Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Account tab > Payment and Classification field group >

Partial Payment Options

How the system handles partial payments (the amount in the Partial Payment/Applied to Payment field) varies according to options set up for your institution. The following information can help you understand how the system applies partial payments for your institution.

Update Function 84

For Partial Payments to be automatically updated by the system, Afterhours Update Function 84 must be set up. When this option is set up, the system will automatically debit the Partial Payment field and post a loan payment (if the Partial Payment field has enough funds to post a payment). It can be run daily, weekly, or monthly.

When using this update function, the loan must meet the following conditions:

| 1. | The loan must be a payment method 0 or 7. |

| 2. | The loan cannot have any holds that cannot be overridden. (For instance, the loan cannot have a hold code 7--legal hold/foreclosure.) |

| 3. | The loan cannot be “locked in” for a payoff or payment reversal. |

| 4. | There must be enough funds in the Partial Payment field to post at least a full payment. |

| 5. | The due date can be in the past, in the current month, or one month in the future. (Refer to option OPPP PPPA below.) |

This process functions as follows:

With update function 84 set, but none of the institution options set (see below), during the afterhours process, the system will compare the loan payment (P/I plus reserve 1 and/or 2) with the amount in Partial Payment. If there is enough money in Partial Payment to post a full payment, it will post a loan payment (tran code 600) and then debit the Partial Payment field by the amount of the payment.

|

WARNING: The process of automatically moving Partial Payment funds to a payment transaction when the Partial Payment field reaches a full payment amount requires the Due Date to be equal to or later than the date Update Function 84 runs, even when the institution options explained below are set. |

|---|

Options

Three institution options pertaining to paying late charges and miscellaneous fees, allowing the loan to be paid “in the future,” and processing excess funds as a curtailment are also available. They are as follows:

OPPP PPLF—Partial Payments–Pay Late Charge/Fees?

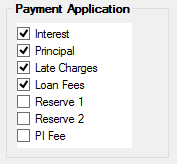

After the loan is brought current by posting payments, any excess funds will post next to late charges and last to fees. (Current means the due date is greater than or equal to today (the run date).) This is assuming the Payment Application field has Principal and Interest first, then Late Charges, then Loan Fees, as shown below:

OPPP PPPA—Partial Payments–Pay Ahead?

If the Partial Payment amount is enough to post two or more payments, the system will post as many payments (P/I Constant) as there are funds available and roll the Due Date for each of those payments. If this option is not set, additional funds gained once the account is caught up (Due Date is in the future) will reduce the Principal Balance or remain in Partial Payments (depending on if option PPPC is set, see below).

For example, a borrower is behind one payment. A collector calls the borrower, and the borrower makes a payment large enough to cover three payments. The collector should run a tran code 510-33 (Partial Payments Increase) for the full amount of the payment (all three payments). In the afterhours, the system will roll the Due Date three times, bringing the borrower current and ahead by two months. If this option were not set in this example, the system would apply one payment (P/I Constant), roll the Due Date once to keep the account current, and leave the remaining amount in Partial Payments or pay down the Principal Balance (if PPPC is set, see below).

OPPP PPPC—Partial Payments–Pay Curtailment?

After paying all full payments (and fees and late charges if the appropriate options are set), the system will post any excess funds as a principal decrease (only on loans not sold to an investor (Percent Sold equal to zero)). After bringing the loan current, paying the late charges and fees (according to the option), and paying the loan ahead (according to the option), any remaining funds will be posted to pay down the principal. (Current means the due date is greater than or equal to the run date.) This option is only available for mortgage loans. See tran code 2510-04, Curtailment from Partial Payment, in the Transactions manual for more information.

|

Note: None of the options will function without Partial Payments being equal to or greater than the Next Payment Due. Any or all of the options can be set. |

|---|

All transactions are posted with an SOV (supervisor override) and as a TORC 61 (partial payments). They are identified in loan history as a payment from partial payments except the loan fees.

All transactions will appear on the Transaction Journal by Tran Origination Code Report (FPSRP041). Any transactions that fail will appear on the Afterhours Processing Exceptions Listing (FPSRP013). A failure of one these transactions may require a manual debit to partial payments.

The Partial Payments Report (FPSRP198) shows all loans that have funds in Partial Payment/Applied to Payment.

|

WARNING: Prior to using this feature, contact your GOLDPoint Systems financial team as your Autopost may need to be adjusted for TORC 61. |

|---|