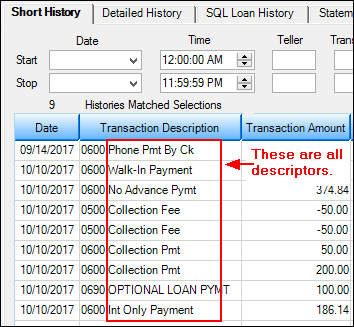

The history description for this transaction is "Walk-in Payment."

If the mail-in payment is from garnished wages, see Tran Code 2600-30, Garnishment Transaction.

In Loan History, the system records all payment transactions as tran code 600. However, a descriptor is also added to help you better understand how the tran code 600 was processed, such as walk-in payment, interest-only payment, agency payment, etc., as shown below:

The following table shows you all the available descriptor codes and their description.

Field Number |

Descriptor Code |

Description |

Tran 600 Description |

|---|---|---|---|

1 |

|

Unknown Descriptor |

Regular Payment |

2 |

1 |

Mailed Payment |

|

3 |

2 |

Walk-in Payment |

|

4 |

3 |

Int Only Payment |

|

5 |

4 |

Drop Box Payment |

|

6 |

5 |

Payment - Manual Offset |

Pmt-Manual Offs |

7 |

9 |

No Advance Pymt |

|

8 |

10 |

Agency Payment |

|

9 |

11 |

Used by Waive Late Charge to skip cntrs |

Loan Payment |

10 |

12 |

Allotment Payment |

Allotment Pmt |

11 |

13 |

SteadyPay Payment |

SteadyPay Pmt |

12 |

14 |

3rd Party Payment |

3rd Party Pmt |

13 |

15 |

Recurring Payment |

Recurring Pmt |

14 |

19 |

Internet Payment |

WWW Payment |

15 |

20 |

Guaranteed Payment |

Guaranteed Pmt |

16 |

25 |

WWW Pmt by CC |

|

17 |

30 |

Garnishment Pmt |

|

18 |

35 |

Lock Box Mail-in Payment |

Lockbox Mail Pmt |

19 |

40 |

Electronic Lockbox Payment |

eLockbox Paymen |

20 |

41 |

Western Union Lockbox Payment |

WesternUn |

21 |

42 |

MoneyGram Lockbox Payment |

MoneyGram |

22 |

43 |

PayNearMe Lockbox Payment |

PayNearMe |

23 |

45 |

Call-in Payment by Credit Card |

Callin Pmt By CC |

24 |

55 |

Telephone Payment by Credit Card |

Phone Pmt By CC |

25 |

65 |

Internet Payment by Online Check |

WWW Pmt By Check |

26 |

75 |

Telephone Payment by Online Check |

Phone Pmt By Check |

27 |

85 |

Call-in Payment by Online Check |

Callin Pmt By Ck |

28 |

95 |

One-Time Scheduled Payment by Check |

1-Time Pmt by Ck |

29 |

96 |

WWW One-Time Scheduled Payment by ACH |

WWW 1-Tm Pmt ACH |

30 |

100 |

Accident or Health Insurance |

A&H Ins Payment |

31 |

110 |

Unemployment Insurance |

Unemployment Pmt |

32 |

120 |

Property Insurance |

Prop Ins Payment |

33 |

130 |

Credit Life Insurance |

Credit Life Pmt |

34 |

140 |

GAP Insurance |

GAP-Auto Pmt |

35 |

141 |

GAP Insurance |

GAP-Mcycle Pmt |

36 |

142 |

GAP Insurance |

GAP-RV Pmt |

37 |

150 |

User Defined Insurance |

Misc Ins Payment |

38 |

165 |

AD&D Insurance |

AD&D Payment |

39 |

171 |

LPD (Auto) Insurance |

LPD Ins Payment |

40 |

172 |

Property Dual |

Prop Dual Pmt |

41 |

173 |

Property Dual Protected |

Prop Dual Pr Pmt |

42 |

175 |

Collateral Plus |

Coll Plus Pmt |

43 |

190 |

VSI Insurance |

VSI Ins Payment |

44 |

191 |

Non File Insurance |

Non File Ins Pmt |

45 |

197 |

Homegard Insurance |

Homegard Ins Pmt |

46 |

198 |

Flood Insurance |

Flood Ins Pmt |

47 |

199 |

Fire Insurance |

Fire Ins Pmt |

48 |

217 |

Retraction of Promotion |

Promo Retraction |

49 |

221 |

Charge-off Loan |

|

50 |

222 |

Reverse Chrg-off |

|

51 |

223 |

Repossession |

|

52 |

224 |

Rev-Repossession |

|

53 |

225 |

Prin / Int Adjustment |

Prin/Int Pmt |

54 |

226 |

Roll Finance Charges |

Roll Finance Chg |

55 |

227 |

Pay Promo to Zero |

Pay Promo 2 Zero |

56 |

228 |

Roll Finance Charge |

Roll Finance Chg |

57 |

229 |

Roll Misc Fees into Balance |

Roll MF into Bal |

58 |

250 |

Postpetition Trustee Payment |

Trustee Payment |

59 |

251 |

Adequate Protection Payment |

Adequate Protect |

60 |

252 |

Postpetition Escrow Payment |

Postpet Escrow |

61 |

253 |

Prepet Claim PMT |

|

62 |

254 |

Postpet Claim PM |

|

63 |

255 |

Insurance Payment on Bankruptcy |

Ins Pmt Bankrupt |

64 |

256 |

Payment on Bankruptcy |

Pmt on Bankrupt |

65 |

257 |

Increase escrow balance on BK loans |

Inc RSV Balance |

66 |

258 |

Reduce Principal Balance by Arrearage |

Reduce Prn on BK |

67 |

259 |

Waive Late Charges on Bk |

Waive Lt Chrg BK |

68 |

260 |

Write-off On BK Account |

W/O BK Account |

69 |

400 |

Prtl W/Off Pmt |

|

70 |

401 |

Full W/Off Pmt |

|

71 |

402 |

Prtl W/Off Pmt |

|

72 |

406 |

Retract Convert to IB |

Retract Convert |

73 |

410 |

Sale of Sec Pmt |

|

74 |

419 |

Interest Adjustment |

Int Adjustment |

75 |

500 |

Collection Pmt |

|

76 |

510 |

Judgment Payment |

|

77 |

580 |

Payoff |

|

78 |

600 |

Death Claim Pmt |

|

79 |

601 |

Payment From Partial |

Pmt From Partial |

80 |

602 |

Curtailment from Partial |

Prin To Partial |

81 |

603 |

Deferment |

Deferment |

82 |

604 |

Convert to IB |

Convert to IB |

83 |

605 |

Advance Payment |

Advance Payment |

84 |

606 |

Stored Value Card |

Value Card |

85 |

607 |

Default/Extension Charge |

Default/Ext chrg |

If you need to make a correction to a Walk-in Payment, you bring up the Walk-In Payment transaction and check the Correction box. If you want to assess a non-sufficient funds fee at the same time as the corrected transaction, check the Y/n Field 1 box. For example, a customer made a walk-in payment using a check. The check later bounces due to insufficient funds. You would need to correct the Walk-In Payment transaction and assess a non-sufficient-funds fee at the same time.

|

Tip: The name of this field should be changed to "Assess NSF Fee." Changing field names is done on the Functions > Administrator Options > Transaction Design in CIM GOLDTeller. Right-click the Y/n Field 1 field to bring up the Field Properties screen and change the name of the field. |

|---|

Once you click ![]() on the corrected Walk-in Payment transaction, the system reverses the transaction and assesses the non-sufficient funds fee. The amount of the fee assessed is pulled from the Loans > Account Information > Account Detail screen > Late/NSF tab > NSF Fields.

on the corrected Walk-in Payment transaction, the system reverses the transaction and assesses the non-sufficient funds fee. The amount of the fee assessed is pulled from the Loans > Account Information > Account Detail screen > Late/NSF tab > NSF Fields.

CP2 Rules on Payoffs

This transaction can be used with the CP2 Transaction Processing Rules screen (function 803/804) in GOLD Services (Application 8).

If, after taking the underpayment into consideration, the amount of credit insurance refunds and/or precomputed interest refund is enough to pay off a loan, the message "REFUNDS COULD CLOSE LOAN/SEE PAYOFF" will be displayed when any of the following transactions are processed:

CP2 transaction (tran code 2600-00) Insurance Payment (tran code 2600-01) Collection Payment (tran code 2600-02) Interest-Only Payment (tran code 2600-03) Mail-in Payment (tran code 2600-04) Walk-in Payment (tran code 2600-05) Regular Payment with CP2 Eligibility Test (tran code 2600-07) No Advance Payment (tran code 2600-09)

Be aware that these refunds may not in themselves be enough to pay off the loan; it may require a portion of the payment that is being posted.

Example:

The loan balance is $100.00, and the principal and interest is $75.00, leaving $25 of the remaining loan balance to fees and late charges. The refunds total $40.00, if the loan is paid off today. A customer brings in an $80 payment.

As you attempt to post the loan payment using this transaction, the system will return with the following message: "REFUNDS COULD CLOSE LOAN/SEE PAYOFF."

You would not be able to use this transaction. You would instead open the Loans > Payoff screen, lock in the payoff, then post the payoff using the Post Payoff tab. The total amount of the payment, $80, would pay off the principal and interest and $5 of the fees and late charges, leaving $20 more to pay off the loan. Because the loan would be paid off early and therefore be eligible for refunds, the $40 in refunds would pay off the remaining $20 left on the loan, leaving $20 as a refund back to the customer. The loan would then be closed.

The system calculates this for you when running a payoff on the Loans > Payoff screen > Post Payoff tab. Any refunds (credits) will show on the Adjustments tab after the loan has been locked for payoff. |