Navigation: Teller System > Transactions > Loan Transactions > Loan Transaction Codes >

Tran Code 2510-05, Full Write-off

This transaction can be run directly from CIM GOLDTeller, or you can use the Loans > Transactions > Charge-off screen to first set up the write-off information, then finishing processing in CIM GOLDTeller. (See Write-off Transaction tab in the Loans in CIM GOLD help for more information.)

This transaction can only be run on payment method 6 loans (interest bearing). For precomputed loans (payment method 3), the loan must be converted to payment method 6 prior to running the transaction. See the Convert Precomputed to Simple topic in the Loans in CIM GOLD manual.

For Institution 158 Only:

Accounts must first be charged off before they can be written off. If Hold Code 2 (charge-off) is not on the account and you attempt to run a Write-off transaction, the system will return the following message:

"Loan must be charged off."

Users will then need to charge off the loan before writing off the loan. See the Charge Offs transaction help for more information. |

This transaction will do the following:

•Accrue interest to today and waive all interest owing.

•Waive all late charges owing.

•Waive all miscellaneous loan fees owing.

•Credit the principal balance to zero and close the loan (running a Payoff transaction (tran code 580)).

Institution Options that Affect Write-offs

•If institution option OP10 CIFW is set to "Y," all open insurance policies will be refunded and canceled after the Full Write-off transaction is run. Taxes and surcharges will also be refunded.

•If institution option OP16 IRWO (Include repossessions in regular write off) is set and the General Category code is 81 or 85, then this transaction will use the Write-Off—Regular Loan General Ledger number (GOLD Services > General Ledger > G/L Account By Loan Type screen); otherwise, it will use the Write-Off—Charge Off General Ledger number.

•If institution option T99C is set up, an IRS 1099-C Cancellation of Debt form will automatically be created for the IRS owner connected to this account. However, the 1099-C form will only be created if the following circumstances exist for the loan:

othe write-off amount is $600 or more

othe account is not in bankruptcy (hold code 4 or 5)

You can view the form in the IRS GOLD system (GOLD Services > IRS GOLD > Forms screen) for the account. This form is automatically sent to the IRS when GOLDPoint Systems sends in all 1099-C forms for your institution. If the Full Write-off transaction is corrected and institution option T99C is on, the system will automatically delete the 1099-C record in IRS GOLD.

If you want to manually create a 1099-C form for the account (institution option 1099-C is not set up), use the Loans > IRS Form 1099-C screen to create and save the form. It will then be saved into IRS GOLD for printing.

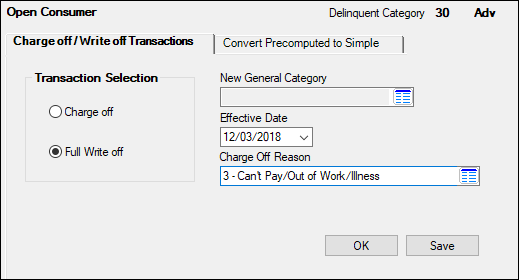

Most users run the Full Write-off transaction by initially setting it up on the Loans > Transactions > Charge Off Transactions screen in CIM GOLD, as shown below:

Loans > Transactions > Charge Off Transactions Screen in CIM GOLD

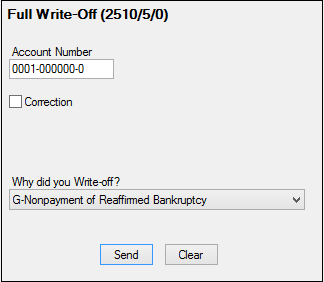

Once information is entered on that screen, the user clicks <OK> and CIM GOLDTeller launches with Full Write-Off transaction displayed and the account number filled in, as shown:

CIM GOLDTeller > Full Write-Off Transaction (tran code 2510-05)

Event Code - In the example above, we changed the name of this field to be "Why did you Write-off?" We suggest you change the name of the field to something tellers will easily understand. This field corresponds to the Identifiable Event Code on the Loans > IRS Form 1099-C screen). These codes should be added to the Event Code field as a drop-down list.

The following image is from the Identifiable Event Code drop-down list on the IRS Form 1099-C screen:

|

You can reverse a write-off once it has been processed, but only if the afterhours does not update the account for any reason. For example, some institutions require that the account be charged-off before it can be written off. Some charge-off options (commonly referred to as COOP options), automatically create an event letter in the afterhours (tran code 22). If someone were to charge-off a loan, then write-off the loan on that same day, the afterhours would still run an event letter for that account, even though the account is now closed.

In order to reverse a write-off, the last History transaction must be tran code 0134—Full Write-off Summary. Therefore, you would not be able to reverse the write-off in this case. If a user attempts to reverse a write-off transaction in CIM GOLDTeller and tran code 0134 is not the last item in Detailed History, they will receive the following error message after clicking <Transmit> on the Full Write-off correction:

INVALID TRAN FOUND FOR REVERSAL

So use caution when writing off a loan, because you may not be able to reverse it easily (as will be discussed in the following steps). Writing off a loan in these cases would require contacting GOLDPoint Systems for programmer intervention to reopen the loan.

If the tran code 0134—Full Write-off Summary is the last item in Detailed History, then reversing a write-off is quite simple. You can reverse a written off loan as long as it's still on the system AND another afterhours transaction has not run. (Institution option OFLM designates how long to keep closed loans on the system.)

Before reversing a write-off, make sure the following option is set under the main CIM GOLD menu: Options > User Preferences > View Closed/Released Accounts. If that option is not selected, you will not be able to view the closed account.

To reverse a write-off:

1.In CIM GOLD, navigate to CIM GOLDTeller.

2.Find and open the Full Write-off transaction (tran code 2510-05) in the transaction menu. Your institution designates which transactions appear in the menu. See CIM GOLDTeller > Functions > Administrator Options > Menu Design for more information. You cannot reverse a written off loan from the Loans > Transactions > Charge Off Transactions screen.

3.Enter the account number in the provided field and the Event Code used in the original Full Write-off transaction, then check the Correction box, as shown below.

4.Click <Send>. The system will reverse the full-write off and re-open the loan. If institution option T99C is set up and the loan was for more than $600, the system automatically created the 1099-C associated with the IRS owner’s SSN and account number. So reversing the write-off automatically deletes the 1099-C record from IRS GOLD (if institution option T99C is set).

Correcting a Full Write-off transaction basically reverses all transactions involved with the write-off. If any late charges were waived, they would be reapplied. If miscellaneous fees were waived, they will be reapplied as well, and so forth.

Check the Charge Off and Recoveries Report (FPSRP269) to view all charge-offs and write-offs processed.

|