Navigation: Loans > Loan Screens > Transactions Screen Group >

The purpose of the Loans > Transactions > Charge-off Transactions screen is twofold:

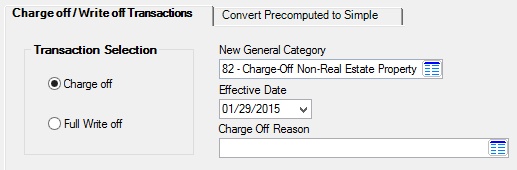

1.To charge off loans or fully write off loans that are now considered bad loans.

2.To convert precomputed loans to daily simple interest loans using the Convert Precomputed to Simple tab.

Loans > Transactions > Charge Off Transactions Screen

|

Note: If an ACH payment return is received with a return code other than R01 (insufficient funds) or R09 (uncollected funds) and Institution Option ACFR is set (e.g., R02-bank account closed, R03-no bank account, R04-invalid bank account number), the system will automatically charge off the loan (transaction 2022-01) as well as stop all future one-time and recurring payments on the account. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |

Security access to this screen should only be given to supervisors, managers, or those with authority to make decisions about charging/writing off loans. Field-level security can be used to prevent use of this screen by selecting either FSDACO - Dont Allow Chrg Off (for charge-offs) or FSDAWO - Dont Allow Write Off (for write-offs) underneath the "FPFS - Miscellaneous Function Security" Record Type on the Loans > System Setup Screens > Field Level Security screen. |

See also on DocsOnWeb:

Charge-off transaction (tran code 2022-01)

Full Write-Off transaction (tran code 2510-05)

|

Record Identification: The fields on this screen are stored in the FPLN record (Loan Master). You can run reports for this record through GOLDMiner or GOLDWriter. See FPLN in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|