Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Field Descriptions >

Confirmed By Court Chapter 13 field group

This field group is only available once a Chapter 13 Bankruptcy Transaction is run. A Confirmation Date must be indicated in this field group before the other fields in this field group become file maintainable.

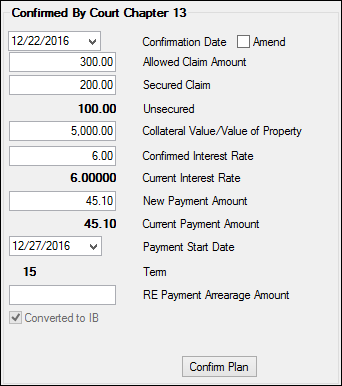

See the following example of this field group:

|

Note: An option is available on the Bankruptcy Options screen that requires precomputed loans (payment method 3) to be converted to interest-bearing loans (payment method 6) before confirming the bankruptcy plan for Chapter 13 bankruptcies. If you attempt to enter a date of the Chapter 13 plan, you will receive the following error message: "You must convert PC to IB before confirming the plan."

See the Require PC to IB at Petition field description on the Bankruptcy Options screen for more information. |

|---|

Overview of Chapter 13 Bankruptcies

A Chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years. During this time the law forbids creditors from starting or continuing collection efforts. See Chapter 13 Bankruptcy Basics on the U.S. Bankruptcy Courts website for more information.

Your institution will receive a notice from the Bankruptcy Court detailing the specifics of the loan moving forward under the Bankruptcy 13. For example, there may be a new interest rate and payment amount, as well as the start date for those payments.

Additionally, if any arrearages (past due payments, fees, and late charges) have incurred on the account before the Bankruptcy transaction was processed, your institution and the borrower must work out a plan to repay those arrearages, as well as any post arrearages that may incur after the repayment plan is confirmed.

Once information has been entered in the fields in this field group, you will need to click the Claim Information link and enter any arrearage information about the bankruptcy claims from the court proceedings. See the Claim Information dialog for more information.

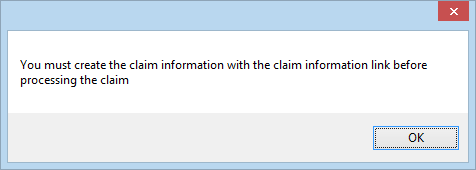

After that information has been entered and saved, you will be returned to the Bankruptcy Detail screen and you can now click ![]() . If you attempt to click this button before entering information on the Claim Information dialog, the system will give you the following error message:

. If you attempt to click this button before entering information on the Claim Information dialog, the system will give you the following error message:

Amending Chapter 13 Information

Once you click ![]() , all information entered on this screen is saved and you cannot make changes to the fields in this field group, unless you do the following:

, all information entered on this screen is saved and you cannot make changes to the fields in this field group, unless you do the following:

1.Make sure you have the Selection box checked next to the names for which this Chapter 13 bankruptcy applies in the list view at the top of the Bankruptcy Detail screen.

2.Select a different date in the Confirmation Date field. The date must be in the past, but it can be today's date.

3.Check the Amend checkbox (see below) if this plan has been amended by the courts. If a user previously entered wrong information and you are only trying to correct the errors, you can leave the Amend field blank.

4.Make any changes to the available fields.

5.Click ![]() and the changes will be updated. A record of all the changes can be viewed in Loan History.

and the changes will be updated. A record of all the changes can be viewed in Loan History.

|

Note: Once arrearage information has been entered and saved and the plan confirmed, you cannot make changes or amendments to those arrearages on the Claim Information dialog box. You can only make changes to the fields in the Confirmed By Court Chapter 13 field group. |

|---|

Field Descriptions

The fields in this field group are as follows:

Field |

Description |

|---|---|

|

Mnemonic: BACONF/BAAMCF |

Use this field to indicate the confirmation date of the customer's Chapter 13 Bankruptcy filing by the Bankruptcy Court. Check the Amend box field if this date needs to be changed. |

|

Mnemonic: BACCLA |

This field displays the total amount of the institution’s bankruptcy claim as recorded by the court (see Claim Information dialog for more information).

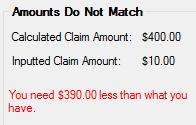

If an amount is manually entered into this field that does not match the allowed amount indicated on the Prepetition Arrearage tab of the Claim Information dialog, that tab will open (displaying an error message similar to the example screenshot below) and a warning indicator will appear next to this field. The original claim amount must then be adjusted on that tab before the plan can be confirmed.

|

|

Mnemonic: BACCSC |

Use this field to indicate the portion of the Claim Amount (see above) that is covered by security as recorded by the court. |

|

Mnemonic: BACCUC |

This field displays the portion of the Claim Amount (see above) that is not covered by security as recorded by the court. This value is affected by the value indicated in the Secured Claim field above. |

Collateral Value/Value of Property

Mnemonic: BACCVP |

Use this field to indicate the value of collateral on the customer loan account (if applicable) or the value of the property used on the loan (as reported by the court). |

|

Mnemonic: BACCIR |

Use this field to indicate the assigned interest rate on the customer loan account following the court ruling. |

|

Mnemonic: BACCNP |

Use this field to indicate the assigned payment amount on the customer loan account following the court ruling. |

|

Mnemonic: LNPICN |

This field displays the assigned payment amount on the customer loan prior to the court ruling. |

|

Mnemonic: BAPMSD |

Use this field to indicate the date when the selected customer account will be assigned the New Payment Amount above. |

|

Mnemonic: BARPAA |

Use this field to indicate the payment arrearage amount following the court ruling, if the loan account is a real estate loan. |

Converted to IB

Mnemonic: LNPCIB |

This field indicates whether the selected account has been converted to an interest-bearing loan. |

See also: Claim Information dialog