Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Field Descriptions > Actions and Dates field group >

Withdrawn

If a withdrawal of claim has been granted by a Bankruptcy Court, you can run the Withdrawn transaction to essentially reverse the Bankruptcy transaction, and the borrower is required to continue making payments on their loan. A Withdrawn transaction is only available if a customer has previously declared bankruptcy (see Placing a Customer in Bankruptcy).

Perform this transaction by following the steps below:

1.Select the box next to the name in the top list view table for which you want to withdraw the bankruptcy.

2.Select the Withdrawn radio button in the Actions and Dates field group.

3.Enter the date this bankruptcy was withdrawn to the right of the radio button.

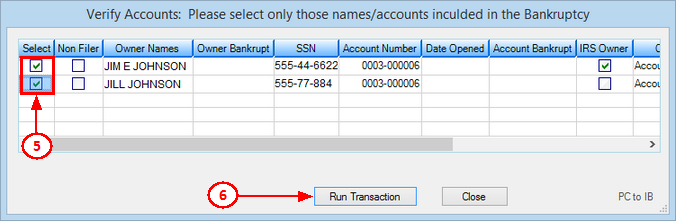

4.Click <Verify Transaction> to open the Verify Accounts dialog, as shown below.

5.Select the appropriate account(s).

6.Click <Run Transaction>.

Results of Withdrawn

When a Withdrawn occurs, the following changes occur on the account(s):

•The Consumer Information Indicator changes to one of the Bankruptcy Withdrawn codes (such as, M, N, O, P), depending on the type of bankruptcy chapter that was applied to the account. The account will be reported as such to the credit repositories during monthend Credit Reporting (see the Credit Reporting help for more information).

•Statement Code (LNSCYC) is put back from bankruptcy history (the code used before the Bankruptcy transaction was run).

•The Do Not Send Statements for This Account box is unchecked. Note: An option must be set to resume sending statements. See Options below.

•The Advertise box is checked. Note: An option must be set to resume advertising. See Options below.

•Late Charge Code (LNLTCD) is put back from bankruptcy history.

•The Phone Restriction field will be changed to "0 - No Restrictions" indicating employees can call the borrower. Note: An option must be set to clear the Phone Restriction, as described in Options below.

•The Email Restriction field will be changed to "0 - No Restrictions" indicating employees can call the borrower. Note: An option must be set to clear the Email Restriction, as described in Options below.

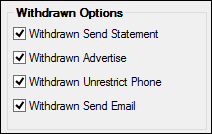

You can set up additional options that affect the results of the Withdrawn transaction through the Bankruptcy Options screen in the Withdrawn Options field group. See the following descriptions:

Withdrawn Options Field Group on the Bankruptcy Options Screen

Withdrawn Send Statement

Mnemonic: BIWISS |

When the Bankruptcy transaction is run, the system checks the Do Not Send Statement field. In other words, the account owner no longer receives statements. If this box is checked and then you run the Withdrawn transaction, the system will uncheck the Do Not Send Statement field and the account owner will resume receiving statements, if applicable. |

Withdrawn Advertise Mnemonic: BIWIAD |

When the Bankruptcy transaction is run, the system checks the Advertise field. In other words, the account owner no longer receives advertisements. If this box is checked and then you run the Withdrawn transaction, the system will uncheck the Advertise field and the account owner will resume receiving advertisements, if applicable. |

Withdrawn Unrestrict Phone

Mnemonic: BIWIUP |

When the Bankruptcy transaction is run, the system flags phone numbers with a restriction of "13 - Contact Attorney Only." However, if this box is checked, and then you run the Withdrawn transaction, the system will change the Phone Restriction to "0 - No Restrictions." Therefore, your employees and collectors can continue calling the borrower concerning late or missed payments. |

Withdrawn Send Email

Mnemonic: BIWISE |

When the Bankruptcy transaction is run, the system flags email addresses with a restriction of "1 - No Email Allowed." However, if this box is checked, and then you run the Withdrawn transaction, the system will change the Email Restriction to "0 - No Restriction." Therefore, your employees and collectors can continue emailing the borrower concerning late or missed payments, advertisements, or notices. |