Navigation: Loans > Loan Screens > Account Information Screen Group > Additional Loan Fields Screen > Valuation/Billing tab >

Troubled Debt field group

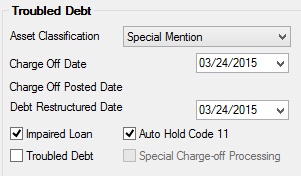

This field group on the Loans > Account Information > Additional Loan Fields screen, Valuation/Billing tab displays Troubled Debt information for the loan account.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LNACLS |

This drop-down list displays the asset classification assigned to the loan as defined for OTS reporting. Valid classification codes are as follows:

Potential Collection Special Mention Substandard Doubtful Loss

A classification of "Doubtful" or "Loss" will stop amortization of deferred fees or premiums. |

|

Mnemonic: LNCODT, LNCOPD |

The Charge Off Date field displays the effective date when the charge-off transaction was run. The Charge Off Posted Date field displays the date the charge-off was posted to the account. The charge-off date is used by both credit reporting and some regulatory reports.

The charge-off date is used by both credit reporting and some regulatory reports. For more information, see the help on the Loans > Transactions > Charge Off Transactions screen. The charge-off date is entered through the Charge-off transaction (tran code 022-01) in GOLDTeller. |

|

Mnemonic: LNRSDT |

This field contains the date this debt was restructured. This field is used in determining restructured loans and leases on the FDIC Schedule RC-C Memoranda report (FPSRP166). |

|

Mnemonic: LNIMPD |

This field displays a checkmark if the loan is impaired. |

|

Mnemonic: LNAHCD |

If this field displays a checkmark, the system automatically puts a hold code 11 on the account if a late notice type 9 or 10 is produced for the account in the afterhours. If hold code 4, 5, 7, 9, or 27 are already on the loan, the 11 will not be added. The system checks the first and second Hold Code fields and places the 11 in one that is blank. If both fields have hold codes, the 11 is placed in the first field. Removal of the hold code must be performed manually by your institution. Note: Update function 67 must be set to "daily." Please submit a work order with your request, if you want to use this function. The system looks at the Holiday Schedule. |

|

Mnemonic: LNTRBL |

This field displays a checkmark if this loan was a troubled debt and required modification to enable the borrower to continue making payments. If this field is checked, a date should be entered in the Debt Restructured Date field above. |

|

Mnemonic: LNSCOP |

The Special Charge-off Processing option is set if your institution uses COOP option 5. When accounts are charged-off using the Charge Off Transactions, and your institution has COOP option 5 set up, the system will:

•Change the Payment Application field to 1274 (any overpayment goes first to principal, then interest, then fees, then late charges).

•Set this option on the Loans > Account Information > Additional Loan Fields screen, Valuation/Billing tab so all principal is paid first, then interest, then fees, late charges, etc.

See the Charge-off Description topic for COOP 5 for more information. Note: If your institution uses the Use Spread Payments option, this option cannot be used. See the Use Spread Payments option on the Loans > Account Detail > Account Information screen > Payment Detail tab.

Note that this option must be turned off in order to make interest-only payments. |