Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 580-01, Payoff Journal

The Payoff by Journal transaction is a good transaction to use if you need to close a loan that has been charged off. You could also run this transaction if a loan has been bankrupt and the bankruptcy courts have allowed the discharge of the loan. Therefore, you could run this transaction if you wanted to close the loan and balance your G/L. (Note: If you are paying off a loan because the borrower has brought in cash or a check to pay off the balance, use the Loans > Payoff screen or regular Payoff transaction instead.)

However, for severely delinquent, bankrupt, or charged off loans, you may want to consider writing off the loan. See the Full Write-off transaction (tran code 2510-05) for more information on how to write off a loan. You would use the Full Write-off transaction or this transaction depending on whether or not you want to report an IRS Form 1099-C for the loan (the Full Write-off transaction creates a 1099-C form).

The Payoff by Journal transaction can only be run in CIM GOLDTeller. It cannot be run from the Loans > Payoff screen. Before you can pay off a loan, however, you must first go to the Payoff screen and lock the loan for payoff by clicking <Lock Loan>. You cannot run a Payoff by Journal from that screen. If you do not lock the loan for payoff before running this transaction, the following error message will appear after attempting to run the transaction: PAYOFF RECORD NOT ON FILE.

Payoff By Journal Transaction

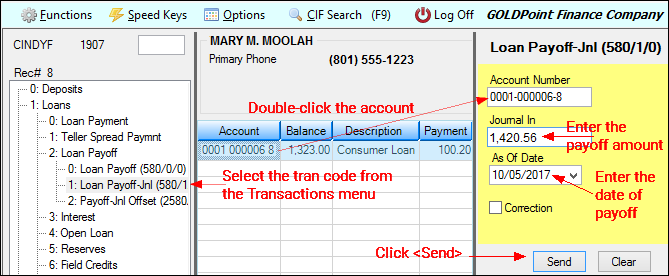

Open the Payoff by Journal transaction in CIM GOLDTeller and pay off the loan using the transaction from there, as shown below:

You will use the Journal In field for the total amount of the payoff. You should run a Payoff Inquiry before running this transaction, so you know the full amount of the loan. See the Payoff Inquiry transaction (tran code 195) description for more information. Important: This must be the total amount of the payoff. If you do not enter the correct payoff amount, you will receive the following error: Transaction Failed: NNNN IS P/O AMOUNT. You can re-run the transaction again with the amount the system tells you is the payoff amount.

|

To quickly re-run the previously run transaction in CIM GOLDTeller with the fields already filled in, press <Shift> + <F12>. |

Be sure the General Category is correct before running this transaction, as it will be reported to the credit repositories during monthend Credit Reporting. For example, if the loan was first charged-off and then you wanted to write-off (payoff) the loan, the loan should have one of the General Category codes for charge-off, such as "82 - Charge-off non-real estate property."

Impact of Payoff by Journal Transaction

•This transaction closes the loan.

•All amortization of fees, maintenance fees, precomputed interest, insurance premiums, insurance commissions, and insurance finance charges are balanced to G/L accounts. (See Note below.)

•Any unearned insurance premiums, precomputed unearned interest, unearned maintenance fees or amortizing fees, or unearned insurance finance charges will reduce the principal balance owing on the loan, and therefore, reduces the amount of payoff due. (See Note below.)

•Any open insurance policies are closed with Cancellation Code of "1 - Early Payoff."

•Miscellaneous loan fees are paid with a tran code 850, and adds that amount to the Payoff amount. The Marketing and Collections screen will show those fees as paid. The balancing of those fees are described in the G/L Balancing section below. (See Note below.)

•Action Code 96 (History Statement Request) and 163 (FHLMC EDR - 61 Payoff Prepaid) will be placed on the account with the Action Date of the Payoff date.

•Any Accrued Interest will be added to the Payoff amount.

•Collects all outstanding Late Charges Due and adds it to the Payoff amount. (See Note below.)

Note: Certain options are available for charged-off loans that will take into account amortizing/maintenance/deferred fees, precomputed interest, insurance premiums, and miscellaneous fees at the time the Charge-off transaction is run. If your institution handles these things at charge-off or during Precomputed-to-Simple conversion, then they will not occur during Payoff. See the Charge-off transaction description for more information.

G/L Balancing

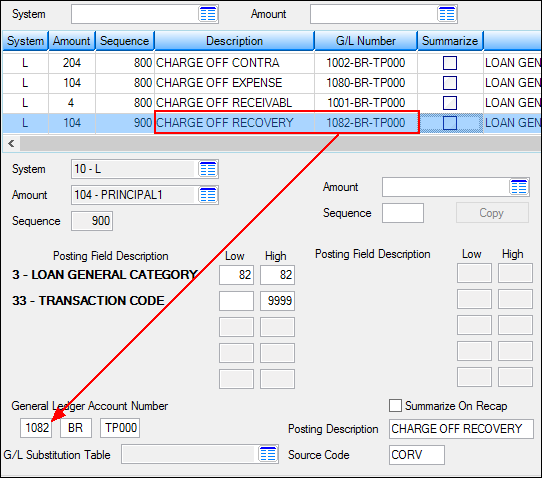

Once you run the Payoff by Journal transaction, you must run a manual teller G/L debit transaction (tran code 1800) transaction to reduce the CHARGE OFF RECOVERY G/L account by Journal Out. This account is set up in the GOLD Services > General Ledger > Autopost Parameters screen, as shown below:

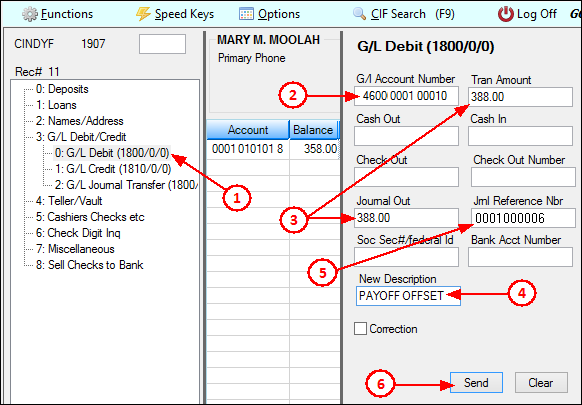

To run a G/L debit transaction by Journal Out, complete the following steps:

1.Open CIM GOLDTeller and select the G/L Debit transaction (tran code 1800).

2.In the G/l Account Number field, enter the G/L account number for CHARGE OFF RECOVERY from the Autopost Parameters screen (as shown above).

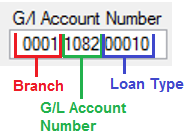

Note: If your institution uses Parameter Substitutions (as shown in the screen example above using "BR" and "TP000" in the General Ledger Account Number field), you cannot use them on this transaction. Instead, use the loan to insert the substitutions. For example, if the loan you ran for the payoff had "0001" for the first four-digits of the account number, that would be the branch (office) number. And if it was for loan type 10, TP would be 10. Please note that the loan type segment is 5-digits long, so if your loan type is 10, don't enter "10." You'll need to enter "00010", as shown below:

3.In the Tran Amount and Journal Out fields, enter the payoff amount you ran during the Payoff by Journal transaction (as shown in the example below).

4.Enter a New Description for this G/L Debit transaction in the provided field. This description will be viewed in the Electronic Transaction Journal and on G/L Balancing reports (such as the G/L Transaction Listing report). This field is mandatory.

5.Optionally, you can put the account number for which you ran the Payoff transaction in the Jrnl Reference Nbr field. Then when G/L reports are run, the account number can be included for this G/L offset.

6.Click <Send>. The system will offset the specified G/L account with the Payoff amount. See the example below illustrating these steps:

These transactions close the loan account and remove all monetary balances from the General Ledger (see Important Note below).

Important Note

If you want to post a G/L journal offset amount along with the Payoff by Journal, you should not use this transaction. Instead, use the Payoff-Journal Offset transaction (tran code 2580-01). That transaction will debit the Payoff amount from the G/L account entered in the Insurance Claim Offset field on the GOLD Services > General Ledger > G/L Account By Loan Type screen. You will not need to run the G/L Debit transaction after running the Payoff-Journal Offset transaction. See the Payoff-Journal Offset transaction for more information. |

See also:

Tran Code 2580-01, Payoff-Journal Offset

Tran Code 2022-01, Charge-offs