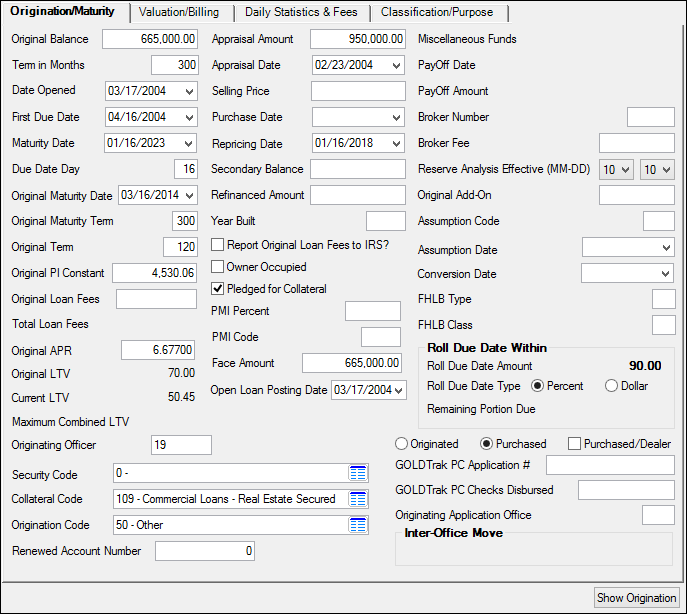

Field

|

Description

|

Original Balance/Term in Months

Mnemonic: LNOBAL, LNTERM

|

•The Original Balance field contains the original amount of the loan, which is used to calculate the Original LTV field below. On loans with precomputed interest (payment method 3), this amount will include the loan principal plus the add-on amounts. This field is originally entered during loan origination (either through GOLDTrak or GOLDTeller).

•The Term in Months field contains the term of the loan in months. It is used in calculating rebates on loans with precomputed interest (payment method 3), and in determining the remaining term of ARM (payment method 7) loans. Generally, you cannot make changes to this field. The information is transferred over when the loan is originated. However, if you have proper security clearance, you can update this field.

|

Note: If Term in Months is file maintained manually by an employee, the account may be flagged with Special Comment Code "CO" (loan modified) during monthend credit reporting. See the Special Comment Code field on the Loans > Credit Reporting screen for more information.

|

|

WARNING: Term in Months is used to calculate payments and should reflect the number of calendar months over which the loan is being amortized. This is not always the same number as the maturity date of a loan.

|

|

Date Opened/First Due Date

Mnemonic: LNOPND, LN1DUE

|

•The Date Opened field displays, in MMDDYY format, the date the loan was opened or funded. See below for more information.

Date Opened details Date Opened details

The system automatically supplies this information when a new loan (tran code 680) is opened through CIM GOLDTeller, GOLDTrak, eGOLDTrak, or boarded over from a third-party origination system. For loans with precomputed interest (payment method 3), this field is one of the keys for calculating rebates of unearned precomputed interest.

When performing the open loan transaction, if there is a date in the Date Opened field (send over from GOLDTrak, eGOLDTrak, or a third-party loan origination software), the date will not be changed. If the Date Opened field is blank (which usually doesn't happen), then the following will occur:

1.If the transaction is not backdated, today's date is defaulted into the field.

2.If the transaction is backdated to a date in the current month, the backdated date is defaulted into the field.

3.If the transaction is backdated into a prior month, the first day of the current month is defaulted into the field. This is done so the loan will appear on new loan reports and regulatory reports for the current month. (If you backdate transactions to a prior month, the loan will not appear on the prior month reports because they will already have been processed.) |

•The First Due Date field displays the first payment due date on the loan in MMDDYY format. This is a critical field that is used by numerous afterhours reports. Coupons and bill/receipt statements use this date to determine the first coupon/billing. For line-of-credit loans (payment method 5), if the First Due Date is not known, the date the loan was opened will be entered, so the field will not be blank. (A bill/receipt will not be created until there is a principal advance. The statement will be created on the next coupon/bill cycle after the advance.) |

Maturity Date/Due Date Day

Mnemonic: LNMATD, LNDUDY

|

•The Maturity Date field displays the date the last payment is due on the customer loan account (and the date the loan should be paid off). See below for more information.

Maturity Date details Maturity Date details

All loans must have a designated maturity date except payment methods 5 (revolving line-of-credit) and 8 (rental accounts), otherwise payments cannot be posted.

Institution Option CZLB automatically closes zero balance payment method 5 loans. At the time the loan is closed, the payoff date is also updated. The "close" transaction is a file maintenance tran code 22 to field 999. The loan will automatically close on the night of the maturity date. If the maturity date is on a weekend or holiday, the loan will close on the night of the first business day following the maturity date. Monetary balances that must be zero are: Principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, and accrued interest on negative reserves. In addition, the loan cannot have an LIP (loan-in-process) method code greater than zero.

Loan advances (tran code 500 field debit to principal) are typically not allowed if a loan is past the maturity date. The error message "LOAN PAST MATURITY, ADVANCES NOT ALLOWED" will be displayed both in GOLDTeller and the "daily rejects" for line-of-credit loans. If there is no maturity date, advances will continue to process. This applies to all payment methods. Institution Option APML allows a principal increase to be processed if a loan is past the maturity date. This requires a supervisor override (SOV).

Institution Option APCO allows a loan payment (tran code 600/608) or an optional loan payment (tran code 690/698) to be processed if a loan has been charged off (hold code 2).

|

•The Due Date Day field displays the day of the month that the payment is due each month. See below for more information.

Due Date Day details Due Date Day details

For example, if "15" is entered here, the payment due date would be the 15th of every month. This field is ignored if the loan payment frequency is anything but monthly.

Additionally, you can use this field to specify if you want the payment on the last day of the month. Because the number of days in a month varies, the number in this field changes. On months that have 31 days, the system will automatically place "31" in the Due Date Day field. In the months that have 28, 29, or 30 days, the system automatically enters "28," "29," or "30," respectively.

If you want to change an opened loan to allow payments for the last day of the month, you would enter "31" in this field, and the system would adjust for the last day accordingly. Note: See the options below for an option that does not allow users to enter a number larger than 27 in this field.

If you change the Due Date Day, you should also change the Due Date to match. However, if you do not change the Due Date, the system will automatically update the Due Date to match this number after the next payment is made. If you change the Due Date Day, the Due Date will move to the next month if the indicated Due Date Day is in the future.

Additionally, if a customer would like a different Due Date and you change the Due Date, you should especially make the corresponding changes to the Due Date Day field, or the system will go back to the original day of the month of the payment before you changed the Due Date.

Options

The following institution options affect this field:

|

•DDCD: This option allows you to set the maximum number of days the Due Date Day can be changed. Example: The Due Date on an account is 01-01-2014, and option DDCD contains 13. The Due Date Day can be changed to any number between 2 and 14. If 15 or higher is attempted, an error message will appear. The next due day cannot be greater than 13 days ahead of the Current Due Date. The 13 will change to be the number stored in this option.

This option can be used in conjunction with option DD27.

|

•DD27: When this option is set, employees at your institution cannot file maintain the Due Date or the Due Date Day to a day greater than 27. |

•MDDD: When this option is set, any change to the Due Date Day will change the day in the Next Due Date. |

|

Note: If a user attempts to change the Due Date or Due Date Day and the system displays an error message, it's likely that certain options are set up for your institution which prevent altering due dates and due date days. See the following institution options for more information:

•CDUR •DDCD •DDAO •DDPF •DD27 •MDDD

Additionally, some institutions have requested hard-coded restrictions on changing these fields. Contact your GOLDPoint Systems account manager to see if such restrictions are in place at your institution.

|

|

|

Original Maturity Date/Term

Mnemonic: MLOTRM, MLOMAT

|

These fields display the original Maturity Date (see above) and original maturity Term for the loan. These fields should never be changed.

|

Original Term/Original PI Constant

Mnemonic: LNTRMO, LNOPIC

|

•The Original Term field displays the original term of the loan (in months) established during the origination of the loan. This field should not be changed.

•The Original PI Constant field displays the customer account's PI Constant at loan origination. The account's current PI Constant might be different from the value in this field. This field is used in connection with late charge code 24. The late charge uses the original P/I in the late charge calculation. This field is populated when a loan is originated through GOLDTrak PC. If the loan is opened with a zero balance, such as for a line-of-credit loan, a zero is entered in this field. |

Original/Total Loan Fees

Mnemonic: LNFEES, LNOFEE

|

These fields display the total amount of the Original loan fees charged to the borrower at closing and the Total Loan Fees (miscellaneous fees) that have been assessed but not paid. These fees will be reported to the IRS during the tax year in which the loan was opened, only if the Report Original Loan Fees to IRS? field on this screen (below) is checked.

As fees are assessed and paid, history will identify what the fees are for. Loan fees are assessed by tran code 660 and paid by a tran code 850. See Chapter 37 in the Loan manual on DocsOnWeb for more details on miscellaneous fees.

Institution Option CFEE is available which requires a teller override when posting a payment if miscellaneous fees are due on the loan.

See also: Fee list view on the Daily Statistics & Fees tab

|

Original APR

Mnemonic: LNOAPR

|

This field displays the original annual percentage rate of the loan. This is a memo field.

|

Original/Current/Maximum Combined LTV

Mnemonic: LNMLTV, LNCLTV, LNOLTV

|

The Original LTV field will be calculated by the system each time this screen is called up. It is for information purposes only and does not affect the loan in any way. The system calculates this ratio by taking the sum of the Original Balance (see above) and Secondary Balance (see below), and dividing it by the lesser of the Appraisal Amount (see below) or the Selling Price (see below). If the Original Balance field is blank, the LTV will not be calculated. Because this is a calculated field, it is not file maintainable, nor can you use it in Report Writer.

Each time this screen is accessed, the system will calculate the current loan-to-value ratio and place it in the Current LTV field. It is for information purposes only and does not affect the loan in any way. The system calculates the ratio by dividing the sum of the current Principal Balance (on the Loans > Account Information > Account Detail screen) and the Secondary Balance by the lesser of the Appraisal Amount or the Selling Price. Because this is a calculated field, it is not file maintainable, nor can you use it in Report Writer.

Maximum Combined LTV displays the combined loan-to-value ratio. It is only calculated for line-of-credit loans (payment method 5, 9, or 10). It is calculated by dividing the sum of the Secondary Balance (on this tab) and the LOC Limit (on the Loans > Account Information > Account Detail screen) by the lesser of the Appraisal Amount or the Selling Price.

|

Originating Officer

Mnemonic: LNOFCR

|

This is the name of the officer or employee who originated the loan.

|

Security Code

Mnemonic: MLSCCD

|

This is the type of security held for collateral for the loan. This information is usually entered when the loan is originated, if your institution uses the Security Code in loan applications. Available security types can be selected from the pop-up box after clicking the list icon  . .

If a loan was assigned a security code, and that security code was laster deleted from the system, you may get an error message on this screen. If so, just select a new valid security code from this pop-up list, or have a manager add the security code back to the list (see Note below).

|

Note: If you have proper security clearance, you can add codes to this field using the Loans > System Setup Screens > Security Codes screen.

|

|

Collateral Code

Mnemonic: LNCOLL

|

This field is used to describe the collateral for a given loan. See below for more information.

This field is file maintainable. What is selected in the Collateral Code field affects how the Account Type (Field 9 of the Base Segment) is recorded in the Credit Bureau Report and transmission file (FPSRP184) sent to Credit Bureaus. See the Credit Bureau Type (Account Type) topic for more information.

Click the list icon  to view and select the collateral code tied to this loan. The following is a list of available collateral codes. to view and select the collateral code tied to this loan. The following is a list of available collateral codes.

Code

|

Description of Collateral Code

|

0000

|

Collateral code not used

|

0001

|

Single family - new

|

0002

|

Single family - previously occupied

|

0003

|

Single family condominium - new

|

0004

|

Single family condominium - previously occupied

|

0005

|

2 to 4 family units - new

|

0006

|

5 to 36 family units - new

|

0007

|

37 or more family units - new

|

0008

|

5 to 36 family units - previously occupied

|

0009

|

37 or more family units - previously occupied

|

0010

|

Non-residential (other improved real estate)

|

0011

|

Combination home and business

|

0012

|

Churches

|

0013

|

Churches and single family

|

0014

|

Housing for the aged

|

0015

|

Developed building lots, acquisition and development of land and unimproved land loans - residential (1-4)

|

0016

|

Developed building lots, acquisition and development of land and unimproved land loans - non-residential

|

0017

|

Developed building lots, acquisition and development of land and unimproved land loans - multi-family residential (5 units or greater)

|

0020

|

Secured by farm land

|

0025

|

2 to 4 family units - previously occupied

|

0040

|

Vacation property

|

0100

|

Commercial loans - secured by other than real estate 5

|

0102

|

Inventory

|

0105

|

Accounts receivable

|

0106

|

Equipment - non-farm

|

0107

|

Equipment - farm

|

0108

|

Livestock

|

0109

|

Commercial loans - secured by real estate

|

0110

|

Commercial loans - unsecured

|

0120

|

Commercial - SBA

|

0130

|

Loans to finance agricultural production

|

0190

|

Commercial real estate second mortgages

|

0200

|

Home improvement loans/second mortgages

|

0201

|

Equity second mortgages

|

0202

|

Equity second mortgages - revolving open end loans

|

0203

|

Equity first mortgages - revolving open end loans

|

0204

|

Equity first mortgages

|

0205

|

Real estate secured - consumer loan or HIL based primarily on the credit-worthiness of the borrower.

|

0210

|

Education loans

|

0220

|

Consumer automobile loans - new

|

0221

|

Consumer automobile loans - used

|

0230

|

Credit cards

|

0231

|

Other revolving credit plans

|

0235

|

Unsecured consumer loans

|

0240

|

Other loans for household family and other personal expenditures

|

0241

|

Assignments of contractors and securities

|

0242

|

Assignments of contracts - commercial

|

0245

|

Loan on savings

|

0246

|

Deposit loans - commercial

|

0250

|

Mobile home loans - retail

|

0251

|

Mobile home on rented property

|

0260

|

Recreational vehicles

|

0262

|

Boats, motorcycles

|

0269

|

Airplanes

|

0300

|

Consumer leases

|

0310

|

Non-consumer leases

|

0350

|

Dealer flooring

|

0400

|

Loans to financial institutions

|

0401

|

Loans to holding companies of other depository institutions

|

0410

|

Loans for purchasing and carrying securities

|

|

|

Origination Code

Mnemonic: LNORIG

|

This field displays the code used to define the origination of a loan. See below for a list of available codes.

Code

|

Description of Origination Code

|

00

|

Origination code not used

|

01

|

Construction - one year

|

02

|

Construction - permanent

|

03

|

Construction loan purchased - serviced by others - will not create statements, report to the IRS, or create loan event letters.

|

04

|

Construction bridge (single family 1-4). These are loans to a builder for the construction of a pre-sold, 1-4 family residence.

|

05

|

Construction speculation (single family 1-4). These are residential construction loans, except those to individuals to fund construction of their own home and construction bridge loans.

|

10

|

Permanent

|

15

|

Loan participations purchased - serviced by others -will not create statements, report to the IRS, or create loan event letters.

|

16

|

Loan purchased - serviced by others - will not create statements, report to the IRS, or create loan event letters.

|

20

|

Refinance - inside

|

21

|

Refinance - outside

|

30

|

Land acquisition development

|

50

|

Other

|

|

|

Renewed Account Number

Mnemonic: LNORIG

|

This is the renewed account number if this account has been renewed, modified, or purchased.

|

Appraisal Amount/Date

Mnemonic: LNAPRS, LNAPAM

|

These fields display the Appraisal Amount (value) of the property at the time of the most recent Appraisal Date. The amount is considered when the original and current loan-to-value ratio is calculated.

|

Selling Price

Mnemonic: LNSELL

|

This field displays the selling price of the property. Although it contains a monetary amount, it is not a money field that requires a teller transaction. This field is used to calculate the original and current loan-to-value ratios.

|

Purchase Date/Repricing Date

Mnemonic: LNREPR, LNPUDT

|

These fields indicate the date your institution Purchased the loan or mortgage-backed bond as well as the next date the interest rate can or will be adjusted to market value (Repriced), or the maturity of the loan for the TFR reports. See below for more information.

|

Note: An action code 29 and date will prevent a loan from repricing from that date forward. A blank date field after action code 29 will not prevent the loan from repricing. This is generally used to stop securities from repricing.

|

The Repricing Date field will be updated by the system using the earliest date derived from the following criteria (update option 43).

•Payment method 3 loans will always enter the maturity date.

•The system will enter the first day of the following month for rate-sensitive loans—those loans that look at the rate tables on a daily basis. This is any loan, other than payment method 7, with a rate pointer other than 255.

If the loan is in process with LIP method 002 or 102, or the LIP is not in process and has LIP method of 000, the rate, dates, and procedures will be from the regular loan fields. If an LIP has method code 001 or 101 and is not rate sensitive (the LIP rate pointer is 255), the calculated maturity date is used. Otherwise, the first of the next month is also used.

•For payment method 5 loans with a fixed P/I constant, the system will calculate and place a new repricing date in the Repricing Date field if the date calculated will occur sooner than the date already in the field. The date is calculated by amortizing the loan using the current balance, interest rate, P/I constant, and maturity date.

For payment method 5 loans with no P/I constant and no maturity date, the loan is skipped and no repricing occurs.

•If the loan is payment method 7 or payment method 4 or 6 with Use ARM Fields checked (on the Loans > Account Information > Account Detail screen), the system will use the date in the Next Rate Change Date field on the Loans > Account Information > ARM Information screen for the repricing date, if the loan has such a date and looks at the Rate Tables. However, the rate change date will not be used and will be ignored if the loan rate is at its maximum, dictated by the Lifetime Maximum Rate Cap (found on the ARM Information screen).

•The system will calculate and place a new maturity date in the Repricing Date field if the date calculated will occur sooner than the date already in the field. The date is calculated by amortizing the loan using the principal balance at the beginning of the afterhours process, the interest rate, and the P/I constant. One of the reasons the repricing date could be different from the maturity date would be due to principal decreases made by the borrower throughout the life of the loan. The only action code recognized is the one calling for a balloon payment. As the loan is amortized, if action code 1 (balloon payment) is encountered, the loan will terminate the amortization and the action date will be entered in the Repricing Date field. (Action codes are found on the Loans > Account Information > Actions, Holds and Event Letters screen.)

|

Note: The principal balance at the beginning of the afterhours process is used to calculate the remaining term. This means that the principal balance will not have been adjusted by any payments or principal increases or decreases processed in the afterhours.

|

Repricing is done on a monthly basis for all loans. The day of the month for the repricing is determined by your institution through an institution option (update option 43). It generally is set up to process a few days prior to monthend. If you want to prevent a loan from repricing starting in February of 2010 for example, use an action code of 29 and an action date several days prior to the 25th of the month. This will allow for Saturdays or Sundays when processing does not occur.

•If this date cannot be calculated, the system will place the loan maturity date in this field.

•The following applies when opening a new loan (tran code 680):

1.For a payment method 7 (ARM) loan with a rate pointer less than 255 and the next rate change date not equal to zero, the system will place the next rate change date in the Repricing Date. (It will not amortize.) If a payment method 7 (ARM) and the next rate change date is zero, the system will use the maturity date and then amortize the loan. If the amortization results in the principal balance being "0" sooner than the maturity date, the amortized date will be used.

2.If the rate pointer is 255 (fixed rate payment method 0), the system will use the maturity date and then amortize the loan. If the amortization results in the principal balance being "0" sooner than the maturity date, the amortized date will be used.

|

WARNING: If you open a new loan for the wrong principal balance, the program will amortize using the wrong principal balance and the repricing date will be calculated incorrectly.

|

Although the system supplies the data for this field, it can be file maintained, if necessary.

|

|

Secondary Balance/Refinanced Amount

Mnemonic: LNBAL2, LNREFA

|

•The Secondary Balance field usually contains the balance of the first mortgage, if this loan is a second mortgage. The amount in this field is used to calculate the Original and Current LTV values (see above).

•The Refinanced Amount field displays the balance of the loan at the time the loan was refinanced. This amount is considered in some TFR reports (New Loan Report (FPSRP023)). |

Year Built

Mnemonic: LNYRBL

|

For real estate loans, this field displays the year a structure was built. For general category 4 (consumer) or 6 (installment) loans only, this field shows the number of times the loan has been extended.

|

Report Original Loan Fees to IRS?

Mnemonic: LNFIRS

|

This field allows you to designate that the Original Loan Fees amount (above) should be reported on the borrower 1098 IRS form at year-end. If not checked (default), no fees will be reported. If checked, the Original Loan Fees will be reported on the 1098 at year-end. The fees will be only reported for the tax year in which the loan was opened. This field is not used for reporting broker information.

|

Owner Occupied

Mnemonic: LNOWNR

|

This field indicates if the property is occupied by the owner or not. If it is checked, the property is occupied by the owner.

|

Pledged for Collateral

Mnemonic: LNPLCL

|

This field answers the question, "Is this loan pledged to FHLB for collateral?" If checked, the loan will be reported to FHLB through a magnetic tape as collateral. If not checked, the system will not report the loan to FHLB, except if GOLDPoint Systems has set up parameters for your institution to do so. All collateral loans should be set up with the Pledged for Collateral field checked.

An option is available on the FHLB collateral tape. You can request that the Appraisal Amount (see above) always be used, instead of using the lesser of the Appraisal Amount or the selling price on the loan. Thus, the Appraisal Amount may not always be specified on the collateral tape, based on what is entered on the loan record. If you want to always use the Appraisal Amount, please send in a work order with your request.

|

PMI Percent/Code

Mnemonic: LNPMIC, LNPMIP

|

The PMI Percent field displays the percent of the mortgage that is charged for the private mortgage insurance on the loan, if applicable. Most loans on GOLDPoint Systems do not require a PMI. Leave this field blank if this loan does not require PMI. See below for more information.

If this loan does require PMI, use the PMI Code field to select the insurer of the PMI.

PMI fees vary, depending on the size of the down payment and the loan, from around 0.3 percent to 1.15 percent of the original loan amount per year. Example: A customer buys a home for $175,000 with a 10 percent down payment, therefore borrowing $157,500. The mortgage insurer charges an annual premium of 0.49 percent (the amount entered in the PMI Percent field). The insurer multiplies the loan amount by 0.0049, for an annual premium of $771.75, which is divided into 12 monthly payments of $64.31.

If the loan principal is automatically increased by a calculated amount, the principal increase can be applied to insurance premiums using codes 9901 through 9907. New codes may be added by sending a work order to GOLDPoint Systems. The following codes are currently available.

Code

|

Description

|

01

|

General Electric Mortgage Insurance Co.

Raleigh, N.C

|

02

|

Verex Assurance, Incorporated

Madison, Wisconsin

|

03

|

CMG Mortgage Insurance Co.

San Francisco, California

|

04

|

Radian Guaranty, Inc.

Philadelphia, Pennsylvania

|

05

|

Investors Mortgage Insurance Co.

Boston, Mass

|

06

|

Liberty Mortgage Insurance Corp.

Cincinnati, Ohio

|

07

|

Mortgage Guaranty Insurance Corp.

Milwaukee, Wisconsin

|

09

|

Foremost Guaranty Corp.

Madison, Wisconsin

|

10

|

Ticor Mortgage Insurance

Los Angeles, Calif.

|

11

|

PMI Mortgage Insurance Co.

San Francisco, Calif.

|

12

|

United Guaranty Corp.

Greensboro, N.C.

|

13

|

Republic Mortgage Insurance Co.

Winston-Salem, N.C.

|

14

|

Maryland Housing Fund

Annapolis, Maryland

|

15

|

WMAC Credit Insurance Corp.

Milwaukee, Wisconsin

|

16

|

Home Guaranty Insurance Corp.

Richmond, Virginia

|

17

|

Commonwealth Mortgage Assurance Co.

Philadelphia, Penn.

|

19

|

PAMICO Mortgage Insurance Co.

Blue Bell, Penn.

|

20

|

Integon Mortgage Guaranty Corp.

Winston-Salem, N.C.

|

21

|

Triad Guaranty

Winston-Salem, N.C.

|

80

|

Secured by certificate of deposit

|

9901

|

Life Insurance Premium

|

9906

|

Disability/Joint Life

|

9907

|

Life/Accident/Health

|

|

|

Face Amount

Mnemonic: LNFACE

|

The calculation for this field varies according to the type of loan and how your institution calculates this amount. This amount is brought over when the loan is originated (it is the amortized face amount of the loan). It is not necessarily the same as the Face Amount displayed on the Loans > Original Loan Disclosure or Purchase Disclosure screens (depending on how your institution uses Face Amount). See below for more information.

You should never need to change the amount in this field. However, if you do need to make changes to this field, you may need special security (see Field-level Security below).

The Face Amount is calculated by taking the Original Balance on the loan (see above) and subtracting any original unearned precomputed interest (if applicable).

Face Amount = Original Balance - Original Unearned Precomputed Interest

Example: The Original Balance on a loan is $1,450.00. The loan is a precomputed loan with Original Unearned Precomputed Interest of $150.00.

$1,450.00 - $150.00 = $1,300 is the Face Amount

Field-level Security

|

The security supervisor at your institution can restrict users from changing this field through the Loans > System Setup Screens > Field Level Security screen, then complete these steps:

| 1. | Select the person or profile for whom you want to restrict this field in the Name or Profile fields. |

| 2. | In the Record Type field, select "CFLN - Loan Master." |

| 3. | Check the box next to "LNFACE - Original Face Amount." |

The employee or profile will not be restricted from making changes to this field.

|

|

|

Open Loan Posting Date

Mnemonic: MRFUND

|

This is the posting date of the open loan.

|

Miscellaneous Funds

Mnemonic: LNMISC

|

This field is a memo field for payment method 8 loans (rentals). This is a money field, entered through a teller transaction only, that can be used in any way by your institution. The field cannot be file maintained. Possible uses are insurance claim funds or rents collected on properties in foreclosure.

|

Payoff Date/Amount

Mnemonic: LNCLAT, LNCLDT

|

The Payoff Date field is entered by the system. This date represents the date this loan was paid off. This field will be updated when a payoff transaction code 580 is processed. A payoff correction code 588 will clear the field. The Payoff Amount field displays the total payoff amount of the loan, as indicated in the Amount field on the Loans > Payoff screen. This field is populated when the Payoff transaction is run (tran code 580). For more information on paying off a loan, see Payoff. See below for more information.

Institution Option CZLB automatically closes zero balance payment method 5 loans. At the time the loan is closed, the payoff date is also updated. The "close" transaction is a file maintenance tran code 22 to field 999. The loan will automatically close on the night of the maturity date. If the maturity date is on a weekend or holiday, the loan will close on the night of the first business day following the maturity date. Monetary balances that must be zero are: Principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, and accrued interest on negative reserves. In addition, the loan cannot have an LIP (loan-in-process) method code greater than zero.

Monetary balances that must be zero are principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, accrued interest on negative reserves, customer balance, LIP balance, and, for payment method 5 loans, the prior and current finance charge. In addition, the loan cannot have an LIP method code greater than zero.

If a reversal of a payoff is processed, this field changes to zero.

|

|

Broker Number/Fee

Mnemonic: LNBFEE, LNBRK#

|

The Broker Number field contains the number assigned to the broker who brought this loan to the institution. This information is usually brought over from GOLDTrak PC when the loan is originated or transferred into CIM GOLD. However, you can enter a valid broker number in this field. All brokers must be first be assigned a number, along with their address and payment information, on the Loans > Payee Information screen.

The Broker Fee field contains the amount paid to the broker who brought this loan to the institution. If the broker fee is more than $599.99, then the record will be transferred to the IRS GOLD system. The amount is reported on the IRS 1099-MISC form if the Report Original Loan Fees to IRS? field (see above) is checked. See below for more information.

Additionally, if the Report to IRS box is checked for the broker on the Payee Information screen, this broker and the amount in the Broker Fee for the current year are fed to IRS GOLD for reporting to the IRS on 1099-MISC forms. At year-end, the system looks at all loans opened that year and totals the fee amounts for each broker number. One 1099-MISC is created combining the fees of each loan for the same broker. Your institution is responsible for printing 1099-MISC forms and processing them with the IRS and brokers. Year-end information is transmitted automatically to the IRS via GOLDPoint Systems. See the Loan Year-end User's Guide under the Loans menu in DocsOnWeb for more information on end-of-year processing.

|

WARNING: You must have the broker information set up on the Loans > Payee Information screen.

|

|

|

Reserve Analysis Effective

Mnemonic: LNANAL

|

Use these fields to select the day and month the reserve analysis will take effect. This field is the exact same as the Reserve Effective field on the Loans > Account Information > Reserves > Reserve Analysis screen > Options, Limits & Loan Fields tab. If you make changes to these fields on this screen, the changes will be reflected on the Reserve Analysis screen, and vice versa.

The reserve analysis effective day is the day the system runs the annual reserve analysis for this loan to determine whether or not the payment needs to increase, decrease, or stay the same for the next year due to taxes, insurance, or other reserve disbursement amounts that may increase or decrease from year to year. See the Reserve Effective field on the Options, Limits & Loan Fields tab for more information about the reserve analysis run date.

|

Original Add-On

Mnemonic: LNOADD

|

This field displays the total of amounts added onto the principal in any loan. Examples of add-on amounts might be Rule of 78s (payment method 3) interest, insurance, and dealer reserves or an insurance premium included as part of a simple interest loan.

|

Assumption Code/Date

Mnemonic: LNASDT, LNASCD

|

The Assumption Code field contains the assumption code for this loan. Valid entries are "1" for a Full-Release of Seller and "2" for a Non-Release of Seller. If the loan was assumed using the Assumption system, once the assumption is completed, this field is updated by the assumption code in the Assumption system.

The Assumption Date field stores the date this loan was last assumed. It controls the interest being reported for the new borrower. Only interest paid after this date will be reported for the new borrower. If the loan was assumed using the Assumption system, once the assumption is completed, this field is updated by the assumption date in the Assumption system.

|

Conversion Date

Mnemonic: LNCVDT

|

This field contains the date the loan was acquired or the date your institution was converted to GOLDPoint Systems. Note: When a new loan is opened using tran code 680, and Institution Option DATC is enabled, the date of the 680 transaction is used in this field.

For loans converted by GOLDPoint Systems, the system will enter the date. GOLDPoint Systems orders coupons beginning with the date in this field.

|

FHLB Type/Class

Mnemonic: LNFHLT, LNFHLC

|

The FHLB Type and FHLB Class fields hold the loan type and class as defined by FHLB. The type code will be reported to FHLB as the loan type, and the class code as the loan classification, through the FHLB collateral tape. Loan collateral instructions from the FHLB in your area will contain proper codes to enter in this field. GOLDPoint Systems cannot list codes because type and class codes may vary between each FHLB office. Thus, your area FHLB may request different codes than those received by GOLDPoint Systems.

|

Note: FHLB Type and Class fields will not be reported on the FHLB collateral tape unless the Pledged for Collateral field above is checked.

|

|

Note: The FHLB San Francisco Collateral File (FPSRP209) does not use the FHLB type or class; instead, it uses the loan classification fields. However, if the loan has been sold on a participation basis and the portion your institution owns has also been pledged to the FHLB San Francisco, your institution's percent owned must appear in the FHLB Class field below.

|

|

Roll Due Date Within field group

|

See Roll Due Date Within field group for more information.

|

Originated/Purchased, Purchased/Dealer

Mnemonic: LNORGN, MRPDLR

|

These radio buttons indicate whether loan is an Originated or Purchased loan. See below for more information.

These buttons will default to Purchased. Purchased also refers to contract loans that are purchased by your institution.

Institution Option LTCB is available for late charges and credit reporting. This option allows an institution to determine the number of days after a loan has been purchased before a late charge will be assessed or the loan will be reported to a credit repository. The system first looks at the Originated and Purchased buttons. If Purchased is selected, the following occurs:

•For late charge assessment, the system subtracts the purchase date from the late charge assessment date. If this is less than or equal to the number of days in the institution option, a late charge is not assessed. (The actual number of days is used, so if a month has 28 or 31 days, those actual days are counted in determining whether to assess or not.)

•For reporting, the system subtracts the purchase date from the credit reporting run date (eighth business day). If this is less than or equal to the number of days in the institution option, the loan will not be reported.

The Real Estate Settlement & Procedures Act (RESPA) specifically states that, under certain circumstances, a late fee cannot be imposed during a 60-day period from the "date of transfer." If you purchase loans, be sure to refer to RESPA and any applicable state regulations to be sure you are in compliance.

|

If the Purchased radio button is marked, the Purchased/Dealer field becomes available. Mark this checkbox field if the loan was purchased from a dealer.

|

GOLDTrak PC Application/Checks Disbursed

Mnemonic: MLAMOU, MLGTRN

|

The GOLDTrak PC Application is the loan application number if the loan was originated through GOLDTrak PC. The GOLDTrak PC Checks Disbursed is the total amount of checks disbursed to this account using the GOLDTrak PC program.

|

Originating Application Office

Mnemonic: M1OAPP

|

This is the office number that originated this loan application.

|

Inter-Office Move

Mnemonic: M1IOFA, M1IOFD, M1IOTA, M1IOTD

|

For those institutions that move accounts from one branch or office to another using the Loans > Inter-Office Move screen, this field displays the old account number and the new account number, as well as the date the account was moved.

|