Navigation: Loans > Loan Screens > Marketing and Collections Screen > Delinquent Payments tab > Miscellaneous Fees list view >

This topic discusses the following:

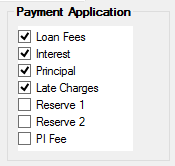

Before you can assess fees, you must first decide which fees your institution wants to use. If you have the proper security, you can assign fees to be used from the Loans > System Setup Screens > Client Code Setup > Miscellaneous Fee Codes screen. Fee codes are defined by GOLDPoint Systems. Fee codes, descriptions, and TORCs can be seen on that screen's help page.

Your General Ledger Autopost must also be set up so when fees are paid, the payments are filtered to the correct General Ledger account. See General Ledger Autopost Setup in the Miscellaneous Fees topic for more information.

|

Institution option OP06-XFEE must be set in order to allow miscellaneous fee processing. Institution option FEEO allows the institution to determine which fees are given priority when paying fees. See Paying Fees below for more information on this option. The loan Payment Application code must include Loan Fees. See the Paying Fees below for more information. Institution option GAP6 is used by the Autopost to designate that Loan Amount fields L-123 and L-223 be used with every L-23 transaction. (See General Ledger Amount Fields section in the Autopost Parameters Screen under Financials > GOLD Services in CIM GOLD > General Ledger screen group on DocsOnWeb.) Institution option GLLN requires a 27 (Miscellaneous Fee Code). (See General Ledger Posting Fields under Financials > GOLD Services in CIM GOLD > General Ledger screen group on DocsOnWeb.) |

You can assess miscellaneous fees one of two ways:

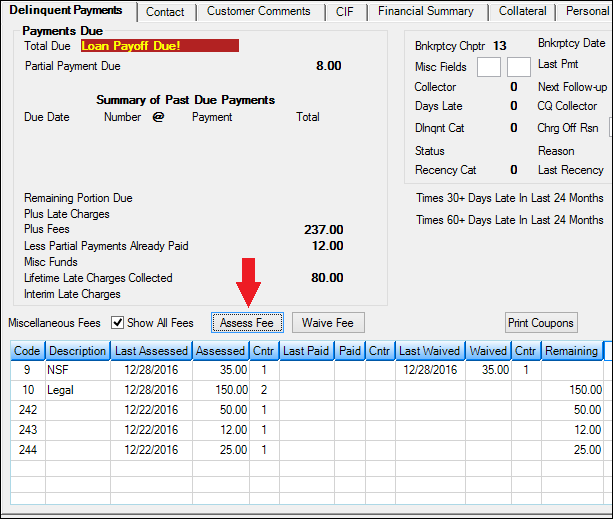

Through CIM GOLD, access the Loans > Marketing and Collections screen > Delinquent Payments tab, then complete the following steps:

1.Click

Loans > Marketing and Collections Screen (<Assess Fee> button)

The following dialog box is displayed.

2.Click the

3.Double-click the fee code you want to assess to this account, and you are returned to the Assess Misc Fee dialog box and that fee code appears in the Misc Fee Codes field. Also, the Amount field will be editable.

4.Enter the amount you want to charge to this account for the miscellaneous fee in the Amount field.

5.Click <OK>. The system will assess the fee and the applicable fee record will appear in the Miscellaneous Fees list view.

|

You can also assess fees through CIM GOLDTeller by entering a fee code and amount in the Assess Loan Fee transaction (tran code 660), as shown below:

This is a journal transaction that adds the amount of the transaction to the total fees (LNFEES) on the loan. Only one fee can be assessed with each transaction.

After this transaction is run, the system creates or updates the fee record (see Miscellaneous Fees list view) and adds the transaction amount to the amount assessed. The date last assessed is set to the transaction date and the assessed counter is incremented by one (see example below).

Correcting an assessed fee subtracts the amount from the total fees. The system subtracts the amount from the amount assessed in the fee record for the fee code, the date last assessed is set back to its previous value, and the counter is decremented by one. Only one fee can be corrected with each correction transaction.

See the Assess Fee transaction in the Transactions Manual for more information. |

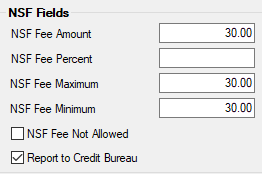

Loan fees can be paid a number of ways. The most common way account owners will pay fees is through their regular loan payment. Loan Fees must be a selection on the Payment Application field. If it's in the first order, funds for loan payments will go first toward paying off any miscellaneous fees before any additional funds are applied toward interest, principal, or late charges, as shown below:

Using the example above, if a loan payment was made for $100 and outstanding loan fees totaled $30, then $30 of the payment would first go toward loan fees, and then the remaining $70 would go toward interest and principal (and if there are still some remaining funds, the rest will go to late charges).

History is read and used when correcting a loan payment. This will reverse all the processing that took place with the payment transaction.

Accounts that pay fees first are skipped in the afterhours processing that makes payments from the amount in the Applied to Payment field if fees are owed. This is necessary to preserve the order dictated by the institution options that affect the Applied to Payment field. See the Applied to Payment field help, as well as the Partial Payments Options for more information on this afterhours function.

Sometimes accounts have more than one fee added to the account. In those situations, an institution option dictates the priority in which the fees are paid. The Fee Order of Processing option (FEEO) contains up to 12 fee codes. GOLDPoint Systems can enter the codes for the fees that you want to be given priority. They are entered in the order of priority with the first code having the highest priority. Only codes that require priority processing need to be entered in this option. All other codes will be processed in code number order.

Manually Paying Fees

You can also manually pay loan fees through CIM GOLDTeller or the Loans > Transactions > EZPay screen.

To pay fees in CIM GOLDTeller, you can use either transaction 850 or transaction 2850. We suggest you use 2850. See transactions 850 and 2850 in the Transactions manual for more information. See the following example of tran code 2850:

Once either of those transactions is run, the system subtracts the amount of the transaction from the total fees (LNFEES) on the loan. The system updates the fee record for the code by adding the transaction amount to the amount paid. The Date Last Paid is set to the transaction date and the Paid counter (on the Miscellaneous Fees list view) is incremented by one. |

You can also pay fees directly from the Loans > Transactions > EZPay screen. To pay fees from this screen, borrowers can be charged an additional processing fee in addition to the fees they are paying if certain options are set up. See Fees in the EZPay help for detailed information concerning this transaction. |

Loan fees can be waived either through CIM GOLDTeller or CIM GOLD.

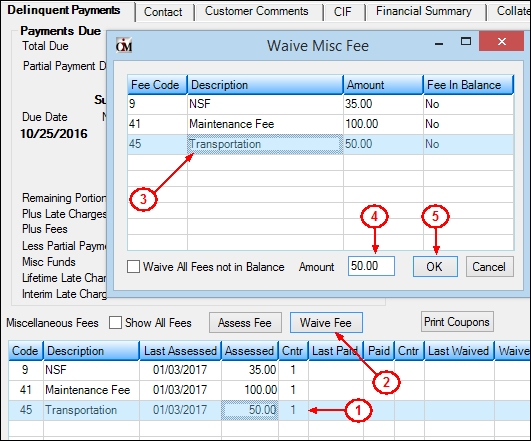

CIM GOLD: The simplest way to waive fees is to access the Marketing and Collections screen > Delinquent Payments tab and complete the following steps:

1.Select the fee you want to waive in the Miscellaneous Fees list view.

2.Click ![]() . The Waive Misc Fee dialog box is displayed.

. The Waive Misc Fee dialog box is displayed.

3.Select the fee you want to waive from the dialog box. If you want to waive all the fees, check the Waive All Fees not in Balance box.

4.Enter the amount of the fee to waive in the Amount field. You can waive all or some of the fee.

5.Click <OK>. These steps are illustrated below:

|

Note: You must first enter your teller number, which you can easily do by accessing the Miscellaneous > Teller Number screen and enter your teller number. |

|---|

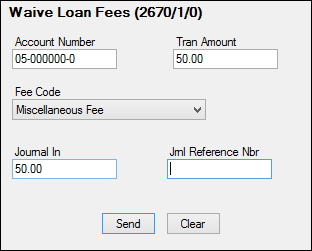

CIM GOLDTeller: To waive fees from CIM GOLDTeller, enter a fee code and amount in the Waive Loan Fee transaction (tran code 2670-01). This is a journal transaction that subtracts the amount of the transaction from the total fees (LNFEES) on the loan, as shown below:

See the Waive Loan Fees transaction in the Transactions manual for more information.

After fees are waived, the system updates the fee record for the code provided by adding the transaction amount to the amount waived. The date last waived is set to the transaction date and the Waive counter on the Miscellaneous Fees list view is incremented by one.

Correcting a waived fee adds the amount to the total fees. Then the system subtracts the amount waived in the fee record for the fee code, the date last waived is set back to its previous value, and the fee counter is decremented by one.

See also: