Navigation: Loans > Loan Screens >

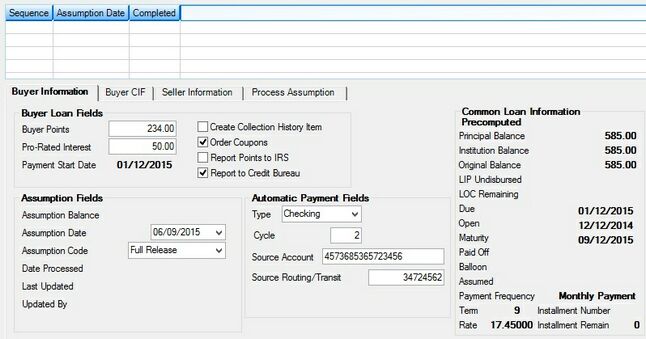

Use this screen to automate the process of a buyer assuming a loan. This information can be entered and stored on this screen until it is added to the loan record (or after the assumption takes place). A simple procedure is used to integrate this information into the Loans and CIF systems in CIM GOLD.

The list view at the top of this screen displays basic information about all loan assumptions that have been set up for the customer loan account. Select an assumption item in this list view in order to edit that assumption's information in the fields on this screen. If a previously created assumption item is edited, the assumption must be processed again to update the changes. Click <Create New> to create a new loan assumption record. An assumption cannot be deleted once it has been processed. See the Process Assumption tab for more information.

Loans > Loan Assumption Screen

|

WARNING: Buyer Information must be set up before entering information on any other tabs on this screen. |

|---|

If the buyer currently has an open account at your institution, the CIF information associated with the buyer needs to be looked up via the Buyer CIF tab. If the buyer is not a previous customer, a household number must be set up for the buyer using either the Customer Relationship Management > Customer Profile or Households screen. Each customer must have a household number.

Once the customer has been set up with a household number in CIF, use the Buyer CIF tab to tie the household number to a loan assumption record.

The fields that appear at the bottom of this screen (regardless of which tab is selected) indicate whether an assumption record has been Created for the customer loan account (assumption records are created when <Create New> is clicked on the Buyer Information tab, information is entered in the fields on this screen, and <Save Changes> is clicked) and whether assumption processing has been Completed for the loan being assumed (see Process Assumption for more information).

The Collateral Summary field at the bottom of this screen displays a brief description of the collateral (if any) used to secure the loan account being assumed by the buyer. Collateral information is entered on the Loans > Collateral Detail screen.

The tabs on this screen are as follows:

|

Record Identification: The fields on this screen are stored in the FPLN record (Loan Master). You can run reports for this record through GOLDMiner or GOLDWriter. See FPLN in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |