Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Field Descriptions > Actions and Dates field group >

Reaffirmation

A reaffirmation is an agreement between a creditor and a debtor concerning restructured loan payments that continue even during bankruptcy (usually in a case where the debtor wants to keep a piece of collateral). Reaffirmation is only allowed for Chapter 7, 11, and 12 bankruptcies. Chapter 13 bankruptcies have a different way of repaying debt (see Confirmed By Court Chapter 13 field group).

There are two methods for processing reaffirmations. The method available depends on the status of the Display Reaffirmation Dates Only field on the Loans > Bankruptcy and Foreclosure > Bankruptcy Options screen:

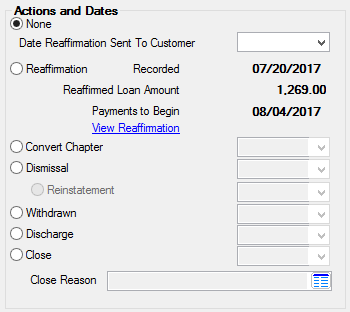

•If Display Reaffirmation Dates Only is not selected, the Standard Reaffirmation process is used. The Standard Reaffirmation allows you to set up a repayment plan and make any necessary changes to the account, such as changing the interest rate, the payment amount, or even writing off a portion of the loan. The Actions and Dates field group is shown below:

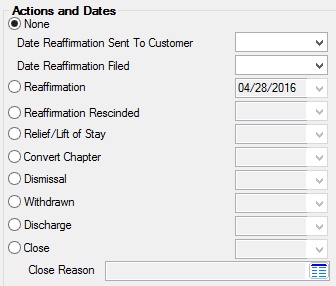

•If the Display Reaffirmation Dates Only option is selected, the Simplified Reaffirmation process is used. Simplified Reaffirmation does not allow any changes to the loan. The loan continues as is and the borrower is responsible for paying all of it. The Actions and Dates field group will appear as follows when this option is selected:

If you later receive a notice from the Bankruptcy Courts stating that the reaffirmation has been rescinded, run the Reaffirmation Rescinded transaction.

|

Note: Also see Reporting an Account in Bankruptcy in the Credit Reporting help for information on how a reaffirmation affects an account during credit reporting. |

|---|

|

Note: See the Bankruptcy Options > Reaffirmation Options field group for options that affect the Reaffirmation transaction. |

|---|