Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Late/NSF tab >

Late Charges field group

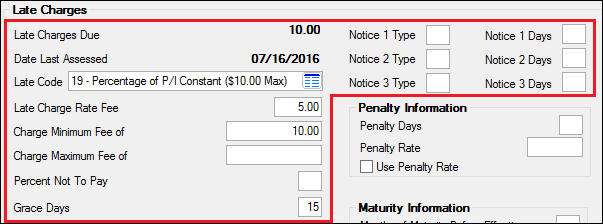

The following fields are found in the Late Charges field group on the Late NSF tab of the Loans > Account Information > Account Detail screen.

|

Note: See help for the Collect Late Charges When Current field for detailed information about collecting late charges for the current month when payments are more than one month past due.

See also Special Late Charge Assessment and Grading for information about special late charge assessment and grading. |

|---|

The fields in this field group are as follows:

Field |

Description |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: LNLATE |

This field will contain the total amount of late charges due, if any, on this loan.

If a Waive Late Charge transaction (tran code 570) is used to reverse late charges, the amount in this field is removed. If a payment is backdated prior to the late charge assessment date and Institution Option WVLC is enabled, the late charge will be automatically waived.

There are three institution options that may affect assessing late charges on Sundays:

•SULT: When this option is on, the system assesses late charges before Saturdays, Sundays, and holidays. •SALT: When this option is on, the system assesses late charges on Saturday. •LTED: When this option is on, late charges are assessed everyday and SULT and SALT are ignored. This is a new option as of 01/17/2021.

See the table below if you are not planning on setting up institution option LTED to know how SULT and SALT affect late charges.

See help for the Collect Late Charges When Current field for detailed information about collecting late charges for the current month when payments are more than one month past due. See also Special Late Charge Assessment and Grading for information about special late charge assessment and grading. |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: LNLTDT |

This field indicates the most recent date late charges were assessed on the customer account. This is an important field the system uses to help determine whether a late charge should be assessed on the account the next time the payment is late (Due Date + Grace Days). Usually, if a late charge has never been assessed on the account, this date reflects the date the loan was opened or funded. However, if you acquire loans, it could be the date the loan was acquired, or it could be the last date of late charge assessment when the loan was being serviced by a different institution.

If a late charge is waived (tran code 570) or reversed (tran code 568), the date remains. If a payment is backdated prior to the late charge assessment date and Institution Option WVLC is enabled, the late charge will be automatically waived.

This field can be added to reports using mnemonic LNLTDT. It is also a basic loan merge field you can add to letters to your customers generated from GOLD EventLetters. See the GOLD EventLetter's User's Guide for more information on how to set up event letters that are sent to customers when specific events occur on customers' accounts.

Note: Event 51, Late Charge Assessment, is available that you can use to send letters to your customers informing them that a late charge has been assessed to their account. See Event 51, Late Charge Assessment, in the GOLD EventLetters manual for more information.

Also see: Notice 1, 2, 3, Type/Days details. |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: LNLTCD |

See Late Code details for more information. |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: LNLTRT |

The late rate is a percentage rate to two decimal points that is used with the Late Code in calculating late charges. If the Late Code field is 15 or 20, this field will be called Late Charge Flat Fee, in which case you would enter a dollar amount to charge as the late fee. This field must be completed for a late charge to work. This is a user-entered field and is file maintainable.

When this field is used as a percentage to calculate the late charge, be aware that the decimal shifts in calculating. For example, if you entered ".35" the system will shift the decimal two more places to the left, so it will actually be .0035 in the calculation. But if you enter "35.00," the system will calculate the percentage using .35.

For example: If we want to charge 35 percent of the daily portion of P/I Constant (Late Code 31), we should enter "35.00" in this field. Then the system will calculate the amount like so:

P/I Constant / 30 X Late Charge Rate Fee X Number of Days Late = Late Charges Due

100 / 30 X .35 X 30 = $35

Had we entered ".35" in this field, the outcome would have been this:

100 / 30 X .0035 X 30 = $0.35

See help for the Collect Late Charges When Current field for detailed information about collecting late charges for the current month when payments are more than one month past due. See also Special Late Charge Assessment and Grading for information about special late charge assessment and grading. |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: LNLTMN, LNLTMX |

These fields display the minimum and maximum amounts that can be assessed in late charges at one time on the loan. These fields are only valid when used with late charge codes 1 (percentage of P/I payment), 2 (percentage of P/I constant), 4 (percentage of 1/12 of principal balance), 12 (percentage of principal balance), 21 (percentage of unpaid portion), 23 (percentage of unpaid portion), 24 (percentage of original P/I), 25 (percentage of unpaid portion or P/I), 26 (charge a flat fee, with minimum and maximum), and 31 (Daily Portion of PI). If you have the proper security, you can change the amounts in these fields.

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: MRGRCP |

Use this field to indicate a percentage value. If this indicated percentage of the current payment due amount is paid, a late charge will not be assessed on the customer account. For example, if your Institution does not add a late charge to the account when a borrower pays 80% or more of the current payment amount due, place the number 80 in this field. If the customer's payment is less than 80% of the payment due, the system will apply a late charge on the account. |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: LNLTGR |

This field contains the number of days allowed after the Due Date and before a payment is made before a late charge is assessed. The late charge will be assessed on this number of days plus the Due Date.

Please be aware that if the Due Date + Grace Days lands on a Saturday, Sunday, or holiday, institution options may affect when the system assesses late charges. See Institution Option SALT and SULT above for details.

Note: Bi-weekly loans should have less than 14 grace days.)

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: LNLTP1, LNLTP2, LNLTP3 |

See Notice 1, 2, 3 Type/Days details for more information. |

|||||||||||||||||||||||||||||||||||||||||||||||

See also: