Navigation: Loans > Loan Screens > Account Information Screen Group >

The Loans > Account Information > Precomputed Loans screen is used to view loan information for payment method 3 loans, formerly referred to as “Rule of 78s.” Precomputed loans are structured with a standard amortization table, such that the total interest is usually determined before the loan is funded. This total interest is added to the loan amount, and payments are applied to the combined balance.

Much of the information on this screen is for research purposes only. Information is populated when the loan is boarded and funded through loan origination software. Generally, you should not make changes to the information on this screen. However, if you have security clearance, some field information can be changed. Use caution when making changes, as this will affect the loan agreement.

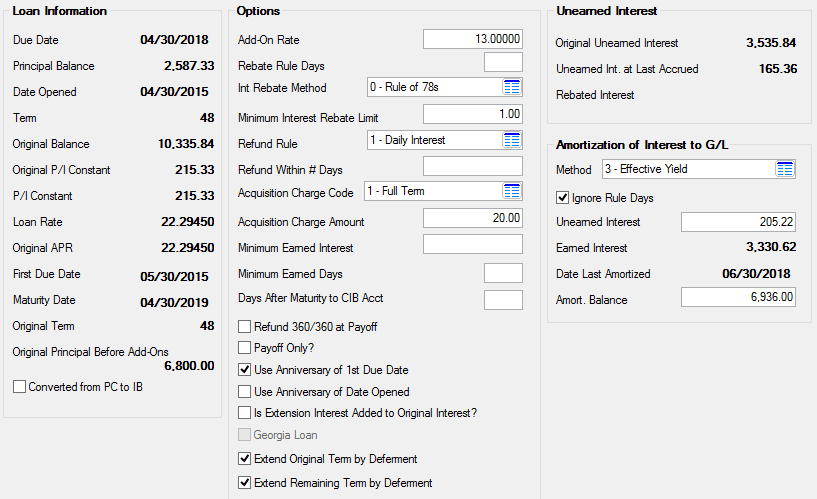

See the following example of this screen:

Loans > Account Information > Precomputed Loans Screen

Converting Precomputed Loans to Daily Simple Interest

You can convert a precomputed loan to a daily simple interest loan (payment method 6) from three different places in CIM GOLD: |

||

1. By clicking <Run PC2IB Transaction> from the Loans > Transactions > CP2 screen on the CP2 tab. |

||

2. You can also use the Loans > Transactions > Charge Off Transactions screen, Convert Precomputed to Simple tab. |

||

3. From the Loans > Account Adjustment screen, then click <Convert to Interest Bearing>. |

||

|

The following field groups are on this screen:

•Amortization of Interest to G/L

|

Record Identification: The fields on this screen are stored in the FPLN records (Loan Master). You can run reports for this record through GOLDMiner or GOLDWriter. See FPLN in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |