Field

|

Description

|

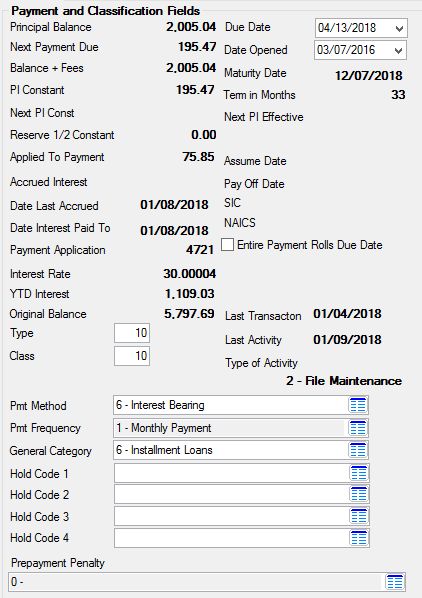

Principal Balance

Mnemonic: LNPBAL

|

This field displays the unpaid principal balance of the loan. It can only be entered, changed, or otherwise affected by teller transactions, which means it cannot be file maintained through this screen. Depending on the kind of loan, a transaction may either reduce or increase this balance.

An option is available to open a new loan with a principal balance of zero for line-of-credit loans (payment method 5). This option is requested by work order. For more information, see the description for transaction code 680 in Appendix A of the Loans manual in DocsOnWeb. Institution Option SOVC requires a supervisor override when posting a Principal Decrease transaction (tran code 510-47).

|

Next Payment Due

Mnemonic: NXTPAY

|

This is the amount of the next payment due. It is the P/I Constant plus Reserve 1/2 Constant, but only if the Payment Application includes paying reserves. If it does not include reserves, then this amount is the P/I Constant.

It does not include late charges past due or miscellaneous fees owing.

|

Balance + Fees

Mnemonic: LNWXFEER

|

This field displays the total balance amount of the loan, plus any additional miscellaneous fees that have incurred. This balance does not include late charges owing or amortizing fees. See the Fees topic on the Loans > Marketing and Collections screen for more information about miscellaneous fees.

|

PI Constant

Mnemonic: LNPICN

|

The PI Constant field contains the portion of the regular payment that is divided between the amount to interest and amount to principal. This field is calculated by the system. See the Interest Calculation Method Examples description for examples of how the P/I Constant is calculated.

When the Pmt Method field below is 5 (line-of-credit) and the Type field below is 2 or 4, this field will be the principal constant and will be the amount to principal only.

|

Next PI Const

Mnemonic: LNPINX

|

The Next PI Const replaces the PI Constant (above) as the amount of the loan payment. This new payment occurs when the due date is advanced by the system to be greater than the Next PI Effective date below. If modified payments are set up on the loan (through the Loans > Transactions > CP2 screen), this field will display the amount of the next modified payment.

For ARM loans, which have a varied interest rate, this amount is automatically calculated based on the information entered on the Loans > Account Information > ARM Information screen. It will be calculated on the number of days entered on that screen in the Days Before Payment P/I Change field before the date entered in the Next PI Effective field below. This amount will also be calculated any time the calculated date is in the past and there is not already something entered in this field.

|

Reserve 1/2 Constant

Mnemonic: LNR1CN+LNR2CN

|

This is the sum of the reserve 1 constant (LNR1CN) and the reserve 2 constant (LNR2CN), as entered on the Reserve Payment tab of the Loans > Account Information > Reserves > Account Reserve Detail screen. If you want loan payments made by customers to also go toward the reserve payment, reserves must be included with the Payment Application.

|

Note: If reserves are included in the Payment Application, the Next Payment Due will include the Reserve 1/2 Constant.

|

|

Applied To Payment/Partial Payment

Mnemonic: LNPRTL

|

This field serves two different purposes, depending on whether or not the account is a simple interest loan:

•If the loan is a payment method 0 (conventional loan) or 7 (ARM), this field contains funds paid toward the loan but not applied to the loan. For these types of loans, the field is called Partial Payment.

•If the account is anything but payment method 0 or 7, this field contains the amount that will be applied toward the next payment due. The name of this field is Applied To Payment.

See below for more information.

Partial Payment

When this field is called Partial Payments on payment method 0 and 7 loans, it indicates that this is a monetary field and the money has not been applied toward a payment. Funds are credited to Partial Payments by a teller transaction and remain there until another teller transaction is processed to debit partial payments and post the money somewhere else (usually as a payment).

This field is generally used by the collection department if less than a full payment is collected. Once the remaining portion of the payment

is received, post those funds to Partial Payments, then debit the full payment amount from Partial Payments and credit it as a payment.

Funds in this field are not automatically applied as a payment by the system unless you have one of the institution options enabled (see Partial Payment Options). The Partial Payment Report (FPSRP198) and the Loan Warning Report (FPSRP083) identify accounts that have funds in Partial Payments. Bill and receipt statements subtract the partial payment amounts from the Total Due. Note: Refer to Partial Payment Options for options that allow the system to automatically debit Partial Payments and post them to the loan during the afterhours process.

Option C (RDPP) subtracts the Partial Payments field from the total amount due. However, for daily simple interest loans (payment method 6), the amount in the Applied to Payment field is always subtracted from the total amount due, whether this option is on or not.

Applied To Payment

This field can be file maintained by the user and does not require a teller transaction.

When the account is anything but payment method 0 or 7, you can make a partial payment, and it will be applied to the account. If the amount you paid is less than a full payment, the Due Date will not roll, but the money will be applied to the areas designated by the Payment Application field below, such as principal first, then interest, then late charges, etc. The amount that you paid toward the payment due is automatically stored in the Applied to Payment field and kept track of here until the full payment is satisfied. When the Due Date rolls, the field is cleared out. This field is also used in determining whether a late charge should be assessed when you are using delinquency grading and collecting late charges before principal and interest.

|

Note: There is a Curtailment from Partial Payment transaction (tran code 2610-04) that will debit partial payments (tran code 500) and automatically credit the principal balance (tran code 510) as a curtailment at the same time. The same edits (SOV, TOV, etc.) are used as with all other field credit (510) and field debit (500) transactions. This transaction processes each transaction separately, and they will appear in history as two separate transactions.

|

See Also:

For details on partial payments and the institution options that relate to them, see Partial Payments Options.

|

|

Accrued Interest/Interest Due

Mnemonic: LNACIN

|

The name of this field changes if the loan is a conventional loan (payment method 0) or other payment methods.

•If it is a conventional loan (payment method 0), the name of this field is Interest Due and it shows the amount of unpaid interest owing on the loan from the last payment date up to but not including the Date Last Accrued.

•For interest-bearing and ARM loans (payment method 6 and 7), this is called Accrued Interest. This is the amount of interest still owing from the Date Interest Paid To (see below) to the last transaction date. If the loan is current (no outstanding payments due), this field will be blank (zero).

A GOLDWriter and variable screen mnemonic (LNACRINT) is available that will show accrued loan interest either to or through today. The calculation is the same calculation as the Loans > Payoff screen uses. The mnemonic uses the same institution option as for payoffs to determine if the calculation is to or through today.

|

WARNING: This mnemonic does not use the payoff record. If you have already locked in a payoff record on the Payoff screen, and you run a GOLDWriter report using this mnemonic, but today is not the actual payoff date, the accrued interest may be different on the report than it is on the payoff record.

|

For ARM loans, the only time there will be a balance in the Accrued Interest field is when the loan is amortizing negatively and interest is deferring based on the rate change frequency. This occurs when the Defer Interest at field on the Loans > Account Information > ARM Information screen is set to "Never Defer Interest" or "Rate Roll." This field is maintained by the system.

|

|

Date Last Accrued

Mnemonic: LNDLAC

|

The date of last interest accrual is the date the system last accrued interest. For conventional loans, this date will always be exactly one frequency of payment behind the due date. Interest for a payment is usually calculated from the date last accrued to the due date for a loan that accrues using a frequency, unless the Interest Calculation Method is 101, 102, or 103.

Daily accrual loans (payment method 6) accrue interest from the date last accrued to, but not including, the date a payment is applied or transaction takes place. A precomputed loan accrues from the date last accrued to the next month. Such accrual is performed in batch processing only. Loans with an LIP Method Code of 1 or 101 will accrue to the current date each time an LIP disbursement is made, or the LIP interest rate is changed.

|

Date Interest Paid To

Mnemonic: LNPDTO

|

This is the date, calculated with each payment, up to which interest has been paid on the loan. This date is not used for interest calculation purposes anywhere in the GOLDPoint System, but is provided on this screen for loan servicing convenience. When charging interest on LIP loans, this date will appear in history. See below for more information.

The system enters this information, but the field can also be file maintained. For amortizing loans (payment methods 0 and 7), if this doesn't stay one cycle behind the due date, the P/I Constant field below could be incorrect.

For daily simple interest loans (payment method 6), this field is calculated in the following way.

When a payment is posted, the Date Last Accrued field above displays the date the payment was posted. The system then takes the amount in the Principal Balance field above and multiplies it by the loan rate and divides it by the interest calculation code base (this determines the per diem). It then divides the Accrued Interest (see above) by the per diem and calculates the number of days. The number of days is subtracted from the Date Last Accrued and that becomes the Date Interest Paid To. When calculating the number of days, the system rounds up. For example, if the number of days is 14.9, then 15 days will be used.

Line-of-credit loans (payment methods 5, 9, and 10) are the same as payment method 6 except as follows:

For periodic loans, the Date Interest Paid To does not change until the full payment is paid. At that time, the Date Interest Paid To will be the date of the finance charge connected to the loan due date.

For example, the loan has a due date of 8-1 and the finance charging is done 15 days prior (7-16). When the 8-1 payment is posted, the Date Interest Paid To would become 7-16. On 8-16, the finance charging would be done for the 9-1 payment. When the 9-1 payment is posted, the Date Interest Paid To would become 9-16. (Regardless of what day a payment is posted, the Date Interest Paid To is the date the finance charge was processed.)

For daily loans (payment method 5), the current and previous finance charges are added to the amount in Accrued Interest. The above-mentioned calculation for daily simple interest is then performed.

|

Note: This field is only an interest estimate for payment methods 5, 6, 9, and 10 and LIP loans. Interest rate changes or large adjustments to the principal balance will make the calculated paid-to date slightly inaccurate for the month of the adjustment. The following month the Date Interest Paid To will be recalculated using the above-mentioned calculation.

|

For payment method 0 and 7 loans only, if a loan has been sold to an investor, any time a principal decrease (tran code 510) or correction (tran code 518) is processed, the system will write to history the "date interest is paid to." This date is not changed but is written to history so that for scheduled/scheduled reporting, the system can use this date as the payment date for the curtailment.

Institution Option PIWD is available for daily simple interest (payment method 6) loans. If this option is set, when a payment is posted (600 transaction code only), interest will only be paid in full-day increments. For example, if the per diem is $5.50, only multiples of $5.50 would be paid to interest ($5.50, $11.00, $16.50, etc.), up to the full amount of interest owed. Any remaining amount will be applied to principal. If the amount paid is less than the per diem, no interest will be paid.

The result of this option will be a more accurate interest paid to date.

Example:

Principal Balance

|

$3,816.10

|

Loan Rate

|

30.0000%

|

Interest Base

|

365

|

Per Diem

|

$3.14

|

Interest for 30 days

|

$97.34

|

P/I Constant

|

$264.00

|

A payment of $100.00 divided by the per diem of $3.14 will be 31. The per diem multiplied by 31 is $97.34. The remainder of the payment ($2.66) will be applied to the principal.

|

|

Payment Application

Mnemonic: LNAPPL

|

The Payment Application field is found on both the Account tab and Payment Detail tab of this screen. However, file maintenance is only allowed on the Payment Detail tab using the Payment Application checkboxes. See the Payment Application definition on the Payment Detail tab for more information.

|

Interest Rate

Mnemonic: LNRATE

|

This is the annual interest rate to the nearest five decimal places. It is the rate entered or calculated at which the payment is being made. To understand how the system uses the interest rate to calculate the P/I Constant, see the Interest Calculation Method Examples topic.

For ARM loans (payment method 7), you must enter the interest rate in the Current Rate field on the Loans > Account Information > ARM Information screen for interest to be calculated on this loan. This is generally used with a rate pointer other than "255." If the rate is file maintained on daily simple interest loans (payment method 5 or 6), the accrued interest is recalculated to the current date using the old rate, and the date last accrued is changed to today's date.

|

YTD Interest

Mnemonic: LNYTDI

|

This is the total amount of interest that a customer has paid on this loan in the current calendar year beginning January 1. It is cleared at the end of each year. This field is maintained by the system. You cannot file maintain this field. For payment method 3 loans (precomputed), this field is blank.

Before year-end runs, this field does not include the Deferred Interest Paid this year. Once year-end processing has run, the YTD Interest and Deferred Interest Paid this year are combined and reported to the IRS for mortgage loan accounts. See the Year-to-date Information field group on the Average Balances tab on the Statistics tab of this screen for more information. Once year-end has run, the total YTD Interest (including Deferred Interest Paid) is shown on the Current & Prior Year-to-Date tab for that year.

This field does not update if the selected customer loan account is a precomputed loan. If this loan has been assumed by a different person (these are rare) an Assume Date will show (see below), the YTD Interest field clears to zero and then begins tracking the interest paid by the new buyer. See the Assume Date field for more details.

|

Original Balance

Mnemonic: LNOBAL

|

This field contains the original amount of the loan, which is used to calculate the Original LTV field (on the Loans > Account Information > Additional Loan Fields screen). On loans with precomputed interest (payment method 3), this amount will include the loan principal plus the add-on interest amount. This field is originally entered when the loan is boarded into CIM GOLD. However, you can file maintain this field if necessary and you have the proper security.

|

Type

Mnemonic: LNTYPE

|

This is the loan type. The loan type is usually designated at origination, but if you have proper security clearance, you can make changes to this field. The loan type indicates what type of loan this is, such as consumer, direct-cash loans, live checks, first mortgage, etc. Each institution defines the Loan Type differently. Loan Types are also used in loan origination such as eGOLDTrak, GOLDTrak PC, and boarding loans through our APIs using a third-party origination application.

The Loan Type is a very important designation. It determines what G/L account to use when certain transactions are run. See the GOLD Services > General Ledger > G/L Account By Loan Type screen for more information.

|

Class

Mnemonic: LNCLAS

|

The Class field is defined and used within each separate financial institution. Your institution can determine how you want to use the Class field for further loan designation. The Class field is included on many reports (see the Loan Reports manual), and can be used when building institution-specific GOLD Writer reports. The Class field usually designates the loan as being originated from a certain area or state. Most commonly, it designates the state where the loan originated.

Certain convenience fees can be tied to loan class. Convenience fees are not allowed on all loan types. Convenience fees allow lending institutions to charge a fee for processing a payment that is out of the ordinary, such through a website, GOLDPhone, or a quick payment through EZPay. See the Fees topic in EZPay for more information concerning convenience fees.

|

Pmt Method

Mnemonic: LNPMTH

|

This field displays the payment method code. The payment method code determines how to calculate interest and what rules to follow in processing the loan account. Once the payment method has been set up on a loan, it should not be changed. Loans use fields differently for different payment method codes. See below for more information.

In addition, certain screens pertain to specific payment methods, such as the Loans > Account Information > ARM Information and Precomputed Loans and Loans > Line-of-Credit Loans screens. Fields on these screens are important to the proper processing of the loan.

Click the list icon to view and select the payment method for this loan. Follow the links in the table below for more information about each payment method.

Code

|

Description of Method Code

|

0

|

Conventional Loan

|

2

|

Growth Equity

|

3

|

Precomputed

|

5

|

Line-of-Credit

|

6

|

Interest Bearing

|

7

|

ARM - Adjustable Rate Mortgage

|

8

|

Rental Account

|

16

|

Signature Loan

|

|

|

Pmt Frequency

Mnemonic: LNFREQ

|

Loan payment frequency codes indicate the frequency of the regular loan payment, such as monthly, bi-weekly, bi-monthly, etc. You cannot change payment frequencies from this screen. For interest-bearing loans (payment method 6), you can change the payment frequency using the Loans > Account Information > Payment Information. For signature loans (payment method 16), you can change the frequency using the Loans > Account Information > Signature Loan Details screen.

|

General Category

Mnemonic: LNGENL

|

Select from this drop-down list the general category of the loan. You can file maintain this field. General Category codes are reported to the credit bureau and are used on OTS reports. See below for a list of possible General Category codes.

Code

|

Description

|

01

|

Real estate first mortgage loans

|

02

|

Second mortgages

|

03

|

Loans on deposits

|

04

|

Consumer loans

|

05*

|

Check guarantee/overdraft loans

|

06

|

Installment loans

|

07*

|

Revolving line

|

08

|

Financing leases

|

09*

|

Commercial loans - other than real estate

|

10

|

Commercial real estate loans

|

11

|

Wrap loans/serviced for real estate

|

12

|

Loans purchased - serviced by others

|

13

|

Loans to farmers

|

30

|

Non-conforming/loans to facilitate

|

40

|

Commercial letter of credit

|

41

|

Stand-by letter of credit

|

50

|

Mortgage-backed bonds

|

51

|

U.S. government securities

|

52

|

Federal agency securities issued by housing-related agencies

|

53

|

Federal agency securities issued by other agencies

|

54

|

Equity securities except FHLB stock

|

55

|

Mortgage-derivative securities

|

56

|

Interest-earning deposits in FHLBs

|

57

|

Other interest-earning deposits

|

58

|

Federal funds sold

|

59

|

Other investment securities

|

60,61

|

State and municipal obligations

|

62

|

Mortgage pool securities - GNMA pools

|

63

|

Mortgage pool securities - FHLMC participation certificates

|

64

|

Mortgage pool securities - FNMA pools

|

66

|

Insured or guaranteed by an agency or instrument of the U.S.

|

68

|

Other mortgage pool securities

|

80**

|

Real estate in foreclosure or charge-off real estate secured by first liens. Stops late charge assessments.

|

81**

|

Repossessed - non-real estate property. Stops late charge assessments.

|

82**

|

Charge off non-real estate property. Stops late charge assessments. When a loan is charged off, the system places a General Category 82 on the loan. See Charge-Off Transactions.

|

83**

|

Charge off of credit cards and related plans. Stops late charge assessments.

|

84**

|

Charge off of commercial and other loans. Stops late charge assessments. Stops late charge assessments.

|

85**

|

Repossessed assets. Stops late charge assessments.

|

86

|

Charge-off of loan to farmers. Stops late charge assessments.

|

87

|

Real estate in foreclosure or charge-off real estate secured by junior liens. Stops late charge assessments.

|

88

|

Charge - Off of REO Assets

|

89

|

Charge - Off of Repossessed

|

90

|

Contract collections

|

91

|

Rental accounts (These are payment method 8.)

|

97

|

Loan is in the application process only. (The account has been opened to track application fees. The origination of the loan has not been completed.)

|

* GOLDPhone transfers allowed.

** If you attempt to enter a general category of 80-89, the system will require that a Charge-off Date be entered on the Additional Loan Fields screen before allowing file maintenance. The charge-off date is used by both credit reporting and some regulatory reports. If a charge-off date has not been entered, those reports cannot determine when the charge-off occurred and when to report the charge-off.

|

|

Hold Code 1-4

Mnemonic: LNHLD1, LNHLD2, LNHLD3, LNHLD4

|

Click the list icon  and select a hold code from the list that you want applied to this account. The hold codes reflect any restrictions for this account. Up to four hold codes can be selected for each loan. This field also appears on many other screens in the CIM GOLD system. See the Hold Code definitions topic in the Actions/Holds/Event Letters help. and select a hold code from the list that you want applied to this account. The hold codes reflect any restrictions for this account. Up to four hold codes can be selected for each loan. This field also appears on many other screens in the CIM GOLD system. See the Hold Code definitions topic in the Actions/Holds/Event Letters help.

|

Prepayment Penalty

Mnemonic: LNPPEN

|

This field reflects any prepayment penalties connected with this account. Click on the list icon  to view a list of prepayment penalty codes and their definitions. The prepayment penalty is set up and file maintained on the Prepayment Penalty tab on this screen. to view a list of prepayment penalty codes and their definitions. The prepayment penalty is set up and file maintained on the Prepayment Penalty tab on this screen.

|

Due Date

Mnemonic: LNDUDT

|

This is the date the next regular payment is due. It is determined by the system from the code, but can be file maintained if you have the proper security clearance. This field can be used in conjunction with the Due Date Day field (on the Additional Loans Fields screen). The system requires a due date to be on the loan before the loan can be opened. See below for more information.

File maintaining the Due Date field will change the Due Date Day field to match the day portion of the due date.

For an LIP loan, this is the date to which the payments have been received. If interest is charged against the LIP, the due date and the LIP Next Bill or Charge Date should always agree. If the LIP interest is billed, the LIP Next Bill or Charge Date will roll when the interest is billed and the due date will roll when the payment is collected.

For payment method 5 loans with a zero balance, a balance increase transaction will update the loan due date by adding the number of days before the finance charge date to the current run date.

An online error message will appear when file maintenance occurs on this field. If the interest calculation code is a 1, 2, or 3, the system will not allow the due date to be anything except one payment frequency ahead of the date last accrued. For LIP loans with an interest calculation code of 1, 2, or 3 and an LIP method code of 2 or 102, the error message will also appear. The error message will be "NO F/M – DATE LAST ACCRUED NOT 1 FREQ BEHIND DUE DATE."

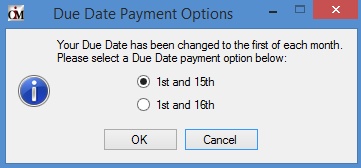

If the Optional Semi Monthly field is marked and this date is changed to the first of the month, the Due Date Payment Options dialog appears. This dialog allows the user to indicate whether the customer's payments will be due on the 1st and 15th or 1st and 16th of each month.

If Institution Option DD27 is enabled, the Due Date Day will not be allowed to be greater than 27.

|

Note: If this field is file maintained manually by an employee, the account may be flagged with Special Comment Code "CO" (loan modified) during monthend credit reporting. See the Special Comment Code field on the Credit Reporting screen for more information.

|

See also:

Special Late Charge Assessment and Grading

|

Note: If a user attempts to change the Due Date or Due Date Day and the system displays an error message, it's likely that certain options are set up for your institution which prevent altering due dates and due date days. See the following institution options for more information:

•CDUR •DDCD •DDAO •DDPF •DD27 •MDDD

Additionally, some institutions have requested hard-coded restrictions on changing these fields. Contact your GOLDPoint Systems account manager to see if such restrictions are in place at your institution.

|

|

|

Date Opened

Mnemonic: LNOPND

|

This field displays the date the loan was opened or funded. The system automatically supplies this information when a new loan (tran code 680) is opened through GOLDTrak PC. For loans with precomputed interest (payment method 3), this field is one of the keys for calculating refunds of precomputed interest. Although the system enters the data for this field, it is file maintainable.

|

Maturity Date

Mnemonic: LNMATD

|

This field displays the date the last payment is due on the customer loan account (and the date the loan should be paid off). All loans must have a designated maturity date except payment methods 5 (revolving line-of-credit) and 8 (rental accounts), otherwise payments cannot be posted. See below for more information.

If the Stop Recurring Payment at Maturity box is selected on the Payment Information screen, recurring payments made on loans after the Maturity Date will be rejected and shown on the Exception Items Report (FPSRP013). You will need to remove the recurring payment if this option is selected and the loan reaches maturity.

Late charges stop assessing once the loan reaches the Maturity Date if the Stop Late Charge if Past Current Maturity? box on the Late/NSF tab is selected on the account. Grace Days applies to this as well, so it will still assess a late charge if the loan is past the Maturity Date, but within the Grace Days. (Example: Maturity Date is 11/19/2018 and Grace Days is 10. If a payment isn't made by 11/29/2019, the system will assess a late charge that last month, but it will not assess one the following month if a payment is not made.)

Note: Usually the Original Maturity Date (MLOMAT) and Maturity Date (LNMATD) are identical. However, sometimes the maturity date's may be different if a deferment was made or other reasons. The Original Maturity Date is found on the Additional Loan Fields screen > Origination/Maturity tab.

Institution Option CZLB automatically closes zero balance payment method 5 loans. At the time the loan is closed, the Payoff Date is also updated. The "close" transaction is a file maintenance tran code 22 to field 999. The loan will automatically close on the night of the maturity date. Monetary balances that must be zero are: Principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, and accrued interest on negative reserves. In addition, the loan cannot have an LIP (loan-in-process) method code greater than zero.

Loan advances (tran code 500 field debit to principal) are typically not allowed if a loan is past the maturity date. The error message "LOAN PAST MATURITY, ADVANCES NOT ALLOWED" will be displayed both in GOLDTeller and the Exception Items Report (FPSRP013) for line-of-credit loans. If there is no maturity date, advances will continue to process. This applies to all payment methods. Institution Option APML allows a principal increase to be processed if a loan is past the maturity date. This requires a supervisor override (SOV).

Institution Option APCO allows a loan payment (tran code 600/608) or an optional loan payment (tran code 690/698) to be processed if a loan has been charged off (hold code 2).

|

|

Term in Months

Mnemonic: LNTERM

|

This field contains the term of the loan in months. It is used in calculating rebates on loans with precomputed interest (payment method 3), and in determining the remaining term of ARM (payment method 7) loans.

|

WARNING: This field is used to calculate payments and should reflect the number of calendar months over which the loan is being amortized. This is not always the same number as the maturity date of a loan.

|

|

Next PI Effective

Mnemonic: LNPIEF

|

This field contains the principal/interest effective date, which is the date that the Next P/I Constant (see above) should replace the P/I Constant (see above). See below for more information.

This field, in conjunction with the Next PI field (on the Loans > Account Information > ARM Information screen), can be used to make a payment change in the amount of money applied to principal and interest. (This is the payment due date for the new P/I.)

The P/I effective date is used for both manual loan adjustments and automatic principal/interest changes on adjustable mortgage loans (ARMs, payment method 7). The Next PI will be calculated on the date of the number of days entered in the Days Before Rate Change field on the ARM Information screen prior to the actual date entered in the field.

To perform file maintenance on ARM (payment method 7) loans, you must access the ARM Rates & P/I Tables tab of the ARM Information screen.

If manual changes are desired, the P/I Change Frequency field on the ARM Information screen should be zero (0).

If modified payments are set up on the loan (through the Loans > Transactions > CP2 screen, this field will display the date when the next modified payment amount will be required.

|

|

Assume Date

Mnemonic: LNASDT

|

This field displays the date this loan was last assumed. It controls the interest being reported for the new borrower. Only interest paid after this date will be reported for the new borrower. If the loan was assumed (see Loans > Loan Assumption screen), once the assumption is completed, this field is updated by the Assumption Date.

|

Payoff Date

Mnemonic: LNCLDT

|

This date represents the date this loan was paid off. This field will be updated when a payoff transaction code 580 is processed. A payoff correction code 588 will clear the field. See below for more information.

Institution Option CLZB automatically closes zero balance payment method 5 loans. At the time the loan is closed, the payoff date is also updated. The "close" transaction is a file maintenance tran code 22 to field 999. At the same time, the system will update the date of the Last Transaction (see below). The loan will automatically close on the night of the maturity date.

Monetary balances that must be zero are principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, accrued interest on negative reserves, customer balance, LIP balance, and, for payment method 5 loans, the prior and current finance charge. In addition, the loan cannot have an LIP Method Code must be greater than zero.

|

|

SIC

Mnemonic: MLSIC1

|

This field displays the Standard Industrial Code (SIC) number.

|

NAICS

Mnemonic: MLSIC2

|

This field displays the North American Industrial Code Standards (NAICS) number. See below for more information.

The NAICS is an industry classification system that covers the entire field of economic activities; producing and non-producing. It was developed by the USA, Mexico, and Canada in connection with the North American Free Trade Agreement (NAFTA) to provide standard industry definitions to be used for analyses of the economies of the three North American countries.

Data collected for businesses are reported to various governmental agencies, trade associations, private research organizations, and others who gather and publish economic information. The data is used to produce statistical information on industrial performance, inputs and outputs, productivity, unit labor costs, and employment. Use of NAICS codes provide uniformity and comparability in the presentation of statistical data describing the economy.

NAICS codes are assigned to each establishment of an enterprise based on the primary activity of that establishment. When a company applies for an Employer Identification Number (EIN), the information about the type of activity in which that business is engaged is requested in order to assign an NAICS code. In addition, statistical agencies such as the Census Bureau and the Bureau of Labor Statistics assign NAICS codes based on information reported to them. NAICS is a replacement for the Standard Industrial Classification (SIC) codes. It began to be used by various governmental agencies beginning in 1997 and took several years to be fully implemented.

Structure of NAICS

NAICS classifies all economic activities into 20 sectors. The first two digits of the NAICS structure (shown in the table below) designate the NAICS sectors that represent general categories of economic activities. The third digit designates the subsector, and the fourth digit designates the NAICS industry.

The NAICS sectors, subsectors, and industry codes are as follows:

Sector

|

Name

|

Sub-Sectors

|

Industry Groups

|

11

|

Agriculture, Forestry, Fishing and Hunting

|

5

|

19

|

21

|

Mining

|

3

|

5

|

22

|

Utilities

|

3

|

14

|

23

|

Construction

|

21

|

84

|

31-33

|

Manufacturing

|

21

|

84

|

42

|

Wholesale Trade

|

2

|

18

|

44-45

|

Retail Trade

|

12

|

27

|

48-49

|

Transportation and Warehousing

|

11

|

29

|

51

|

Information

|

4

|

9

|

52

|

Finance and Insurance

|

5

|

11

|

53

|

Real Estate and Rental and Leasing

|

3

|

8

|

54

|

Professional, Scientific, and Technical Services

|

1

|

9

|

55

|

Management of Companies and Enterprises

|

1

|

1

|

56

|

Administrative and Support and Waste Management and Remediation Services

|

2

|

11

|

61

|

Educational Services

|

1

|

7

|

62

|

Health Care and Social Assistance

|

4

|

18

|

71

|

Arts, Entertainment, and Recreating

|

3

|

9

|

81

|

Other Services (except Public Administration)

|

4

|

14

|

92

|

Public Administration

|

8

|

8

|

|

|

Entire Payment Rolls Due Date

Mnemonic: LNEPMT

|

Checkmark this box if you want this loan to roll the Due Date when an entire payment is made (the amount collected is greater than or equal to the Next Payment Due). This does not apply if miscellaneous loan fees are collected before principal, interest, and late charges (Payment Application starts with 7 (loan fees)).

The program will compare what was collected to the Next Payment Due minus anything in the Roll Due Date Within field to determine whether a full payment was made.

There is a field that doesn't appear on any screens in CIM GOLD but is used to track late charges when using the SPREAD routine (see Use Spread Payments option on the Payment Detail tab). This field is called LNVESC. As payments are spread to the different parts of the loan according to the Payment Application, this field and the other tracking fields will track how much of the Partial Payment goes to principal and interest, reserves, P/I fees, and late charges, in the event a full payment isn't made.

Note: Miscellaneous loan fees are not included in the full payment calculation. If a full payment was made, the Due Date will roll ahead one month. If part of the full payment was applied to late charges, then either the entire amount of the payment or just the principal and interest portion will be credited to the Applied To Payment field, depending on which option you have set.

Note: The amount of late charges paid in one payment or cycle cannot exceed one P/I Constant.

For example, if a payment due is $100 and late charges of $40 are also due, but the customer brings in a payment of $100, the due date will still roll, even though the full amount of $140 has not been paid. If the Entire Payment Rolls Due Date box is not checked, then the payment would not cause the due date to roll, because the loan payment of $100 plus the late charges of $40 would require the customer to pay $140 before rolling the due date. Instead, the system would place the $100 payment in the Applied To Payment field (above) and the due date would not roll until another payment was made in the amount of the Next Payment Due (see above), any Late Charges, minus the amount in the Applied To Payment.

|

Note: Late charges, fees, etc. are only included as part of the payment if the Late Charges, Loan Fees, etc. boxes are checked in the Payment Application field above.

|

The system also determines whether a payment is counted as full and thereby rolls the due date based on the Next Payment Due (see above), as well as what is entered in the Roll Due Date Within field. For example, if the Next Payment Due (see above) amount is $200, and the Roll Due Date Within amount is $10, and a customer brings in a payment for $190, the Due Date (see above) will roll to the next date, as $190 plus $10 equals the full payment.

|

Note: Miscellaneous loan fees are not included in the full payment calculation.

|

If only a partial payment is made, the due date is not rolled and the amount of the partial payment is displayed in the Applied To Payment field.

|

Note: The amount of late charges paid in one payment or cycle cannot exceed one P/I Constant (see above).

|

|

|

Last Transaction

Mnemonic: LNTRAN

|

This field contains the date of the last transaction on this account. The system supplies this date through the teller transactions, and the field is not file maintainable. This field is also updated by tran code 520 (Assess finance charge) for payment method 5 loans. Backdated Transactions: If a transaction is backdated, this field will display the backdated effective date, not the date the transaction was actually processed.

|

Last Activity

Mnemonic: LNACTV

|

This field contains the date of the last activity on this account. The system supplies this date, and it is not file maintainable. If you want to find more information on the last activity, see the Loans > History screen to bring up the history of the account.

|

Type of Activity

Mnemonic: LNACTP

|

This field gives a code referring to the type of activity that occurred on the date in the Last Activity field above. It is entered by the system and cannot be file maintained. See below for a list of possible codes in this field.

Code

|

Description of Activity

|

1

|

Posting journal debit or credit; non-customer transaction

|

2

|

File maintenance

|

5

|

Payment or other customer transaction

|

9

|

No activity since conversion

|

|