Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Payment Detail tab >

Options field group

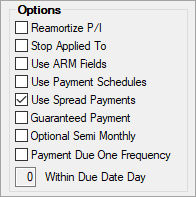

The Options field group on the Loans > Account Information > Account Detail screen is used to enter information about options such as whether this loan account uses ARM fields, whether the account's principal and interest should be reamortized, and whether a payment schedule is used.

The fields in this field group are as follows:

Field |

Description |

|||

|

Mnemonic: LNAMZ6 |

Check this box if you want to allow a daily simple interest loan tied to prime to calculate a payment which will amortize the loan. See below for more information.

|

|||

|

Mnemonic: LNAPLY |

This option is only for interest-bearing (payment method 6) and precomputed (payment method 3) loans only. When this box is checked, if the payment being posted is more than than the actual payment amount, the extra amount will not be added to the Applied to Payment field; the extra amount will automatically be posted to the Principal Balance instead of being credited toward the next payment due.

Partial payments (payments for less than the full amount) will update the Applied To Payment field. When a partial payment is made, the Applied To Payment field will be updated and will continue to do so until sufficient money has been applied to roll the Due Date. If the amount paid plus the amount in the Applied To Payment field exceeds the payment due, the Due Date will roll and the Applied To Payment field will be cleared. But with this option set, the extra amount does not go towards the Applied To Payment, and instead, the extra amount goes directly to decreasing the Principal Balance.

Important Note: The Entire Payment Rolls Due Date option (LNEPMT) should not be used in conjunction with the Stop Applied To this option. These two options conflict on purpose. |

|||

|

Mnemonic: LNRTSN |

This field will only be file maintainable if the loan is payment method 6, daily simple interest. It is used for creating scheduled rate changes on simple interest loans. The default value is unchecked, which indicates that the ARM fields will not be used. If this box is checked, the system will act like this is a payment method 7 loan (ARM). It is from these fields that scheduled rate changes are created. Even though you may access the ARM fields, the system will still use the simple interest calculations for the loan. |

|||

|

Mnemonic: LNPMSC |

Check this box if this account is allowed modified payment schedules. The default value is not checked (no). If checked, you can set up modified payment schedules for this account using the Loans > Transactions > CP2 screen. You must have proper security to set up payment schedules. For more information, see the CP2 screen. |

|||

|

Mnemonic: LNSPRD |

The Use Spread Payments option is an override indicator that tells the system to use the SPRDPMTS program for calculating payments and processing payments. See below for more information.

|

|||

|

Mnemonic: LNGPMT |

This box is selected when a loan is originated from GOLDTrak PC (using field TF_GUARANTEED_PMT_LN). The person originating the loan determines whether the payment is guaranteed. This is an information only field and manually updated. The mnemonic is LNGPMT and it can be included on GOLDWriter and GOLDMiner reports.

An example of a guaranteed payment is a third-party company offering to make loan payments on behalf of their customers. The payment is always made whether or not the customer actually pays their bill to the third-party company, making the payment guaranteed. |

|||

|

Mnemonic: LNOO24 |

Check this option to indicate that your institution uses an alternate version of the regular semi-monthly payment Frequency. See below for more information.

|

|||

Payment Due One Frequency

Mnemonic: LNPD1F |

Use this option if your institution wants to restrict the Due Date from rolling more than one frequency in the future from the date of the payment. For a future due date (LNDUDT > Today), today must be within one frequency prior to the due date in order to roll, but any past due date will roll. The system will apply any extra funds according to the payment application.

This option can be used with all payment frequencies and the following payment methods: precomputed (payment method 3), interest-bearing (payment method 6), and signature loans (payment method 16).

Note: The Entire Payment Rolls Due Date field (LNEPMT) or the Use Spread Payments field (LNSPRD) must be checked on the loan to use this feature. The Roll Due Date Within (LNDDRA) option can work with this option as well.

Example Today’s date is 07/01/2020 and the Due Date is 06/28/2020. The Next Payment Due is $100; the loan has $50 in miscellaneous fees and $35 in late fees. The Payment Application is late charges, fees, interest, then principal (4721). The borrower makes a $300 payment today.

•The Due Date rolls to 07/28/2020 only •$100 goes to Next Payment Due (P/I Constant + Reserves 1/2 Constant) •$35 goes to late fees •$50 goes to miscellaneous fees •$115 goes to principal reduction (not to Applied To Payment/Partial Payments) |

|||

|

Mnemonic: LNWIDY |

This option is available for customers who are set up to make automatic payments (on the Loans > Account Information > Payment Information screen) but who also want to make additional payments within the same frequency. See below for more information.

|