Navigation: Loans > Loan Screens > Account Information Screen Group > Actions, Holds and Event Letters Screen >

Holds field group

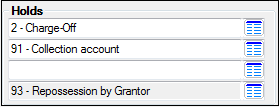

The four fields in the Holds field group on the Actions, Holds, Event Letters screen contain Hold Codes that indicate any restrictions on this account (LNHLD1-4).

Click the list icon ![]() and select a hold code from the list that you want applied to this account. The hold codes reflect any restrictions for this account. Up to four hold codes can be selected for each loan.

and select a hold code from the list that you want applied to this account. The hold codes reflect any restrictions for this account. Up to four hold codes can be selected for each loan.

|

Note: Bankruptcy transactions cannot be run on a customer account if the account currently has four active hold codes. One of the active hold codes will need to be removed to make room for the hold code created by the Bankruptcy transaction. |

|---|

Hold codes in the Hold Code 1 field will be reported to the credit bureaus. To print a credit report, click <Credit Report> and CIM GOLD will transfer this account's information to GOLDTrak PC, where the credit report will be printed.

Late charges will be assessed regardless of the hold code.

Hold codes that are not marked TOV (teller override required) or SOV (supervisory override required) do not stop transactions (see the list below). When these types of hold codes are applied to an account and a teller or loan processor runs a transaction on this account, such as a loan payment, the hold codes will appear as messages during the transaction process.

For hold codes that have a TOV, a teller or loan processor will need to override a message that appears during transaction processing on the account. (Usually done through GOLDTeller.) For hold codes marked with SOV, a supervisor within your institution will need to override the message by entering their user name and password before the transaction can process. However, all transactions that are processed during the nightly processing will be completed since they will be processed using an SOV override.

Hold codes identified as "cannot override" (see the list below) will freeze the loan, and no transaction can be performed either by a teller or during the nightly processing without the hold code being removed. Transactions that do not process include reserve disbursements, auto payments, posting of interest on reserves, and charging of LIP interest. Late charges will continue to be assessed in most instances. Refer to specific hold codes for more details on late charges.

Reserve Analysis statements continue to process regardless of the hold code (see hold codes 4, 5, 7, and 9, which indicate statements sort to the top).

Year-end statements continue to be created except for hold codes 39 and 43. ARM rate and/or P/I adjustments continue to process.

Bill and receipt statements for bankruptcy hold codes 4 and 5 can be stopped if Institution Option STBK is enabled. (The Loan Reports manual explains each of the statements affected by this option, which are many. Refer to the Loan Reports manual for more details.)

All event letters print. (The use of general categories 80 and above stops event letters.)

|

Note: If you have the proper security clearance, you can designate which hold codes appear in the list by completing the following steps:

1.Access the Loans > System Setup Screens. 2.Select Client Code Setup from the Setup Screen field. 3.From the Data to choose selections for field, select Loan Hold Codes. 4.Check the box next to each of the hold codes you want to appear in this field. 5.Click <Save>. The hold codes you selected will now appear in the Holds field on the Actions, Holds and Event Letters screen. |

|---|

The following hold codes are set up by GOLDPoint Systems and are available for use. If this list of hold codes is incomplete for your institution, please send in a work order requesting a new hold code be set up.

|

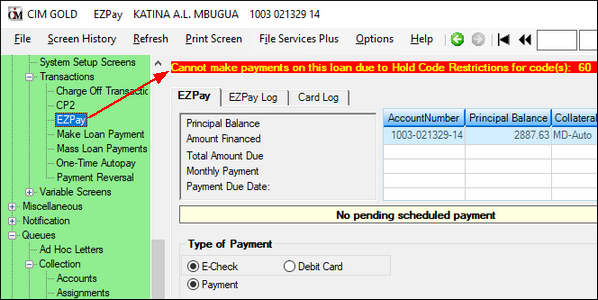

Note: In order for hold codes to also affect accounts for EZPay payments, the hold code must also be added to the CIM Hold Code Restriction list in the EZPay IMAC table. The EZPay IMAC table is only accessible by GOLDPoint Systems personnel. Contact your GOLDPoint Systems account manager if you want any of these hold codes added for EZPay reasons, then you will need to also manually add the hold code to each account needing this restriction in the provided Hold Code fields. When both options are added, a message will be displayed on the EZPay screen, as shown below:

That customer will be restricted from making payments through CIM GOLD EZPay, but not on your website. To restrict users from certain activity on your website, use the options on the Internet and Phone Systems > User Profile screen > Accounts tab > Permissions tab instead. |

|---|

Hold Code |

Description |

|---|---|

01* ¤ § |

Foreclosure completed (cannot override). Stops late charge notices. |

02* ¤ § |

Charge-off (unpaid balance reported as loss by credit grantor) (cannot override). Stops late charge notices. (Note: To stop late charges from assessing, be sure to change the General Category code to 80-89.) Institution Option ACCO, is available which, when set, will allow a principal increase on charged-off loans. Institution Option APCO allows the following transactions to be posted without an override: loan payment (tran code 600/608), waive late charge (tran code 570/578), pay late charge (tran code 550/558), waive misc fee (tran code 670/678), pay loan fee (tran code 850/858), VSI Add (tran code 870/878), VSI Cancel (tran code 890/898), assess miscellaneous fees (tran code 660/668), and autopayments. |

04* + § |

Bankruptcy - Chapter 7 or 11 - stops late charge notices, still assesses (cannot override), stops auto payments. Sorts reserve analysis statements to the top. Institution Option BKPM allows the following transactions to be posted without an override: payments (tran code 600/608), partial payments (tran code 510/518 to field 33), principal increase (tran code 510/518 to field 47), teller spread payments (690/698), waive late charge (tran code 570/578), pay late charge (tran code 550/558), waive misc fee (tran code 670/678), pay loan fee (tran code 850/858), VSI Add (tran code 870/878), VSI Cancel (tran code 890/898), assess miscellaneous fees (tran code 660/668), and autopayments. |

05* + § |

Bankruptcy - Chapter 13 - stops late charge notices, still assesses (cannot override), stops auto payments. Sorts reserve analysis statements to the top. Institution Option BKPM allows the following transactions to be posted without an override: payments (tran code 600/608), partial payments (tran code 510/518 to field 33), principal decrease (tran code 500/508 to field 47), teller spread payments (690/698), waive late charge (tran code 570/578), pay late charge (tran code 550/558), waive misc fee (tran code 670/678), pay loan fee (tran code 850/858), VSI Add (tran code 870/878), VSI Cancel (tran code 890/898), assess miscellaneous fees (tran code 660/668), and autopayments. Institution Option LTBK will stop assessment of late charges on Chapter 13 bankruptcy accounts. |

06* ¤ § |

Deed in lieu of foreclosure - shows on GNMA report as a finance charge (cannot override), stops auto payments. Stops late charge notices. |

07* + § |

Legal hold (cannot override) - foreclosure. 1) Affects FHLMC inactive loans. This hold code automatically creates an action code 155 and action date. The action date matches the date the hold code is entered. The date in the Action Date field needs to match the FHLMC inactivation date. This affects FHLMC loan level reporting. If there is an action date in the current investor cycle, then the FHLMC Loan Level Report will show one month's net interest. If there is an action date in the prior investor cycle, then the FHLMC Loan Level Report will show no net interest to be remitted. 2) Shows on GNMA, FHLMC Loan Level, and FHLMC Midanet reports as a foreclosure. 3) Allows late charges to assess. 4) Stops late charge notices. Note: Action code 155 and the action date need to be removed manually if foreclosure is canceled. 5) Stops auto payments. 6) For loans with this code, the Bill and Receipt Statement (FPSRP003) can be prevented from being generated. 7) Sorts reserve analysis statements to the top. |

08 |

Reinstatement plan in effect - (supervisory override required). Stops auto payments. |

09* + § |

Legal hold (cannot override) - foreclosure. Stops late charge notices, still assesses, stops auto payments. Shows on GNMA report as a foreclosure. For loans with this code, the Bill and Receipt Statement (FPSRP003) can be prevented from being generated. Sorts reserve analysis statements to the top. |

10 |

Military indulgence. |

11** |

A message will appear on the screen at the time a transaction is performed. Refer to Collection/REO (cannot override). |

12 |

LIP open for this account. |

14 |

Reserve deficiency exists on this account (teller override required). |

15 |

Reserve deficiency - loan servicing (no override). |

16 |

Reserve deficiency - Insurance Department (cannot override). |

17 |

Life insurance - stops payment of life insurance. |

18 |

Property tax hold, will not allow property taxes to be paid from tax service tapes. (This has no effect on teller transactions.) |

19 |

Unsecured student loan. |

20 |

Refer late charge to Loan Department (teller override required). |

21 |

Need federal ID or Social Security number (also see hold code 71). |

22 |

Insurance loss claim on loan. |

23# |

Prepayment penalty applies - 1 year (SOV required when more than the regular payment attempts to be posted. This hold code does not work with payment method 5, 9, or 10 loans, or LIP payment method 1 or 101.) |

24# |

Prepayment penalty applies - 2 years (SOV required when more than the regular payment attempts to be posted. This hold code does not work with payment method 5, 9, or 10 loans, or LIP payment method 1 or 101.) |

25# |

Prepayment penalty applies - 3 years (SOV required when more than the regular payment attempts to be posted. This hold code does not work with payment method 5, 9, or 10 loans, or LIP payment method 1 or 101.) |

26 |

Do not report 1098 to IRS but does create a year-end statement. |

27+ |

Loan in default (cannot override). Stops auto payments and late charge notices. |

28 |

Refer to loan service department (supervisory override required). Auto payment, etc. will not be stopped. Allows late charges to assess regardless of hold codes. |

29 |

Refer to Commercial/Consumer loan department (supervisory override required). Auto payment, etc. will not be stopped. Allows late charges to assess regardless of hold codes. |

33 |

Payment deferred by law. |

37 |

Loan with illegal assumption status (cannot override). |

39 |

No annual statement or reporting to IRS. Will not create statements or report to IRS. |

40 |

Graduated payment loan. |

41 |

Print loan statement, but no reserve analysis at year-end. |

42 |

Allow reserve analysis to lower payment for account. |

43 |

Do not print loan statement at year-end but do report 1098 interest to IRS. |

44 |

Report 1098 interest to IRS regardless of general category or collateral code. (Does not report if less than $600 unless Option R SKCK is set.) |

47 |

"SPECIAL PROCESSING REQUIRED." Teller override required to process payment or extra principal payment. |

48 |

Loan to collect cash payment only (teller override required) (supervisory override required to process payment or extra principal payment). Stops auto payments. |

49 |

Send no advertising or direct mail solicitations. |

50 |

Pending modification request. You are responsible for the removal of the hold code after modification request processed or when it no longer applies. This code will not display at the teller station or require any overrides. |

51 |

Modification request. Permanent code on loans that have been modified as to original terms (e.g., principal balance, loan maturity date, interest rate, payment method, etc.). This code will not display in GOLDTeller or require any overrides. |

52 |

Pending in-house refinance. You are responsible for the removal of the hold code after refinance completed or when it no longer applies. This code will not display at the teller station or require any overrides. |

60 |

Account frozen (no override). Stops all monetary transactions. In case of ACH transactions, the account will be displayed on the Afterhours Processing Exceptions Listing (FPSRP013). Does not stop assessment of late charges or notices. Does not affect investor reporting or credit bureau reporting. You are responsible for the removal of the hold code when it no longer applies. This hold code message will appear in GOLDTeller when processing transactions on this account. If you want this Hold Code to also affect payments in CIM GOLD EZPay, make sure the option has been added to the EZPay IMAC table. Contact your GOLDPoint Systems account manager for more information.

GOLDPoint Systems Only: Add "60" to the list of CIM GOLD Hold Code Restrictions on the Setup tab of the GOLDPoint Systems > EZPay IMAC Table screen. |

61 |

Lost draft–verify check number (no override). |

62 |

Account in dispute. This hold code is manually set on the account by a user when the account is in dispute for any reason. If this hold code is set up, the following occurs on the account:

•"DISPUTED" appears in red in the Status bar at the top of the screen, so users instantly know the loan is in dispute. •Users cannot make payments on the account from CIM GOLDTeller or EZPay (or any other payment transaction screen). If users attempt to make a payment on a disputed account, the message "Account is in Dispute" will appear and they will not be able to finish processing the payment (unless the hold code is removed). •Borrowers will not be able to make payments from your website (GOLDAccount Center). They will receive an error message.

After establishing this hold code, you need to also set the Compliance Code, so the account is reported properly during monthend Credit Reporting. The Compliance Code gives a reason for the dispute, such as:

XF - Account in Dispute under Fair Credit Billing Act XB - Account Information Disputed by Customer

The Compliance Code is set up on the Credit Reporting screen > Reporting Codes & Original Information tab. See the Compliance Code help for more information. Compliance Codes are reported in Base Field 20 of the Credit Report transmission. Accounts with Compliance Codes are also reported in the Credit Report (FPSRP184) generated on a monthly basis through GOLDView. |

69 |

Officer/director loan. |

70 |

Employee loan. |

71 |

Social Security number verified—needs to be verified, won't report to credit bureau. |

72 |

Stops following transactions on LIP loans: 430, 431, and 500 (LIP method code must be greater than 0). No TOV or SOV allowed. |

82 |

GOLDPhone lockout. This stops a customer from accessing the loan account from GOLDPhone. |

83 |

Stop ACH–This hold code stops ACH payments from being made through the CIM GOLD EZPay screen. However, in addition to Hold Code 83 being set on each account not allowed to make ACH payments, the hold code must also be added to EZPay IMAC Table by your GOLDPoint Systems account manager.

Setting Hold Code 83 on an account does not restrict ACH payments from being made on the web unless the GOLDAccount Center option, BlockPmtNoTransfer, has been set up by your GOLDPoint Systems account manager. You can restrict ACH payments being made on the web for specific customers by unchecking the ACH Loan Pay field on the Internet and Phone Systems > User Profile screen > Accounts tab > Permissions tab.

GOLDPoint Systems Only: •Add "83" to the list of CIM GOLD Hold Code Restrictions on the Setup tab of the GOLDPoint Systems > EZPay IMAC Table screen. •Set up GOLDAccount Center option, BlockPmtNoTransfer. |

86 |

Loan sold servicing released. Stops ARM rolls (cannot override). |

87 |

Send prenote on loan auto-payment for ACH. |

88 |

Issue check to cover loan auto-payment—never ACH. |

89 |

Assumption in progress. Cannot override. |

90 |

Judgment awarded. (Also see action code 99.) |

91* |

Collection account (assigned to collection agency, lawyer, etc.). Reported to credit bureau. |

92* ¤ § |

Voluntary surrender. Reported to credit bureau. Stops late charge notices. |

93* ¤ § |

Repossession by grantor. Reported to credit bureau. Stops late charge notices. |

94* |

Paid account; a foreclosure was started. Reported to credit bureau. |

95* |

Paid account; was a charge-off. Reported to credit bureau. |

96* |

Paid account; was a collection. Reported to credit bureau. |

97* |

Paid account; was a voluntary surrender. Reported to credit bureau. |

98* |

Paid account; was a repossession. Reported to credit bureau. |

99* |

Settled; account legally paid in full for less than full balance. Reported to credit bureau. |

| * | In addition, you must enter action code 94 and a date. |

| ** | If the Auto Hold Code 11 field on the Loans > Account Information > Additional Loan Fields screen is checked, the system will automatically put a hold code 11 on the account if a Late Notice Type 9 or 10 is produced for that account in the afterhours. If Hold Codes 4, 5, 7, 9, or 27 are already on the loan, the 11 will not be added. The system checks the Hold Code 1-4 fields and places the 11 in one that is blank. If all fields have Hold Codes, the 11 is placed in the first field. Removal of the Hold Code must be performed manually by your institution. Note: GOLDPoint Systems must set update function 67 to "daily" for your institution. Please submit a work order with your request, if you want to use this function. |

| + | The system allows file maintenance for the loan Interest Rate field (LNRATE) on the Loans > Account Information > Account Detail screen, Account tab and the Current Rate field (LNAMRT) on the Loans > Account Information > ARM Information screen, ARM Rates & P/I Tables tab, both online and in the afterhours. This is for payment method 7 loans and payment method 4 and 6 loans using the ARM fields (Use ARM Fields field checked on the Loans > Account Information > Account Detail screen.) |

| # | An institution update option (65) is available that will automatically delete the applicable hold code at the end of the 1st, 2nd, or 3rd year. It runs daily. The system compares the loan's date opened to the processing date to determine if the hold code needs to be dropped. If you would like this option, please send in a work order with your request. |

| ¤ | If you attempt to enter a Hold Code 1, 2, 6, 92, or 93, the system will require that a Charge-off Date be entered on the Loans > Account Information > Additional Loan Fields screen before allowing file maintenance. The charge-off date is used by both credit reporting and some regulatory reports. If a charge-off date has not been entered, those reports cannot determine when the charge-off occurred and when to report the charge-off. |

| § | Stops late notice created through the Past Due Notices and Report (FPSRP018). Past due notices generated through GOLD EventLetters will be created unless the event code is removed from the Event field. |