Column

|

Description

|

Year and Prepaid

|

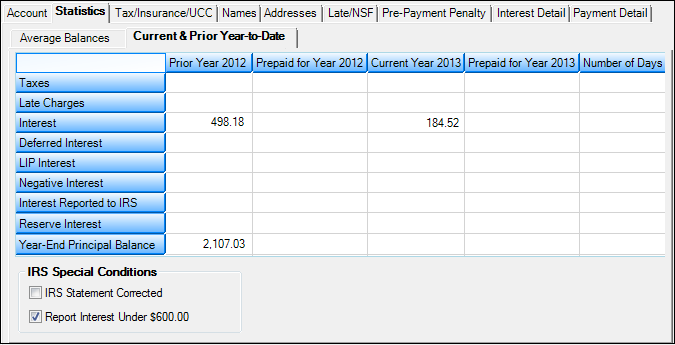

These columns show prior, current, and prepaid information for a two-year period. At year-end, the current year’s information becomes blank, the year and its information move to the left, and a new year appears.

Prior Year — This is calculated during the year-end process by reading history and the prepaid fields. The calculated amount is then placed in the prior year or prepaid columns. The prepaid amount will then be added to or subtracted from the next year’s totals.

Current Year - Some information, such as taxes and interest, is pulled from fields on other loan screens. However, other fields, such as Late Charges, are always blank for the current year. During the year-end process, the Current fields are all cleared.

Example: In December 2009, the borrower pays the 12/01/2009, 01/01/2010, and 02/01/2010 payments. Interest is paid in arrears so the 02/01/2010 interest paid cannot be deducted in 2009 and that amount is stored in the Prepaid for Year 2010 column. In December 2010, the borrower pays the 12/01/10, 01/01/11, and 02/01/11 payments.

During the 2010 year-end process, the interest portion of prepayments paid in 2009 for 2010 will be added to the 2010 interest reported to the IRS. In addition, the interest portion of prepayments paid in 2010 for 2011 will be subtracted from the interest reported to the IRS.

|

Number of Days

|

This shows the actual number of days the interest is prepaid for. See the Prepaid Interest Information section.

|

WARNING: If the loan is paid more than one year ahead, the Number of Days column will include the number of days for all years combined. However, the Prepaid for Year column only calculates the amount for one year. Anything over 365 indicates the loan is prepaid more than one year. The interest reported to the IRS will be correct for the year it was paid in and the next year. However, interest paid beyond one year will not be correct for IRS reporting for years prepaid beyond one year. You will need to manually make IRS corrections in the IRS system for those years. See the Prepaid Interest Information section for an example.

|

|

Row

|

Description

|

Taxes

(LNPYTT, LNYTDT)

|

This is the total amount of taxes paid during the year.

Prior Year-As part of the year-end process, taxes are recalculated by reading history and that amount is placed here. There will never be amounts in the Prepaid for Year columns (see NOTE above).

Current Year-During the year, this field displays the Year-to-Date Taxes Paid field from the Average Balances tab. However, at year-end the field is zeroed out.

|

Late Charges

(LNYLTL, LNYLTC)

|

This is the total amount of late charges paid minus any fees assessed.

Prior Year-This is calculated at year-end by reading history (see NOTE at beginning of this section). However, as miscellaneous fees are included as late charges, in order to not include fees as late charges, the following calculation is performed.

1.When history is read, all fees assessed via transaction code 660 are added. 2.All late charges paid are added. 3.The assessed fees for the year are subtracted from the late charges paid during the year. 4.The remainder of step 3 is the amount of late charges reported as interest to the IRS.

This process makes the assumption that fees assessed are paid prior to late charges.

Current Year-There will never be an amount here.

By using Institution Option IRSL, late charges can be added to the Interest Reported to IRS row (explained below).

|

Interest

(LNPYTD, LNYTDI, LNYITN)

|

This is the total amount of interest paid during the year. It includes the subsidy portion and any prepaid interest paid during the year. It does not include LIP interest or deferred interest paid.

Prior Year-As part of the year-end process, interest is recalculated by reading history and that amount is placed here (see NOTE section at the beginning of this help).

Current Year-During the year, this field displays the Year-to-Date Interest Paid field. However, at year-end the field is zeroed out.

Prepaid For Year-If the loan was prepaid at year-end, the amount of the prepaid interest is stored in the current year’s Prepaid for Year column. That amount will be added to the current year’s interest paid. See the Year and Prepaid column description.

|

Deferred Interest

(LNYDTN, LNYITL, LNYTDD)

|

This is the total amount of deferred interest paid within each year. This amount will be included in the Interest Reported to IRS row (explained below).

Prior Year-This field is calculated at year-end by reading history.

Current Year-During the year, this field displays the Year-to-Date Deferred Interest Paid field. However, at year-end, this field is zeroed out.

|

LIP Interest

(LNLYTL, LNLYTD)

|

This is the total amount of LIP interest paid within each year. This amount will be added to the Interest Reported to IRS field (see NOTE section at the beginning of this help) if Institution Option RLIP has been set.

Prior Year-As part of the year-end process, LIP interest is recalculated, by reading history, and that amount is placed here.

Current Year-During the current year, this field displays the Year-to-Date LIP Interest Paid field. However, at year-end, the field is zeroed out.

|

Note: LIP interest is different than loan interest. If a loan had an LIP method code of 1 or 101 when payments were posted, it is identified as "LIP interest."

|

|

Negative Interest

|

This is the total amount of interest paid on negative reserves during the year, if your institution pays interest on negative reserves. See Appendix F, Interest on Negative Reserves, in the Loan manual on DocsOnWeb.

Prior Year-As part of the year-end process, the Interest Paid field for negative reserves will clear to zero. The amount will then be stored in this field.

Current Year-There will never be an amount here.

|

Interest Reported to IRS

(LNRIRS)

|

This field holds the total amount of interest paid by the customer and reported to the IRS for the previous year.

|

Note: If the loan was assumed in the prior year and there was pro-rated interest, the amount in the prior’s Interest and Interest Reported to IRS fields will be different by the pro-rated interest. The pro-rated interest could be added to or subtracted from the year-to-date interest.

|

Only loans with specific general categories and/or collateral codes are reported to the IRS. (Refer to year-end documentation.) However, if you want a loan reported that would not normally be reported, use hold code 44. This hold code will report the interest to the IRS regardless of the general category or collateral code. If the interest is less than $600, the system will check the value in the Report Interest Under $600.00 field to determine whether to report the interest.

LIP Interest

Institution Option RLIP must be enabled before year-end in order for LIP interest to be reported to the IRS.

Prior-This field is calculated at year-end by reading history and prepaid fields. Prepaid interest paid last year for this year is added to the Interest field, while prepaid interest paid this year for next year is subtracted from the Interest field. See the Prepaid Interest Information section. This field includes LIP interest, deferred interest paid, and prepaid interest. Late charges are included as interest if your institution is using that option (see Late Charges row description above). If the amount is less than $600, see the Report Interest Under $600.00 field.

Current-There will never be an amount here.

|

Note: To include reserve disbursements from Reserve 2 with a Disbursement Code 1 (other charges) as "interest reported to the IRS," Institution Option RCSF must be enabled. This is only reported at year-end and is not included in the YTD amount during the year.

|

|

Reserve Interest

(LNPYTR, LNYTDR)

|

This field holds the total amount of all interest paid by your institution to the reserve account.

Prior Year-This field is calculated at year-end by reading history (see NOTE at beginning of section). Interest can be posted at monthend, quarterly, and at year-end. In addition, as loans are paid off or are service released during the year, interest is accrued and posted at that time.

Current Year-There will never be an amount here.

|

Year-End Principal Balance

(LNYEPB)

|

This field displays the year-end principal balance. It is entered by the system and cannot be file maintained.

|

Note: To include reserve disbursements from Reserve 2 with a Disbursement Code 1 (other charges) as "interest reported to the IRS," Institution Option RCSF must be enabled. This is only reported at year-end and is not included in the YTD amount during the year.

|

|

|