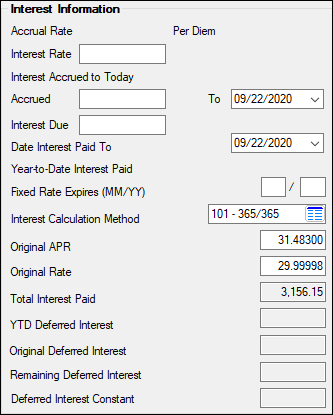

Field

|

Description

|

Accrual Rate

Mnemonic: LNAMRT

|

This field displays the interest rate to five decimal places at which interest should accrue (9.37500). This is the interest rate on ARM loans (payment method 7).

|

Per Diem

Mnemonic: ASBADIEM

|

The amount in this field is one day’s accrued interest of the principal balance plus deferred interest, or the LIP undisbursed balance for LIP loans (AKA construction loans). See below for more information.

When the payoff occurs after the payoff date, this amount will be added to the payoff amount for each day after the payoff date the payoff actually occurs. The interest calculation method used to figure the per diem amount is determined by a code in the Per Diem Code field on the Loans > Payoff screen. This field is not file maintainable.

The per diem on the screen can be rounded to two (default) or three decimal places. Institution Option POPD displays three decimal places (e.g., 29.342 as opposed to 29.34). The online payoff letter uses this option also. However, the event letters do not use this option. The GOLD EventLetters program can display the per diem either way based on how the letter is set up.

•You can insert the merge field <<PER_DIEM>> in the letter, and the system will calculate the per diem as follows:

Principal Balance (LNPBAL) + Current Interest Rate (LNRATE) / Interest Calculation Method (LNIBAS)

•Or you can include the merge field <<PO_PER_DIEM>>. This field is pulled from the Per Diem field on the Payoff screen. We suggest you use the <<PO_PER_DIEM>> merge field. See Event Letter 14 in Appendix A of the GOLD EventLetters user's manual for more information on fields available for the Payoff letter. |

|

Interest Rate

Mnemonic: LNRATE

|

This field displays the interest or payment rate to use on this loan. The information in this field is brought over during loan origination. If you have proper security, you can make changes to this field. See below for more information.

This shows the annual interest rate using five decimal places.

This field is called Payment Rate only for ARM loans (payment method 7), and for daily simple interest loans (payment methods 4 and 6) with the Use ARM Fields field checked on the Payment Detail tab. It is the rate entered or calculated at which the payment is being made. For these loans, you must enter the interest rate in the Current Rate field on the ARM Information screen for interest to be calculated on this loan. This is generally used with a Index Rate Pointer other than "255."

If the rate is changed on daily simple interest loans (payment method 5 or 6), the accrued interest is recalculated to the current date using the old rate, and the Date Last Accrued is changed to today's date.

|

Note: If the loan has reached maturity (Maturity Date), the system may advance the Maturity Rate into the Interest Rate field, and begin calculating the daily interest at the Maturity Rate. This is only for payment method 5 (line-of-credit) and 6 (interest bearing) loans. See the Maturity Information field group topic for more information.

|

If this field is changed and <Save Changes> is clicked, the system will save all other changed information on this screen but give the user a chance to opt out of (or confirm) saving changes to the Interest Rate specifically. A dialog will appear as shown below:

|

Note: For institution 158, this field cannot be changed if the loan was charged-off (General Category 82). The rate will be zero percent (or the Interest Rate field will be blank) and cannot be changed. If users attempt to change the rate from zero to something else, they will receive an error message.

|

|

|

Interest Accrued to Today

Mnemonic: BATYDINT

|

This field displays the amount of interest that has accrued through the current day since the loan was opened. This field is calculated each time the screen is accessed.

|

Interest Due/Accrued / To

Mnemonic: LNDLAC, LNACIN

|

This field is titled differently depending on the payment method code. For payment method 0 (conventional loans), it is Interest Due, meaning the interest due with the payment that is due on the next due date.

For all other payment method codes, it is Accrued. As accrued interest, it includes unpaid interest up to but not including the date last accrued. See below for more information.

This field is usually file maintained by the system, but can be adjusted by the user if necessary. The To field (LNDLAC) displays the date interest was last accrued.

|

Note: The To field (LNDLAC) cannot be set to a future date unless this screen has been accessed as part of the Loan Initialization process (from the Loans > Loan Initialization screen). See the linked help for more information.

|

Conventional Loan (Payment Method 0)

The date of last interest accrual for conventional loans should always be one payment frequency behind the Due Date. For example, if the loan Due Date is 10-01, the date last accrued should be 09-01. Interest for a payment is usually calculated from the date last accrued to the Due Date for a loan that accrues using a frequency, unless the Interest Calculation Method (below) is "101," "102," "103," "104," or "105."

Interest Bearing (Payment Method 6)

Simple-interest loans (also known as interest bearing) accrue interest from the date last accrued to, but not including, the date a payment is applied.

Precomputed Loans (Payment Method 3)

Precomputed loans accrue from the date last accrued to the next month. Such accrual is performed in batch processing only.

LIP Loans (AKA Construction Loans)

Loans with an LIP Method Code of "1" or "101" will accrue to the current date each time an LIP disbursement is made, or the LIP interest rate is changed.

A GOLDWriter report and Variable Screen mnemonic (LNACRINT) is available that will accrue loan interest either to or through today. The calculation is the same calculation used on the Payoff screen. The mnemonic uses the same institution option as for payoffs to determine if the calculation is to or through today.

|

WARNING: This mnemonic does not use the payoff record. If you have already created a payoff record in the loan payoff system and you run a report using this mnemonic, but today is not the "payoff date," the accrued interest will be different.

|

|

|

Interest Due

Mnemonic: LN20ID

|

This field only appears for Payment Method 20 (Daily Periodic) loans. This payment method has not yet been released, so documentation is not yet available.

|

Date Interest Paid To

Mnemonic: LNPDTO

|

This is the date, calculated with each payment, up to which interest has been paid on the loan. See below for more information.

This date is not used for interest calculation purposes anywhere in the GPS system, but is provided on this screen for loan servicing convenience.

The system enters this information, but the field can also be file maintained.

For conventional loans (payment methods 0 and 7), if this

doesn't stay one cycle behind the due date, the P/I Constant field could be incorrect, so the system will not let you update this field to any date other than one month behind the Due Date.

For daily simple interest loans (payment method 6), this field is calculated in the following way.

•When a payment is posted, the Date Last Accrued is changed to the Date Posted. The system then takes the amount in the Principal Balance field and multiplies it by the loan Interest Rate and divides it by the interest calculation code base (this determines the per diem). It then divides the ACCRUED INTEREST by the per diem and calculates the number of days. The number of days is subtracted from the DATE LAST ACCRUED and that becomes the DATE INTEREST PAID TO. When calculating the number of days, the system rounds up. For example, if the number of days is 14.9, then 15 days will be used.

Line-of-credit loans (payment methods 5, 9, and 10) are the same as payment method 6 except as follows:

•For periodic loans (the Interest Collected With Payment is set to Periodic on the Loans > Line-of-Credit Loans screen), the Date Interest Paid To does not change until the full payment is paid. At that time, the Date Interest Paid To will be the date of the finance charge connected to the loan Due Date.

For example, the loan has a Due Date of 8-1 and the finance charging (billing date) is done 15 days prior (7-16). When the 8-1 payment is posted, the Date Interest Paid To would become 7-16. On 8-16, the finance charging would be done for the 9-1 payment. When the 9-1 payment is posted, the Date Interest Paid To would become 9-16. (Regardless of what day a payment is posted, the Date Interest Paid To is the date the finance charge was processed.)

Note: Revolving card loans (payment method 5 with LNCARD = "Y") are only Periodic.

•For daily loans (the Interest Collected With Payment is set to Periodic on the Loans > Line-of-Credit Loans screen), the current and previous finance charges are added to the amount in Accrued Interest. The above-mentioned calculation for daily simple interest is then performed.

|

Note: This field is only an interest estimate for payment methods 5 and 6 and LIP loans. Interest rate changes or large adjustments to the principal balance will make the calculated paid-to date slightly inaccurate for the month of the adjustment. The following month the Date Interest Paid To will be recalculated using the above-mentioned calculation.

|

For payment method 0 and 7 loans only, if a loan has been sold to an investor, any time a principal decrease (tran code 510) or correction (tran code 518) is processed, the system will write to history the "date interest is paid to." This date is not changed but is written to history so that for scheduled/scheduled reporting, the system can use this date as the payment date for the curtailment.

Institution Option PIWD is available for payment method 6 loans. If this option is set, when a payment is posted (600 transaction code only), interest will only be paid in full-day increments. For example, if the per diem is $5.50, only multiples of $5.50 would be paid to interest ($5.50, $11.00, $16.50, etc.), up to the full amount of interest owed. Any remaining amount will be applied to principal. If the amount paid is less than the per diem, no interest will be paid.

The result of this option will be a more accurate Interest Paid To date.

Example:

Principal Balance

|

$3,816.10

|

Loan Interest Rate

|

30.0000%

|

Interest base (part of Interest Calculation Method)

|

365

|

Per diem

|

$3.14

|

Interest for 30 days

|

$97.34

|

P/I Constant

|

$264.00

|

A payment of $100.00 divided by the per diem of $3.14 will be 31. The per diem multiplied by 31 is $97.34. The remainder of the payment ($2.66) will be applied to the principal.

|

|

Year-to-Date Interest Paid

Mnemonic: LNYTDI

|

This is the total amount of interest that a customer has paid on this loan in the current calendar year beginning January 1. It is cleared at the end of each year. This field is maintained by the system. It cannot be file maintained by the user. This field does not include the deferred interest paid this year. For year-end reporting to the IRS, this field is added to the Year-to-Date Deferred Interest Paid field on the Statistics tab. This field also does not include LIP interest.

This field does not update if the selected customer loan account is a precomputed loan with a pre-payment penalty.

If an assumption has been processed on this loan, the Year-to-Date Interest Paid field clears to 0 and then begins tracking the interest paid by the new buyer.

|

Fixed Rate Expires (MM/YY)

Mnemonic: LNFREX

|

This field allows the loan to act like a fixed rate loan until it reaches the month and year entered in this field, at which time it becomes a floating rate loan based on the Interest Rate Pointer entered. Enter the date using MM/YY format. The fixed rate is based on the Interest Rate field above.

This field can be used with payment methods 0, 5, and 6.

|

Interest Calculation Method

Mnemonic: LNIBAS

|

This field indicates what basis to use in calculating loan interest. See below for more information. Also see Interest Calculation Method examples, as this field is very important. This field determines what number of days to use to calculate the P/I Constant. Once this field has been established through loan origination, it should not be changed, unless this information was boarded with incorrect information (user error). The method of calculating interest must be disclosed to borrowers. If you have security clearance, you can change this field if this situation (boarded with wrong Interest Calculation Method) occurs.

This code is used for all payment methods except "3," Precomputed. The possible methods are as follows:

001 - 365/365 days per year

002 - 360/360 days per year

003 - 365/360 days per year

004 - 360/365 days per year

005* - 366/366 days in a leap year

| * | Note that for a leap year, if the interest period includes two years, such as 12/15/20 to 01/15/21, the period from 12/15/20 (the leap year) to 01/15/21 will use the 366-day basis and the period from 01/15/21 to 02/15/21 will use the 365-day basis. |

The following codes are used to allow the loan's Date Interest Paid to (above) and Date Last Accrued to be other than one frequency behind the Due Date. As payments are made, the loan will simultaneously advance each of these dates one full frequency, and will not require them to stay synchronized. If these codes are not used the system will force the Date Last Accrued and Date Interest Paid to to (see above) be one full frequency behind the Due Date for loans that pay over a frequency period.

101 - 365/365 days per year

102 - 360/360 days per year

103 - 365/360 days per year

104 - 360/365 days per year

105 - 366/366 days in a leap year

For bi-weekly loans, use 01 or 101, 14 days and a 365-day year. The interest is calculated by the system as follows:

Principal Balance X Interest Rate / 365 X 14

The payment is always due on the same day of the week, such as Monday, Tuesday, etc., and not on the calendar day, such as the 1st, 2nd, etc.

The following criteria explain the interest calculations in the loan accrued interest report.

The total accrued interest for each loan is calculated using the following rules. However, if the loan is payment method 0, the system begins by taking the amount in interest due less interest for one full frequency plus the appropriate following calculation.

If the payment frequency is "01" and the date last accrued is exactly one frequency prior to the end of current month, then:

Accrued Interest = Loan Balance X Interest Rate / 12

If the payment frequency is "01" and the date last accrued is less than one month, then:

Accrued Interest = (Loan Balance X Interest Rate / 12) X Days Accrued / Days In Month

If the payment frequency is "01" and the date last accrued is greater than one month prior to the end of current month, then:

Accrued Interest = (Loan Balance X Interest Rate X # of Full Months Due / 12) + {(Loan Balance X Interest Rate / 12) X # of Days Less Than One Month / # of Days in Current Month}

If the payment frequency is not equal to "01" then:

Accrued Interest = (Loan Balance X Interest Rate X Payment Frequency / 12) X # of Full Payment Frequencies in Accrual Period + {(Loan Balance X Interest Rate X Payment Frequency / 12) X # of Days Short of One Full Frequency} / No. of Days in the Current Frequency.

If this is an ARM loan (payment method 7), the interest calculation will look at the rate change frequency and date. If the loan is in the middle of a rate change, the system will perform the interest accrual based on the old rate up to the rate change date and then use the new rate for the remaining days, in addition to the four criteria listed above for payment method 0 loans.

|

|

Original APR/Rate

Mnemonic: LNAPRO, LNORTE

|

These fields display the original annual percentage rate (APR) and interest rate of the loan.

The Original Rate does not change if the current interest rate changes. However, in the rare event that changes do need to be made to this field, you must have proper security clearance.

|

Note: To restrict Original Rate from being file maintainable, check the LNORTE - Original Rate box under Record Type CFLN (Loan Master) on the Loans > System Setup Screens > Field Level Security screen.

|

|

Total Interest Paid

Mnemonic: LNAIPD

|

If applicable, this field displays the total amount of interest paid on the account through the present date.

This field is updated by the system and cannot be edited by the user.

|

YTD Deferred Interest

Mnemonic: LNYTDD

|

This field displays the amount of deferred interest that has been paid year-to-date.

This field pertains to deferred interest on interest-bearing (payment method 6) loans. See Deferred Interest on Interest-Bearing Accounts for more information.

|

Original Deferred Interest

Mnemonic: LNODFI

|

This field displays the original amount of deferred interest. In the afterhours of the Action Code 172 date, the system totals the amount of deferred interest from the Date Opened to the Action Code 172 date and puts that amount in this field. If you have proper security, you can make changes to this field. However, the field will not be file maintainable unless you have a "5" (Deferred Interest) included with the Payment Application.

This field pertains to deferred interest on interest-bearing (payment method 6) loans. See Deferred Interest on Interest-Bearing Accounts for more information.

|

Remaining Deferred Interest

Mnemonic: LNRDFI

|

This field displays the amount of deferred interest that remains after monthly calculations. If you have proper security, you can make changes to this field. However, the field will not be file maintainable unless you have a "5" (Deferred Interest) included with the Payment Application.

This field pertains to deferred interest on interest-bearing (payment method 6) loans. See Deferred Interest on Interest-Bearing Accounts for more information.

|

Deferred Interest Constant

Mnemonic: LNDICN

|

This is a calculated field that displays the amount of payment that goes towards reducing the deferred interest each frequency. This field is calculated as follows:

Original Deferred Interest / Original Installment Number (LNOINO) = Deferred Interest Constant (LNDICN).

This field pertains to deferred interest on interest-bearing (payment method 6) loans. See Deferred Interest on Interest-Bearing Accounts for more information. If you have proper security, you can make changes to this field. However, the field will not be file maintainable unless you have a "5" (Deferred Interest) included with the Payment Application.

|