Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Payment Detail tab >

Payment Application field group

Mnemonic: LNAPPL

The Payment Application field is found on both the Account tab and Payment Detail tab of this screen. However, file maintenance is only allowed on the Payment Detail tab using the Payment Application checkboxes.

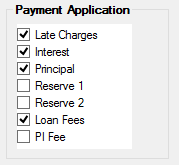

The Payment Application checkboxes display how you want loan payments to be applied. For example, you can apply the loan payment first to interest, then principal, then any remaining funds can go to late charges, reserve payments, miscellaneous fees, or PI fees (maintenance fees). You can check as many boxes as you want, as shown below:

The order of where loan payments are disbursed are reflected by the order of these checkboxes. For example, if the Late Charges checkbox appears at the top of this field group, late charges will be paid first. You can change the order by dragging a field up or down in this box.

All boxes you check here will appear in number format in the Payment Application field on the Account tab. For example, interest is 1, principal is 2, etc. (see code table below).

The Payment Application field on the Account tab contains up to nine digits that describe the method used in spreading the payment. The order of the spread is left to right. For example, a commonly used application code of 214 would spread the payment first to interest, second to principal, and third to late charges.

The following table displays the codes that represent how the payment is applied, as displayed in the Payment Application field on the Account tab.

Code |

Description of Application Code |

|---|---|

0 |

A zero or a blank space will allow skipping a loan payment only for payment method 5 or 6 loans. |

1 |

Amount to principal |

2 |

Amount to interest |

3 |

Amount to reserve 1 |

4 |

Amount to late charges |

5 |

Deferred Interest. This can only be set for certain types of loans. See Deferred Interest on Interest-bearing Accounts for more information. If "5" is part of the payment application, the following fields are file maintainable (with proper security access):

|

6 |

Amount to reserve 2 |

7 |

Amount to total miscellaneous loan fees (not maintenance fees or amortizing fees) |

8 |

Amount to PI fees. PI fees are maintenance fees for interest-bearing loans (payment method 6) only. See Maintenance Fee for more information. |

9 |

Reserved for future use |

Please note that certain payment options (see the Entire Payment Rolls Due Date and Payment Due Date Roll field group) may affect whether a payment counts as a full payment and the Due Date is rolled. For example, even if the payment only goes toward fees and late charges and a little toward paying the P/I Constant, the payment may still qualify as a full payment and roll the Due Date if those options are set. See the help for those fields for more information.

Also, the Stop Applied To option determines if a payment totaling more than one payment either continues to roll the Due Date, or if extra funds are applied toward decreasing the Principal Balance. See the Stop Applied To help for more information.

Once the Next Payment Due has been met by the customer through a loan payment, any extra funds a customer pays goes toward paying down late charges and fees (depending on the order of the Payment Application), and if there are still funds remaining, that extra amount goes toward reducing the principal. The Next Payment Due includes the P/I Constant and Reserve Constants, if the Reserve Constant 1 and Reserve Constant 2 checkboxes are selected in the Payment Application box. It does not include late charges and miscellaneous fees.

Example 1: Next Payment Due is $200, which does not include any reserve constants. A customer makes a payment for $350. This customer has $60 in late charges and a miscellaneous fee of $10. The Payment Application is set in this order: late charges, fees, interest, principal. Here’s how the system would apply this payment:

$60 to late charges $10 to fees $200 to the loan payment (P/I Constant; Due Date is rolled) $80 extra to principal

Example 2: Next Payment Due is for $250, which includes a Reserve Constant 1 of $50. A customer brings in a payment for $350. This customer has $30 in late charges, as well as a miscellaneous loan fee of $25. The Payment Application is set in this order: principal, interest, reserve 1, reserve 2, late charges, fees. Here’s how the system would apply this payment:

$250 to the loan payment (P/I Constant + Reserve Constant and Due Date is rolled) $30 to late charges $25 to fees $45 extra to principal

Example 3: Next Payment Due is for $250, which includes a Reserve Constant 1 of $50. A customer makes a payment for $150 at the beginning of the payment Frequency, and then another payment of $200 three days before the Due Date. This customer has $30 in late charges, as well as a miscellaneous loan fee of $25. The Payment Application is set in this order: late charges, fees, reserve 1, reserve 2, interest, principal. Here’s how the system would apply this payment:

1st Payment ($150): $30 to late charges $25 to fees $50 to Reserve Constant 1 $45 to Applied to Payment, $190 in Remaining Portion Due (Due Date is not rolled)

2nd Payment ($200): $190 to P/I Constant (Due Date is rolled and Remaining Portion Due is cleared) $10 extra to principal

Example 4: A customer makes a large enough payment to qualify as three payments. Does the Due Date roll three times? It depends on if the Stop Applied To option is selected and/or whether the loans is uses the Use Spread Payments option.

•If the Stop Applied To option is selected and the Use Spread Payments is not selected, than the Due Date does not roll three times. Instead, any extra funds after the entire Next Payment Due payment is met (and any late charges and fees are completely paid off) are applied toward decreasing the Principal Balance. The Due Date only rolls once.

•If the Stop Applied To option is not selected and neither is the Use Spread Payments option, than the Due Date does roll two or three times (depending on the amount of late charges and fees), and any left over amount after the PI Constant, late charges, and fees have been paid will be saved in the Remaining Portion Due field.

•If the Stop Applied To option is not selected and the Use Spread Payments option is selected, than the Due Date does roll three times. |

Payments made during a loan frequency that do not make a full Next Payment Due amount follow the same order as the Payment Application; however, the P/I Constant must be met before the Due Date is rolled (unless certain payment options are set. See the Entire Payment Rolls Due Date and Payment Due Date Roll help for more information).

Example 1: Next Payment Due is $200, which does not include any reserve constants. A customer makes a payment for $150. This customer has $60 in late charges and a miscellaneous fee of $10. The Payment Application is set in this order: late charges, fees, interest, principal. Here’s how the system would apply this payment:

$60 to late charges $10 to fees $80 to the loan payment, but since it's not enough to meet the P/I Constant, that amount will go into the Applied to Payment field, and the Partial Payment Due will show $120. If another payment of $120 is not made by the Due Date, the system will assess a late charge in the afterhours of the Due Date (if your institution applies late charges).

Example 2: Next Payment Due is for $250, which includes a Reserve Constant 1 of $50. A customer brings in a payment for $250. This customer has $30 in late charges, as well as a miscellaneous loan fee of $25. The Payment Application is set in this order: principal, interest, reserve 1, reserve 2, late charges, fees.

Additionally, the Roll Due Date Within option is set to 20 Dollars.

Here’s how the system would apply this payment:

$250 to the loan payment (P/I Constant + Reserve Constant) $0 to late charges $0 to fees The Due Date would roll because the Next Payment Due amount was met.

Example 2: Next Payment Due is for $250, which includes a Reserve Constant 1 of $50. A customer brings in a payment for $250. This customer has $30 in late charges, as well as a miscellaneous loan fee of $25. The Payment Application is set in this order: late charges, fees, principal, interest, reserve 1, reserve 2.

Additionally, the Roll Due Date Within option is set to 20 Dollars.

Here’s how the system would apply this payment:

$30 to late charges $25 to fees $195 to the loan payment, but since it's not enough to meet the P/I Constant + Reserve Constant, the amount goes go into the Applied to Payment field, and the Partial Payment Due will show $55. If another payment of $55 is not made by the Due Date, the system will assess a late charge in the afterhours of the Due Date (if your institution applies late charges).

Example 3: Next Payment Due is for $250. A customer brings in a payment for $280. This customer has $30 in late charges, as well as a miscellaneous loan fee of $25. The Payment Application is set in this order: late charges, fees, principal, interest, reserve 1, reserve 2.

Additionally, the Roll Due Date Within option is set to 25 Dollars.

Here’s how the system would apply this payment:

$30 to late charges $25 to fees $225 to the loan payment and Due Date is rolled, because the payment amount is within the Roll Due Date Within option of $25. However, the Remaining Portion Due will show $25.

In this same scenario, if the Roll Due Date Within option is set to 0, then the system would apply the payment like so:

$30 to late charges $25 to fees $225 to Applied To Payment with $25 to Partial Payment Due. The Due Date would not roll, because the payment amount went to pay for late charges and fees first and not enough remained to make the full P/I Constant payment of $250.

However, let's take this same scenario one step further, but this time the Entire Payment Rolls Due Date option is on (but the Roll Due Date Within option is still 0). Here’s how the system would apply this payment:

$30 to late charges $25 to fees $225 to the loan payment and Due Date is rolled, because the payment amount equaled the Next Payment Due amount, even though the Payment Application directed late charges and fees to be paid first. However, the Remaining Portion Due will show $25. |