Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group >

The Bankruptcy Detail screen is used to place customers in bankruptcy and view/edit their bankruptcy filing information.

See the following example of this screen:

A teller number is required to operate this screen. For more information on setting up tellers, see the Security > Setup screen > Teller tab.

This help page contains the following topics:

See Field Descriptions for more information about the fields on this screen.

This screen is used to process bankruptcy related transactions. It is used to establish the bankruptcy, while linking associated borrower(s), account(s), and phone restrictions as specified in the bankruptcy documents.

If multiple individuals are involved in the same bankruptcy filing, you can quickly select the names using the Selection checkbox in the Bankruptcy list view, or by searching to accounts/SSN/EIN in the Case Number search fields. For example, if a husband and wife filed bankruptcy, you could look up the information for the husband and select his applicable accounts, then look up the wife. If she has additional accounts that the husband does not have, and those accounts are involved in the bankruptcy, they too can be selected for bankruptcy.

Certain bankruptcy decisions require creditors to not contact debtors once a bankruptcy occurs. Running the Bankruptcy transaction will automatically flag phone numbers and email accounts as being restricted. See Results of Bankruptcy on Accounts for more information. Additionally, if a bankruptcy is dismissed, withdrawn, discharged, or some other action takes place (see Actions and Dates field group), options are available to unrestrict phone numbers and email addresses.

You can also use this screen to convert bankruptcy chapters if needed, in addition to discharging, withdrawing, reaffirming, and dismissing the bankruptcy. Depending on the transaction you choose to process, features on the screen will be enabled or disabled. For example, if the borrower and your institution reach an agreement that they will continue to pay their loan as long as your institution does not repossess their collateral, you can reaffirm the debt with the new agreements by selecting the Reaffirmation radio button.

An afterhours report (FPSRP208) shows all accounts that have a bankruptcy status (hold code 4 (Chapter 7, 11, 12) or 5 (Chapter 13)).

Running any transactions on this screen also affects the Consumer Information Indicator reported to credit repositories at monthend. See the Consumer Information Indicator field for more information.

See the Security Setup topic for security setup options that may affect users accessing this screen.

•To learn how to place a customer in bankruptcy, see Placing a Customer in Bankruptcy.

•To learn how to undo a bankruptcy, see Undoing Bankruptcy.

•To learn about the institution options that pertain to bankruptcy, see Bankruptcy Options.

•To learn about all the fields on this screen, see Field Descriptions.

•To learn more about confirming Chapter 13 bankruptcies, see the Confirmed By Court Chapter 13 field group.

As the bankruptcy proceedings move along, additional transactions will need to take place on the account. When your institution receives notices that the bankruptcy is dismissed, the chapter filing has changed, or it has been discharged by a Bankruptcy Court, then you will run one of those transactions listed in the Actions and Dates field group.

Additionally, your institution may choose to withdraw the bankruptcy claim or reaffirm the debt. See Reaffirmation and Withdrawn for more information.

Putting an account in bankruptcy affects the credit report sent to the credit repositories each month. For more information on this process, see Reporting an Account in Bankruptcy in the Credit Reporting documentation.

|

Note: In order to use this new screen (instead of the original Loans > Bankruptcy and Foreclosure > Bankruptcy screen), GOLDPoint Systems must set up certain institution options, as well as set up servers capable of producing bankruptcy forms and POC itemization. You must contact your GOLDPoint Systems account manager before using this screen. |

|---|

|

GOLDPoint Systems Only: Institution option UNBK must be set up. Additionally, an automatic initialization is required in order to use the new bankruptcy records (FPBA, FPBB, FPNP) instead of the old bankruptcy records (FPBK).

Also, a programmer needs to set up the institution to use two servers: GPS Forms Server and Bankruptcy Courts. This is done through the GOLDPoint Systems > Configuration Manager. |

|---|

The following links on the bottom of this screen bring up claim and informational dialogs as well as pop-up versions of various screens and tabs in CIM GOLD. Certain options must be enabled in order for these links to appear on this screen. See the Links field group on the Bankruptcy Options screen for more information.

Information about each of these links can be found below:

*You can also jump to this screen when you verify accounts after clicking the <Verify Transaction> button, as shown below):

Field-level Security In addition to the options set in the Links field group (as discussed above), any of these links can be restricted for individual users with field level security.

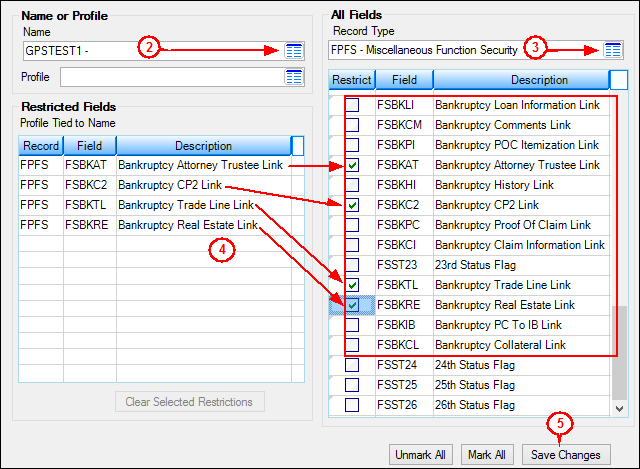

To restrict users:

1.Access the Loans > System Setup Screens > Field Level Security screen. 2.Select the Name or Profile of the person (or profile) for whom you want to restrict security. 3.In the Record Type field under All Fields, select FPFS - Loan Miscellaneous Security. 4.Check the Restrict box next to any of the bankruptcy links, as shown below (or FSLXNX for the Court Records link). 5.Click

|

See Bankruptcy Terms and Procedures for more information about bankruptcy in general. The options and functionality of this screen vary depending on which options are set on the Loans > Bankruptcy and Foreclosure > Bankruptcy Options screen.

|

Record Identification: The fields on this screen are stored in the FPBB and FPBA records (Personal Bankruptcy Information, Account Bankruptcy Information). You can run reports for these records through GOLDMiner or GOLDWriter. See FPBB and FPBA in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPBB and FPBA records on the Field Level Security screen/tab. |