Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Late/NSF tab >

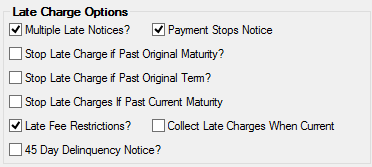

Late Charge Options field group

The following fields are found in the Late Charges Options field group on the Late NSF tab of the Loans > Account Information > Account Detail screen.

|

Note: See help for the Collect Late Charges When Current field (see below) for detailed information about collecting late charges for the current month when payments are more than one month past due.

See also Special Late Charge Assessment and Grading for information about special late charge assessment and grading. |

|---|

Late charges are usually assessed automatically by the system in the afterhours of when loan payments are late (Due Date + Grace Days). However, if the Due Date + Grace Days lands on a Saturday, Sunday, or holiday, the system may assess late charges in the afterhours of the following day, previous day, or even on that date, depending on certain institution options being set (as explained below). The account owner may have another day or two to make their payment before late charges are assessed, should certain options be set.

The three institution options that affect assessing late charges on Sundays/holidays are:

•SULT: When this option is on, the system assesses late charges before Saturdays, Sundays, and holidays. •SALT: When this option is on, the system assesses late charges on Saturday. •LTED: When this option is on, late charges are assessed everyday (even Sundays and holidays) and SULT and SALT are ignored. This is a new option as of 01/17/2021.

See Assessing Late Charges if you are not planning on setting up institution option LTED to know how SULT and SALT affect late charges. |

The fields in this field group are as follows:

Field |

Description |

|

|

Mnemonic: LNMBNT |

Check this box if late notices will be created for all multiple borrowers connected to this account (through the Customer Relationship Management > Households screen, Accounts tab, then select account owner or co-owner from the Account Ownership field). When the actual notice is created, asterisks (**) will appear in the bottom-right of the name and address section for notices created for the second, third, etc., borrowers on the loan. This will help you quickly identify when more than one notice is created for the same account.

See also help for the Payment Stops Notice field below. |

|

|

Mnemonic: LNPTST |

If this box is checked, the system looks for a checkmark in the Owner Occupied field and Collateral Code of 1 (single family - new), 2 (single family - previously occupied), 3 (single family condo - new), or 4 (single family condo - prev. occupied) on the Additional Loan Fields screen. If a payment has been posted during the month but the loan is not current, a late charge will not be assessed. If you use this field, you should not have Institution Option SLTG set, which controls the assessing of late charges on an institution-wide basis rather than a loan-by-loan basis. |

|

Stop Late Charge if Past Original Maturity/Term?

Mnemonic: LNLCPM, LNSLOT |

If Stop Late Charge if Past Original Maturity is marked, the system will look for a date in the Maturity Date field and compare it to the date the late charge is being assessed. If the original Maturity Date plus Grace Days is prior to the date the late charge is being assessed, the system will not assess a late charge. If the original Maturity Date is equal to or in the future of the date the late charge is being assessed, the system will continue to assess late charges as usual.

If Stop Late Charge if Past Original Term is marked, the night late charges are to be assessed, the system will compare the number of late charges that have been assessed to the number of months in the Original Maturity Term field (found on the Additional Loan Fields screen divided by the payment frequency. Once the number of times late reaches that calculation, no further late charges will be assessed. (If the original term of the loan was 24, with monthly payments, no more than 24 late charges will be assessed, even if the loan term is extended.)

For biweekly loans, the calculation is the original maturity term times 26 divided by 12. |

|

Stop Late Charges if Past Current Maturity

Mnemonic: MLSLCM |

Check this box to stop late charges once the loan reaches the current maturity date, not at the original maturity date. This field is transferred from GOLDTrak PC.

If this is selected, the system will look for a date in the Maturity Date field and compare it to the date the late charge is being assessed. If the maturity date plus Grace Days is prior to the date the late charge is being assessed, the system will not assess a late charge. If the Maturity Date is equal to or in the future of the date the late charge is being assessed, the system will continue to assess late charges as usual. |

|

|

Mnemonic: MRLTFR |

If this field is checked, then at the time a late charge would be assessed, the program checks to see if a full payment (payment collected equals the P/I Constant) has been made this month within the grace period (Due Date + Grace Days). If a full payment has been made within the grace period, then no late charge will be assessed for the month, regardless of which payment is being applied.

Example:

Loan is due for 08/16.

The use of this option is state regulated. |

|

Collect Late Charges When Current

Mnemonic: LNLTCC |

Check this box to indicate to the system that all payments made to delinquent accounts between the due date and grace days period for the current month will keep that account from assessing a late charge for the current month (see Example 1 below). See below for more information.

|

|

|

Mnemonic: LN45DY |

Use this field to indicate whether your institution wants 45-day delinquency notices to process on the customer loan account. See the Notice 1, 2, 3, Type/Day details for more information. |

See also: