Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Statistics tab > Average Balances tab >

Year-to-date Information field group

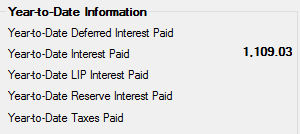

The fields in the Year-to-Date Information field group on the Average Balances tab display interest and taxes paid for the year for this loan account.

The following definitions explain each of the fields in this field group:

Field |

Description |

||

|---|---|---|---|

Year-to-Date Deferred Interest Paid

Mnemonic: LNYTDD |

Deferred interest is the total of unpaid interest that has been added to the principal balance of the loan. This field displays the total amount of deferred interest added to the loan year-to-date. This field is not file maintainable. |

||

|

Mnemonic: LNYTDI |

This is the total amount of interest that a customer has paid on this loan in the current calendar year beginning January 1. It is cleared at the end of each year. This field is maintained by the system. It cannot be file maintained by the user. This field does not include the deferred interest paid this year. For year-end reporting to the IRS, this field is added to the Year-to-Date Deferred Interest Paid field on the Statistics tab. This field also does not include LIP interest.

If an assumption has been processed on this loan, the Year-to-Date Interest Paid field clears to 0 and then begins tracking the interest paid by the new buyer.

This field also appears on the Interest Detail tab of the Loans > Account Information > Account Detail screen. |

||

Year-to-Date LIP Interest Paid

Mnemonic: LNLYTD |

This field contains the amount of interest that has been charged to this LIP or paid by the borrower during this calendar year. The system will update this field each time interest is paid. The field goes to zero at year-end.

Interest must be posted from a 600 transaction code (regular payment). If you post using a 510 (field credit), it will not update the LIP year-to-date interest paid, but will update the Year-to-Date Interest Paid (above). (The history specifically indicates "LIP interest" if the transaction is posted correctly.)

This field does not update if the selected customer loan account is a precomputed loan with a pre-payment penalty.

|

||

Year-to-Date Reserve Interest Paid

Mnemonic: LNYTDR |

This field contains the year-to-date interest paid to reserves (transaction 610 or 620). At year-end, the field resets to zero. This field is not file maintainable. |

||

|

Mnemonic: LNYTDT |

This is the total amount of taxes paid during the year. This is a calculated field that includes all reserve payments made from this account's reserves to taxes for the current year. This is the total amount of tax paid by the customer on the loan in the current calendar year beginning January 1. It is cleared at the end of each year. Any teller transaction that pays taxes will update this field. You can only change data in this field by request to GOLDPoint Systems. |